Mastercraft Boat Intrinsic Value Calculation – MasterCraft Boat to Release Earnings Results Ahead of Wednesday Market Opening

May 9, 2023

Trending News 🌥️

MASTERCRAFT ($NASDAQ:MCFT): MasterCraft Boat, a leading manufacturer of boats and accessories, is due to announce its earnings results prior to the market opening on Wednesday, 10th May. The company has seen significant growth since its inception, with strong sales of its boats, accessories, and other marine products over the past two decades. MasterCraft Boat is expected to share its financial results in detail during their earnings call on Wednesday, with analysts expecting the company to report a profit for the quarter. This earnings report will likely be closely monitored by investors, as it could offer insight into the company’s future prospects. Analysts will be paying specific attention to the company’s cash flow, profitability, and debt levels, in order to determine the sustainability of MasterCraft Boat’s operations.

The stock price of MasterCraft Boat could see significant movement depending on the outcome of the earnings report. Investors will be looking for any signs of potential growth or stagnation that could influence the stock price in either direction. With this in mind, market watchers are sure to tune in to the company’s earnings call on Wednesday with keen anticipation.

Market Price

MASTERCRAFT BOAT announced on Monday that it would be releasing its earnings results ahead of Wednesday’s market opening. The stock opened at $28.8 and closed at $29.0, up by 1.0% from its last closing price of $28.8. Analysts are expecting the company to post strong numbers following a strong performance in the previous quarter.

Investors will be closely watching the results of MASTERCRAFT BOAT stock to determine if the company is on track to reach its yearly goals. It will be interesting to see how investors react to the news when the results are released. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mastercraft Boat. More…

| Total Revenues | Net Income | Net Margin |

| 761.52 | 56.18 | 11.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mastercraft Boat. More…

| Operations | Investing | Financing |

| 138.99 | -81.21 | -42.36 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mastercraft Boat. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 299.76 | 139.94 | 8.99 |

Key Ratios Snapshot

Some of the financial key ratios for Mastercraft Boat are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.2% | 25.5% | 12.8% |

| FCF Margin | ROE | ROA |

| 15.3% | 40.0% | 20.3% |

Analysis – Mastercraft Boat Intrinsic Value Calculation

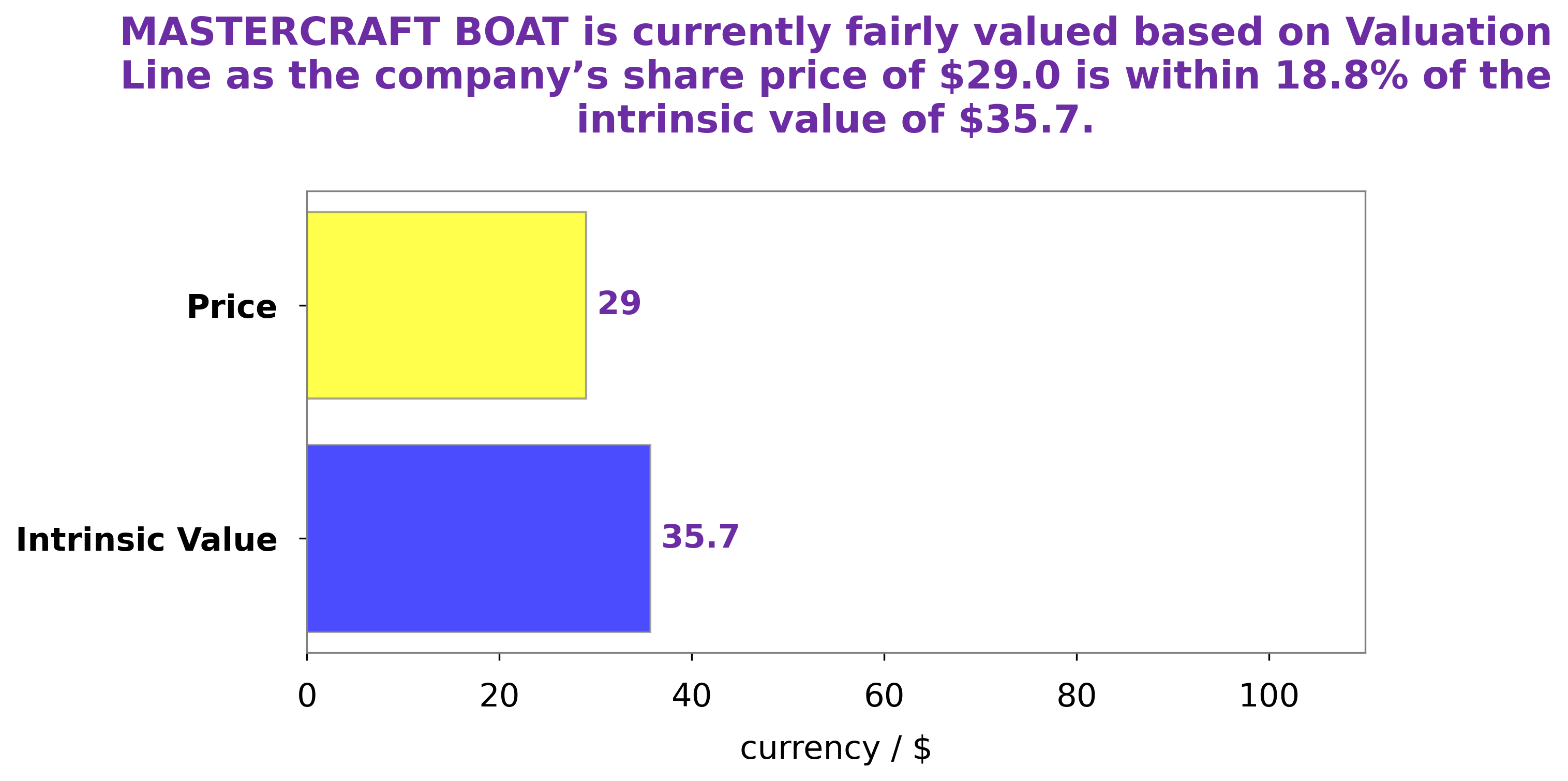

At GoodWhale, we conducted a thorough analysis of the fundamentals of MASTERCRAFT BOAT to determine its intrinsic value. Our proprietary Valuation Line revealed that the intrinsic value of MASTERCRAFT BOAT share is around $35.7. Currently, MASTERCRAFT BOAT stock is being traded at $29.0, meaning the stock is undervalued by 18.7%. This provides us with the opportunity to invest in this stock at an attractive price. More…

Peers

MasterCraft Boat Holdings Inc is a leading designer and manufacturer of premium inboard wakeboard, ski and luxury performance boats. The company’s boats are sold under the MasterCraft brand, as well as under the Nautique, Moomba, Supra, and XStar brands. The company operates in four segments: North America, Europe, Asia, and Other International. The Limestone Boat Co Ltd, Maiden Lane Jewelry Ltd, Malibu Boats Inc are its main competitors.

– The Limestone Boat Co Ltd ($TSXV:BOAT)

The Limestone Boat Co Ltd is a company that manufactures and sells boats. The company has a market cap of 5.38M as of 2022 and a return on equity of 247.14%. The company’s products are sold through its network of dealers and distributors in the United States, Canada, and Europe. The company was founded in 1971 and is headquartered in Kingston, Ontario, Canada.

– Maiden Lane Jewelry Ltd ($OTCPK:MDNL)

Maiden Lane Jewelry Ltd is a jewelry company with a market cap of 5.77M as of 2022. The company has a Return on Equity of -27.96%. The company designs, manufactures, and sells jewelry products.

– Malibu Boats Inc ($NASDAQ:MBUU)

Malibu Boats is a leading manufacturer of recreational boats in the United States. The company has a market cap of 980.44 million as of 2022 and a return on equity of 27.7%. Malibu Boats designs, manufactures, markets, and sells recreational powerboats under the Malibu and Axis brand names. The company offers a range of boat models, including wakeboard boats, ski boats, and performance boats. Malibu Boats also manufactures boats for the US Coast Guard and the US Navy.

Summary

Investors are keen to see how MasterCraft Boat will perform in its upcoming earnings report, which is due out before the market opens on Wednesday, May 10th. Analysts are expecting strong earnings for the company, driven by higher demand for its products and services. Investors will look for potential indicators of future growth and profitability, such as gross profit margins, operating margins, and return on equity.

Additionally, investors will be interested to learn more about the company’s capital expenditures and plans for expansion over the next year. As MasterCraft Boat continues to innovate and expand, investors will likely remain bullish on the stock.

Recent Posts