BTB REIT to Publish Fourth Quarter 2022 Financial Results on February 27th, 2023

January 30, 2023

Trending News 🌥️

BTB ($TSX:BTB.UN) Real Estate Investment Trust (BTB REIT) is a publicly traded real estate investment trust that specializes in acquiring, owning and managing a diversified portfolio of income producing office and retail properties located in Canada. BTB REIT is listed on the Toronto Stock Exchange (TSX) under the ticker symbol BTB.UN. The company’s primary focus is to acquire, own and manage a diversified portfolio of income producing office and retail properties located in Canada. BTB REIT will announce its fourth quarter of the year 2022 financial results on Monday, February 27th, 2023. The results will be released before the commencement of trading on the Toronto Stock Exchange. This report is expected to include a comprehensive overview of the company’s position and its progress towards achieving its goals.

BTB REIT’s portfolio consists of a diversified mix of properties located across Canada including office and retail properties in major cities such as Toronto, Montreal, Calgary, and Vancouver. The company has a long-term strategy to create value through enhanced asset management initiatives and acquisition of assets that can generate higher returns, both in terms of rental income and capital appreciation. The company also encourages investors to contact their investor relations team at any time with questions or concerns.

Price History

So far, media sentiment has been mostly positive on the company’s performance. On Thursday, BTB REAL ESTATE INVESTMENT TRUST stock opened at CA$3.8 and closed at CA$3.8, down by 1.0% from the previous closing price of 3.8. Analysts have pointed to a number of factors that could contribute to BTB REIT’s performance in the fourth quarter. These include the company’s focus on improving its portfolio of real estate investments and its ability to capitalize on current market conditions.

In addition, the company has been successful in managing its debt burden, which has allowed it to improve its liquidity position. Investors will be looking to the company’s fourth quarter financial results to determine whether these strategies are paying off for BTB REIT. They will also be examining the company’s balance sheet and cash flow statements to determine if the company is on track to meet its financial goals. For those interested in investing in BTB REIT, now may be a good time to invest. The company’s stock price has been relatively stable over the past few months, and its financial results are expected to be released soon. If the company’s financial performance meets or exceeds expectations, this could be an opportunity for investors to capitalize on the company’s potential. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for BTB.UN. More…

| Total Revenues | Net Income | Net Margin |

| 114.8 | 59.6 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for BTB.UN. More…

| Operations | Investing | Financing |

| 72.42 | -93.96 | 12.79 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for BTB.UN. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.21k | 741.08 | 5.48 |

Key Ratios Snapshot

Some of the financial key ratios for BTB.UN are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 52.2% |

| FCF Margin | ROE | ROA |

| – | – | – |

VI Analysis

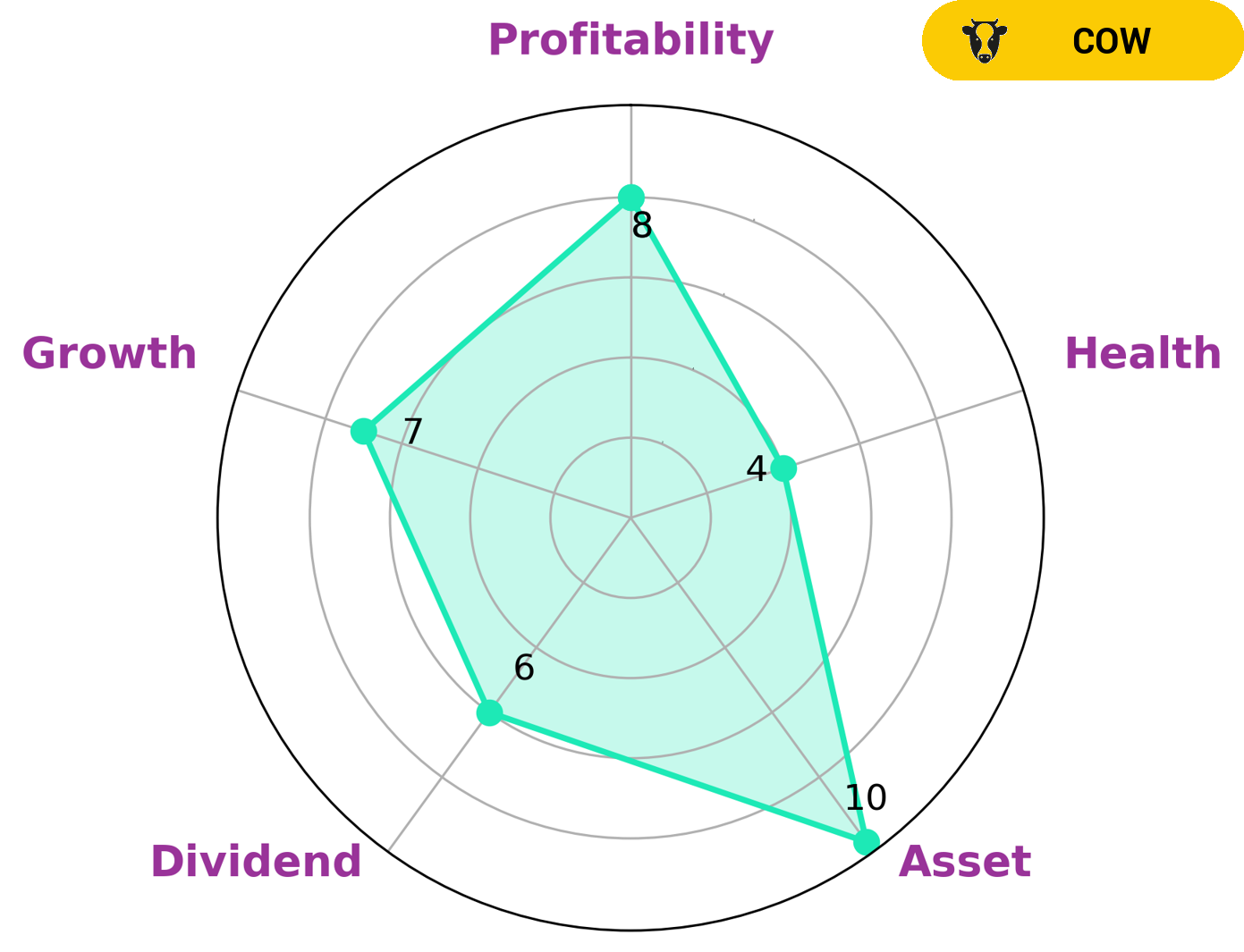

BTB REAL ESTATE INVESTMENT TRUST is a company that has the track record of paying out consistent and sustainable dividends, making it a ‘cow’ in terms of investment potential. Investors looking for a low-risk, steady income stream may be interested in investing in this company. According to VI Star Chart, BTB REAL ESTATE INVESTMENT TRUST shows an intermediate health score of 4/10, with the potential to safely ride out any disruption caused by the current crisis. The company is strong in terms of its asset, growth, and profitability and medium in dividend. Thus, investors looking for organic growth and long-term returns may find this company interesting. The company’s fundamentals reflect its long-term potential. With its consistent dividend payouts and steady growth, BTB REAL ESTATE INVESTMENT TRUST could be a good addition to any investor’s portfolio. It is important to note however, that no investment is without risk and investors should always do their due diligence prior to investing. Before investing, investors should make sure to understand the risks and rewards associated with the company and consider the company’s future prospects. More…

VI Peers

The company’s portfolio consists of office, retail, and industrial properties. BTB is one of the largest real estate investment trusts in Canada and is headquartered in Montreal, Quebec. Its competitors include Morguard Real Estate Investment Trust, Highlands REIT Inc, and Cominar Real Estate Investment Trust.

– Morguard Real Estate Investment Trust ($TSX:MRT.UN)

Morguard Real Estate Investment Trust has a market cap of 331.19M as of 2022. The company is involved in the ownership, development, management, and investment of real estate properties.

– Highlands REIT Inc ($OTCPK:HHDS)

Highlands REIT Inc is a real estate investment trust that owns, operates, and develops income-producing real estate properties. The company’s portfolio consists of office, retail, and industrial properties located in major markets across the United States. Highlands REIT is headquartered in Denver, Colorado.

Summary

BTB Real Estate Investment Trust (BTB REIT) is a Canadian real estate investment trust that focuses on the acquisition, ownership and management of income-producing properties in Canada. The company has a diverse portfolio of properties, including retail, office, industrial, and multi-residential. BTB REIT has seen strong growth and performance over the past several quarters, highlighted by record revenue and net operating income in the fourth quarter of 2022. Investors have also been buoyed by positive media sentiment, which has remained mostly positive.

BTB REIT is expected to report its fourth quarter 2022 financial results on February 27th, 2023. The company is expected to show continued growth and performance as it works to build long-term value for its shareholders. Analysts suggest that investors should consider BTB REIT for its attractive yield and potential for capital appreciation.

Recent Posts