CPNREIT dividend yield calculator – CPN Retail Growth Leasehold REIT Declares 0.322 Cash Dividend

May 29, 2023

Dividends Yield

CPN Retail Growth Leasehold REIT announced a 0.322 cash dividend on May 25, 2023. The REIT has issued dividend per share of 0.88, 1.03, and 0.39 THB over the last three years, leading to an average dividend yield of 3.98%. The dividend yields from 2021 to 2023 are respectively 4.66%, 5.38%, and 1.91%.

For those investors looking for dividend-paying stocks, adding CPN RETAIL GROWTH LEASEHOLD REIT ($SET:CPNREIT) to your list of choices may be a good idea. The ex-dividend date is May 23, 2023, so shareholders should take note of this date in order to be eligible to receive the dividend.

Price History

The stock opened at THB12.9 and closed the same day at THB12.9, representing an increase of 0.8% from the previous closing price of THB12.8. The company is one of Thailand’s largest real estate investment trusts and provides investors with attractive investment opportunities with long-term returns. Investors are provided with a steady income and the potential to benefit from capital appreciation in the long-term. CPN Retail Growth Leasehold REIT is committed to maintaining financial stability and providing shareholders with attractive returns. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CPNREIT. More…

| Total Revenues | Net Income | Net Margin |

| 5.14k | 2.28k | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CPNREIT. More…

| Operations | Investing | Financing |

| 4.16k | – | -3.13k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CPNREIT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 80.51k | 47.42k | 12.89 |

Key Ratios Snapshot

Some of the financial key ratios for CPNREIT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 77.5% |

| FCF Margin | ROE | ROA |

| – | – | – |

Analysis – CPNREIT Intrinsic Value Calculation

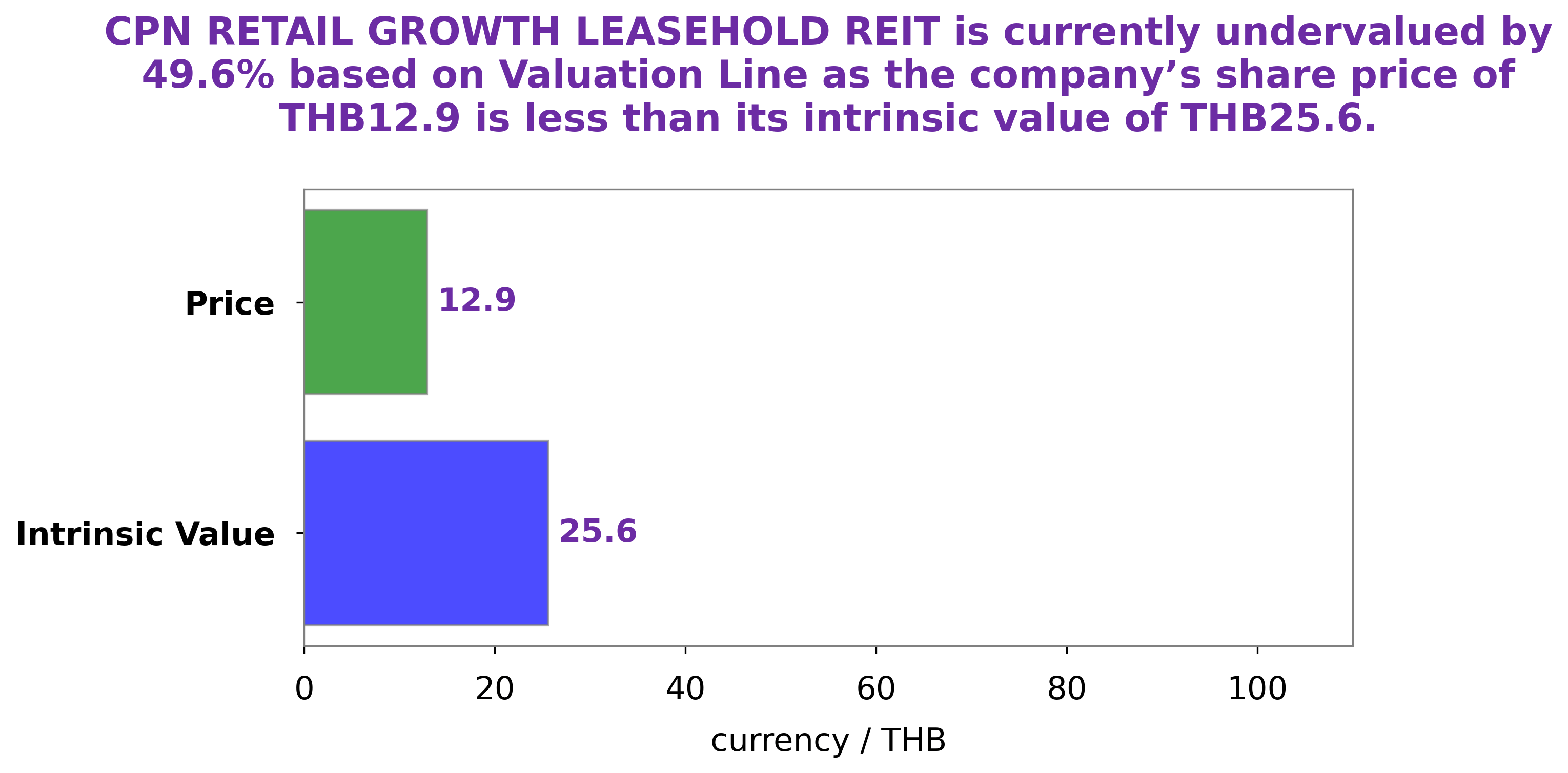

GoodWhale has conducted an analysis of CPN RETAIL GROWTH LEASEHOLD REIT’s financials and our proprietary Valuation Line has determined the intrinsic value of a CPN RETAIL GROWTH LEASEHOLD REIT share to be around THB25.6. Currently, CPN RETAIL GROWTH LEASEHOLD REIT stock is being traded at THB12.9, which is a 49.7% discount to its estimated intrinsic value. This suggests that the stock is currently undervalued and may present an attractive buying opportunity. More…

Peers

CPN Retail Growth Leasehold REIT is one of many real estate investment trusts (REITs) on the market today, joining competitors such as LH Shopping Centers Leasehold Real Estate Investment Trust, Medalist Diversified REIT Inc, and Emirates Properties REIT. Each of these REITs offers investors a unique set of opportunities to invest in the lucrative real estate market.

– LH Shopping Centers Leasehold Real Estate Investment Trust ($SET:LHSC)

LH Shopping Centers Leasehold Real Estate Investment Trust (LH Shopping) is a real estate investment trust (REIT) that specializes in the acquisition and ownership of shopping centers in the United States. The company is headquartered in New York City and has a market cap of 5.76B as of 2023. LH Shopping is focused on providing investors with a stable income stream through the rental income generated from the shopping centers it owns. Additionally, LH Shopping has a diversified portfolio of retail properties across the United States that are leased to a variety of tenants. LH Shopping’s goal is to provide investors with a long-term investment opportunity that offers both income and appreciation potential.

– Medalist Diversified REIT Inc ($NASDAQ:MDRR)

Medalist Diversified REIT Inc is a real estate investment trust (REIT) with a market capitalization of 16.39M as of 2023. The company specializes in making investments in a variety of real estate opportunities, including multi-family, retail, industrial, office, healthcare, and hospitality properties. The company’s goal is to provide steady dividend income to investors while also preserving the value of their investments. With its diversified portfolio of real estate investments, Medalist Diversified REIT Inc has been able to weather the industry’s ups and downs and has been able to maintain a healthy market cap over the years.

Summary

Investors interested in CPN RETAIL GROWTH LEASEHOLD REIT may be pleased to know that the company has issued increasing dividends over the last 3 years. The 2021 dividend yield is 4.66%, rising to 5.38% in 2022 and 1.91% in 2023 for an average dividend yield of 3.98%. This stock may be a good choice for investors seeking dividend-paying stocks. Moreover, the increasing dividend yield over the last several years reflects a strong financial performance and demonstrates the potential for further growth.

Recent Posts