CTO Realty Growth Reports Record Quarterly Earnings of $0.39 per Share and Revenue of $24.72M

April 28, 2023

Trending News ☀️

CTO ($NYSE:CTO) Realty Growth recently reported record quarterly earnings of $0.39 per share and revenue of $24.72M, both of which exceeded expectations. CTO Realty Growth is a publicly traded real estate investment trust (REIT) engaged in the ownership, management, and redevelopment of multifamily properties in the U.S. The company’s funds from operations (FFO) of $0.39 exceeded expectations by $0.01 and their revenue of $24.72M surpassed estimates by $1.74M. Going forward, the company is well positioned to continue to capitalize on opportunities in the U.S. multifamily market and their shareholders look forward to their continued success.

Price History

The news had positive implications on the stock market, as CTO Realty Growth shares opened at $16.7 and closed at $17.0, a 1.7% increase from last closing price of 16.7. This significant growth in quarterly results, especially in terms of revenue, demonstrates the company’s resilience and strength in the real estate market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CTO. More…

| Total Revenues | Net Income | Net Margin |

| 82.32 | -1.62 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CTO. More…

| Operations | Investing | Financing |

| 56.1 | -267.63 | 201.38 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CTO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 986.54 | 481.77 | 22.08 |

Key Ratios Snapshot

Some of the financial key ratios for CTO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 21.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis

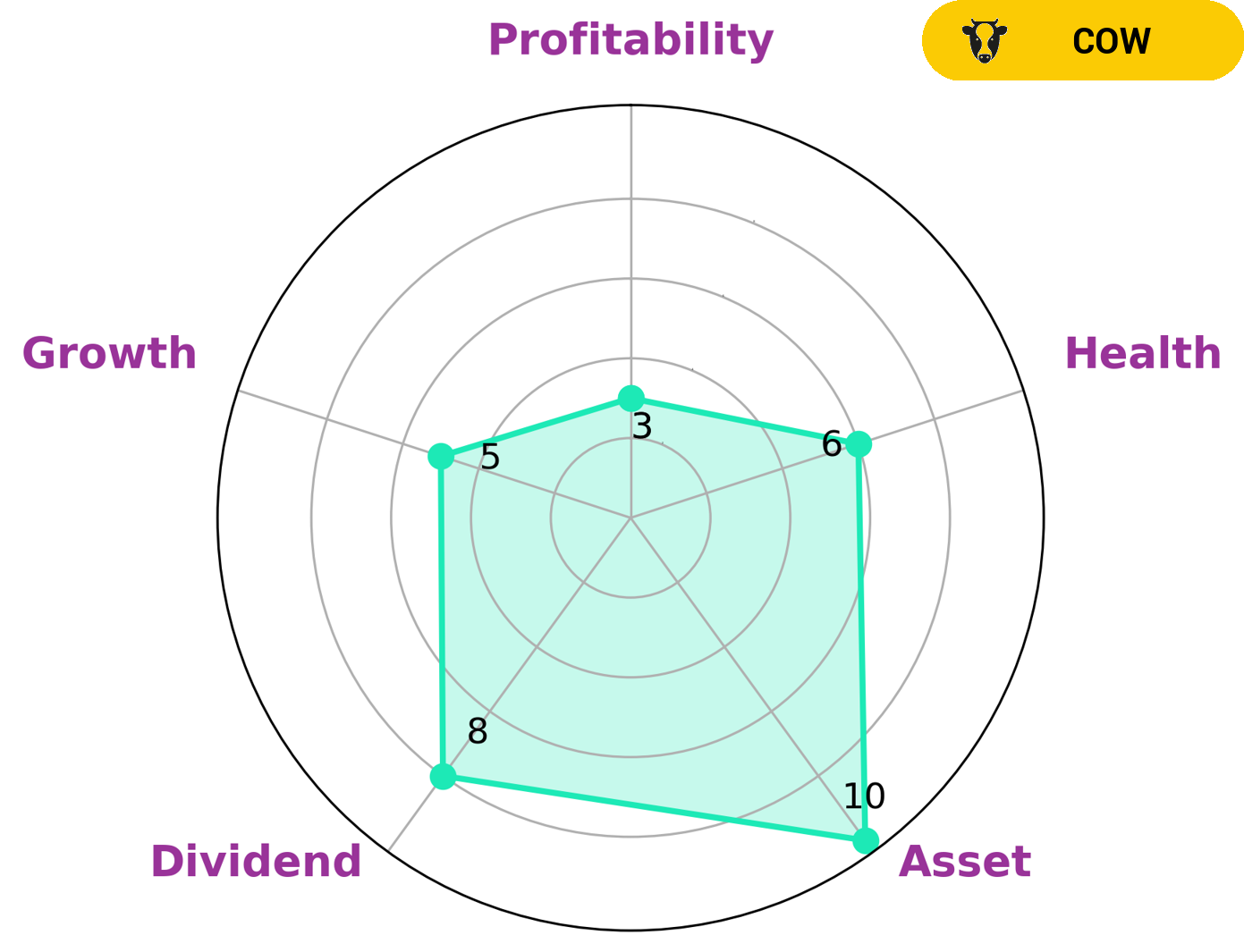

At GoodWhale, we believe in analyzing a company’s fundamentals to make the most informed decisions. CTO Realty Growth is one such company that we have studied, and our analysis of their Star Chart results reveal that they possess strong assets, dividends and medium growth rate. However, they are weak in terms of their profitability. We have classified CTO Realty Growth as a ‘cow’ – a type of company that has a history of paying out consistent and sustainable dividends. For investors interested in seeking out companies that have dependable and reliable dividends, CTO Realty Growth should be an ideal choice. Moreover, this company is likely to be able to sustain operations in times of crisis due to its intermediate health score of 6 out of 10 with regard to cashflows and debt. In conclusion, CTO Realty Growth is a reliable and safe bet for investors looking for companies with steady returns. More…

Peers

The company’s competitors include Postal Realty Trust Inc, Axis Real Estate Investment Trust, Keppel Pacific Oak US REIT.

– Postal Realty Trust Inc ($NYSE:PSTL)

Postal Realty Trust Inc is a publicly traded real estate investment trust that owns and manages properties leased to the United States Postal Service. As of December 31, 2020, the company owned and managed 1,435 properties leased to the USPS.

– Axis Real Estate Investment Trust ($KLSE:5106)

As of 2022, Axis Real Estate Investment Trust has a market cap of 3.07B. The company is a real estate investment trust that focuses on owning and operating income-producing real estate properties in the United States. The company’s portfolio includes office, retail, industrial, and hotel properties.

– Keppel Pacific Oak US REIT ($SGX:CMOU)

Keppel Pacific Oak US REIT is a publicly traded real estate investment trust that owns and operates a portfolio of industrial properties in the United States. The company’s market cap is 569.23M as of 2022. Keppel Pacific Oak US REIT’s portfolio consists of properties in major industrial markets across the United States, including Los Angeles, Chicago, Dallas, Atlanta, and Miami.

Summary

CTO Realty Growth is a real estate company that recently reported their financial results for their fourth quarter. The company reported Funds From Operations (FFO) of $0.39 per share, beating analyst estimates by $0.01. Revenue came in at $24.72M, also exceeding estimates by $1.74M. Investors should note that CTO Realty Growth has seen steady growth in both FFO and revenue over the past four quarters, indicating a positive trend for the company.

Recent Posts