Morguard Real Estate Investment Trust Shareholders Still in Red Five Years Later in 2023.

March 23, 2023

Trending News ☀️

MORGUARD ($TSX:MRT.UN): Despite the high potential of investing in property, MREIT has struggled to maintain its financial stability in the past five years. MREIT provides investors with exposure to an array of real estate properties across Canada, including office, retail and residential buildings. In the beginning, it seemed as though this strategy would pay off and the company would generate a steady stream of income from its properties. Unfortunately, the Canadian real estate market has been slow to recover from the effects of the global recession and MREIT has not been able to keep up with the competition. The current conditions of MREIT’s investments have led to a decrease in profit which has ultimately caused the stock price to fall and remain stagnant for the past five years.

As a result, shareholders who invested in MREIT five years ago have yet to recover their initial investment and remain in the red. While it is still too early to tell if MREIT will be able to turn things around and generate a positive return for its investors, it is clear that its current strategy needs to be reassessed and adjusted in order to ensure long-term success. If the company can find a way to make its investments more profitable, then shareholders may finally begin to see a return on their investments in the near future.

Share Price

Despite the generally positive media sentiment, the stock has yet to deliver on its promise of higher returns. On Thursday, MORGUARD REAL ESTATE INVESTMENT TRUST stock opened at CA$5.3 and closed at CA$5.3, up by 0.4% from last closing price of 5.3. This small jump does not make up for the losses shareholders have experienced over the past five years and indicates that the stock is still lagging behind other investments in the real estate sector. It is yet to be seen if the trust can recover and deliver the returns it has promised its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for MRT.UN. More…

| Total Revenues | Net Income | Net Margin |

| 242.63 | -86.1 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for MRT.UN. More…

| Operations | Investing | Financing |

| 73.97 | -32.42 | -43.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for MRT.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.38k | 1.33k | 17.95 |

Key Ratios Snapshot

Some of the financial key ratios for MRT.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 48.8% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

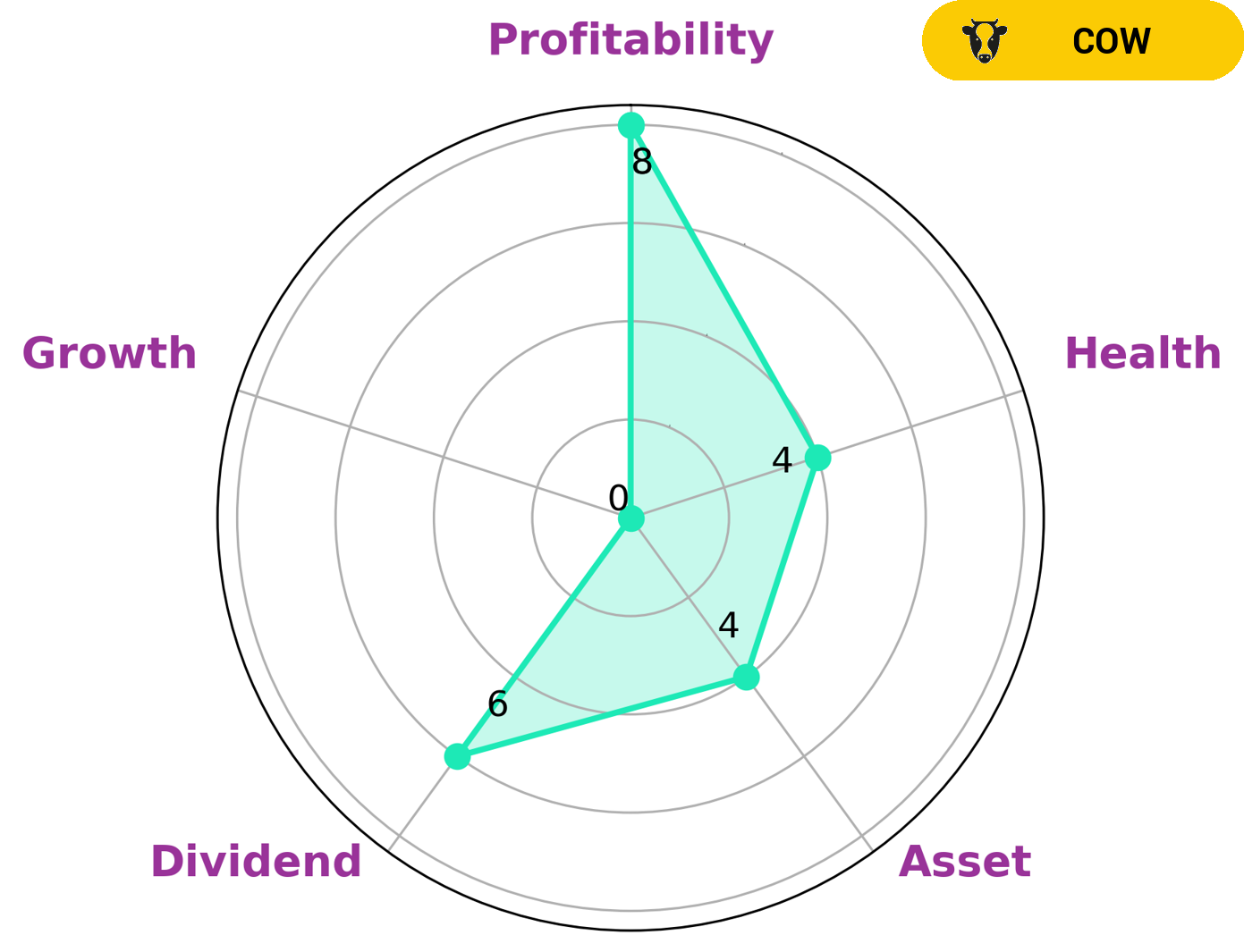

As a GoodWhale investor, I analyzed the fundamentals of MORGUARD REAL ESTATE INVESTMENT TRUST to see if it is a suitable addition to my portfolio. According to the Star Chart, MORGUARD REAL ESTATE INVESTMENT TRUST is strong in profitability, medium in asset, dividend, and weak in growth. This indicates that the company is able to generate profits and maintain steady dividends, but may not necessarily experience rapid growth in the future. MORGUARD REAL ESTATE INVESTMENT TRUST has an intermediate health score of 4/10 considering its cashflows and debt, suggesting that it might be able to sustain future operations in times of crisis. The company is also classified as a ‘cow’, meaning that it has the track record of paying out consistent and sustainable dividends. Based on this data, MORGUARD REAL ESTATE INVESTMENT TRUST is an ideal choice for those investors who are looking for reliable dividends and are less interested in aggressive growth. This company may be particularly attractive for income-seeking investors with a long-term investment horizon. More…

Peers

Its competitors include BTB Real Estate Investment Trust, PRO Real Estate Investment Trust, and Melcor Real Estate Investment Trust. While each company has its own strengths and weaknesses, Morguard has proven to be a powerful force in the industry.

– BTB Real Estate Investment Trust ($TSX:BTB.UN)

BTB Real Estate Investment Trust, Canada’s largest real estate investment trust, is a leading provider of commercial real estate solutions across the country. The company owns and operates a diversified portfolio of properties in major urban centres, including office, retail, and industrial properties. BTB’s market cap is $286.39M as of 2022. The company has a strong track record of delivering value to its shareholders, and its diversified portfolio and experienced management team provide a solid foundation for future growth.

– PRO Real Estate Investment Trust ($TSX:PRV.UN)

H&R REIT is a real estate investment trust that owns, operates, and develops a portfolio of office, retail, and industrial properties. The company has a market cap of $349.49 million as of 2022. H&R REIT’s portfolio includes properties in Canada, the United States, and Europe. The company was founded in 1996 and is headquartered in Toronto, Canada.

– Melcor Real Estate Investment Trust ($TSX:MR.UN)

Melcor Real Estate Investment Trust has a market cap of $73.89M as of 2022. The company is a real estate investment trust that invests in, owns, and manages a portfolio of income-producing real estate assets in Canada. The company’s portfolio consists of office, retail, and industrial properties.

Summary

Despite the poor performance in the past, recent market sentiment towards the trust has been largely positive. Analysts attribute this optimism to the strong fundamentals of MREIT, which is supported by a diversified portfolio of high-quality real estate assets, a solid track record of performance and a stable management team. The trust also has a good balance sheet and a healthy dividend yield. With the expected economic recovery in the near future, investors should consider buying MREIT shares as part of a long-term, diversified portfolio.

However, when doing so, it is important to keep in mind that investing involves risk and that the price of MREIT shares can go up or down depending on market conditions.

Recent Posts