eXp World Reports Q2 GAAP EPS of $0.01, Revenue Misses by $10.61M

May 3, 2023

Trending News 🌧️

EXP ($NASDAQ:EXPI): The company revealed a GAAP earnings per share (EPS) of $0.01, which exceeded analyst expectations by $0.08. Despite their positive growth in certain aspects, the company’s stock has dropped due to the revenue miss. It remains to be seen how the market will view these results in the long-term. Investors will be watching to see if eXp World can continue to generate impressive profits despite the revenue miss.

Earnings

The report showed total revenue of $933.4M USD, a 13.3% decrease from the previous year, and a net loss of $7.2M USD, a 146.5% decrease from the previous year. Despite this, EXP World has seen a steady increase in total revenue over the past three years, going from $609.32M USD to $933.4M USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Exp World. More…

| Total Revenues | Net Income | Net Margin |

| 4.6k | 15.44 | 0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Exp World. More…

| Operations | Investing | Financing |

| 210.53 | -22.46 | -204.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Exp World. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 381.68 | 132.69 | 1.62 |

Key Ratios Snapshot

Some of the financial key ratios for Exp World are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 67.4% | – | 0.1% |

| FCF Margin | ROE | ROA |

| 4.3% | 1.3% | 0.9% |

Market Price

Total revenue fell by $10.61 million from the year-ago quarter. This news caused eXp World‘s stock to open at $11.4 and close at the same price, down by 2.1% from the previous closing price of $11.7. Although eXp World’s quarterly results came in lower than expected, its stock remains relatively resilient due to investors’ confidence in the company’s long-term growth potential. eXp World is looking to capitalize on its strong customer relationships and innovative technology to drive future success. Live Quote…

Analysis

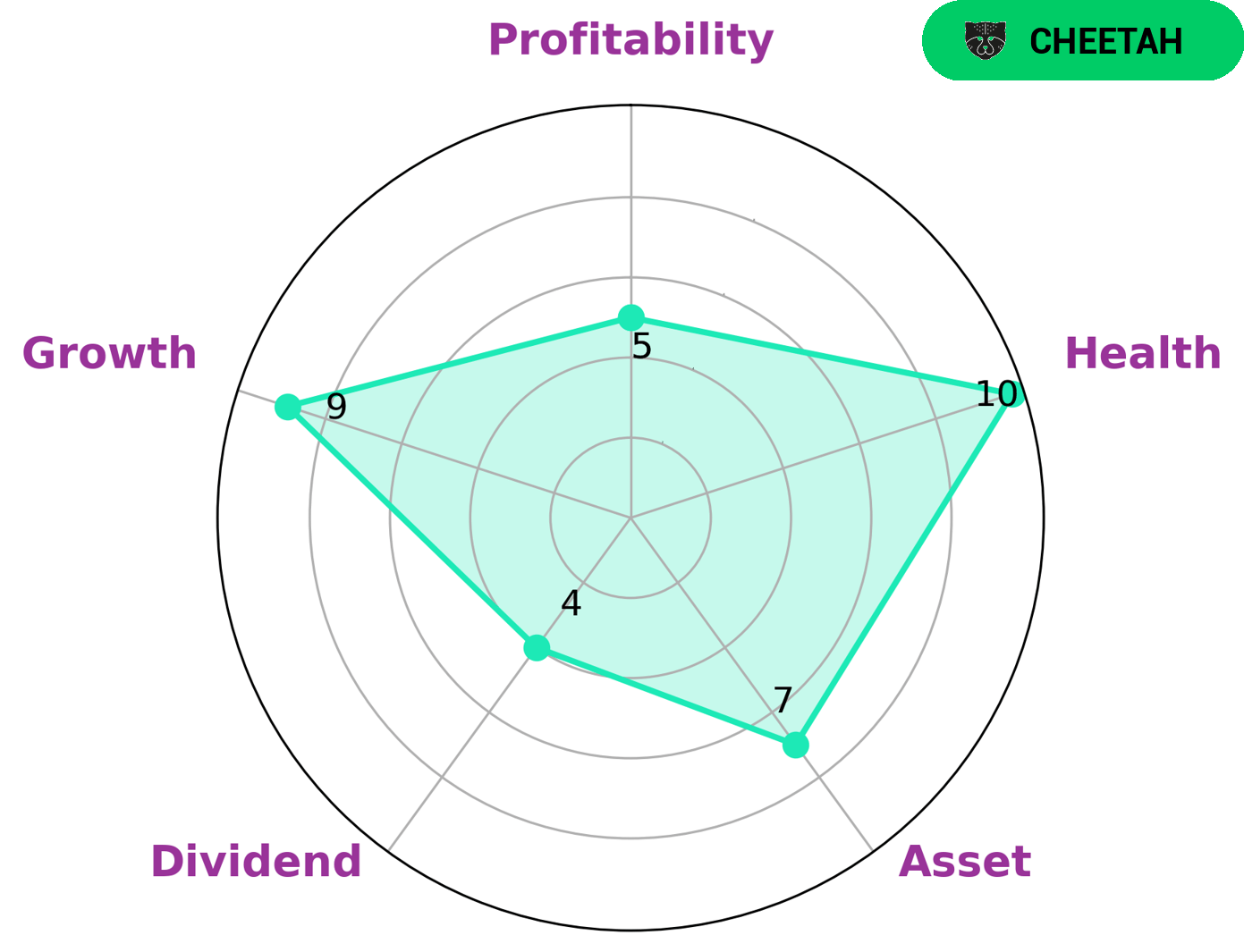

As GoodWhale has analyzed the financials of EXP WORLD, we can conclude that the company is strong in terms of assets and growth, yet medium in terms of dividend and profitability. Its health score of 10/10 with regard to its cashflows and debt indicates that it is capable of sustaining its future operations even in times of crisis. Based on our analysis, EXP WORLD falls under the ‘cheetah’ classification; a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. This would make it an attractive option for investors looking for higher returns and more aggressive investments. Yet, there is a risk that the company may not be able to sustain its growth in the long run. Therefore, potential investors must consider their risk tolerance before investing in EXP WORLD. More…

Peers

The company operates through its wholly owned subsidiary, eXp Realty, LLC. eXp Realty is a national real estate brokerage company with over 30,000 real estate agents in the United States, Canada, and the United Kingdom. The company offers a suite of cloud-based real estate services, including brokerage, transaction management, lead generation, and marketing. eXp World Holdings Inc. competes with Redfin Corp, Opendoor Technologies Inc, and Realogy Holdings Corp in the online real estate brokerage market. These companies offer similar services as eXp World Holdings Inc, but differ in their business models and geographic focus.

– Redfin Corp ($NASDAQ:RDFN)

Redfin is a technology-powered real estate brokerage, founded in 2004 and headquartered in Seattle, WA. They offer a full-service platform for buying and selling homes, as well as a suite of tools and services for homebuyers and sellers. Redfin has a market cap of $516.24M as of 2022 and a return on equity of -50.48%. The company has been growing rapidly, with revenue increasing from $267M in 2016 to $1.1B in 2020. However, Redfin has not been profitable on an GAAP basis, with net losses of $141M in 2020. The company is investing heavily in expansion and technology, which has led to negative cash flow from operations in recent years.

– Opendoor Technologies Inc ($NASDAQ:OPEN)

Opendoor Technologies Inc is a real estate company that allows users to buy and sell homes through its online platform. The company has a market cap of 1.53B as of 2022 and a return on equity of 0.03%. Opendoor was founded in 2014 and is headquartered in San Francisco, CA.

Summary

EXP World Inc. released its latest quarterly report, indicating a GAAP earnings per share of $0.01, which beat the consensus estimates by $0.08. Revenue for the quarter was recorded at $850.6M, missing estimates by $10.61M. Despite the lower than expected revenue, the company’s EPS outperformed analysts’ expectations, suggesting that the company has managed to reduce its expenses in order to achieve higher profits.

This could potentially indicate that EXP World has become more efficient in managing its operations. Investors should closely monitor the company’s financial performance in coming quarters and assess whether these improved profit margins are sustainable.

Recent Posts