CBRE Group Outperforms Expectations with Record Revenue and Earnings

April 28, 2023

Trending News 🌥️

This impressive performance was driven by strong growth in all sectors, with particular strength in Advisory and Transaction Services, Investment Management and Asset Services. They are the largest and most experienced commercial real estate services provider, offering a range of integrated services including brokerage, property and project management, capital markets, consulting, corporate finance and research. Overall, CBRE ($NYSE:CBRE) Group performed exceptionally well against expectations in the third quarter and continues to be a formidable player in the global commercial real estate market. The company’s strong performance is a sign of the potential for continued growth in the future.

Share Price

The announcement sent CBRE’s stock up 8.9%, opening at $72.0 and closing at $76.1, up from a prior closing price of 69.9. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Cbre Group. More…

| Total Revenues | Net Income | Net Margin |

| 30.83k | 1.41k | 4.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Cbre Group. More…

| Operations | Investing | Financing |

| 1.63k | -832.46 | -1.77k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Cbre Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.51k | 11.91k | 25.25 |

Key Ratios Snapshot

Some of the financial key ratios for Cbre Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.9% | -0.1% | 4.3% |

| FCF Margin | ROE | ROA |

| 4.4% | 10.5% | 4.0% |

Analysis

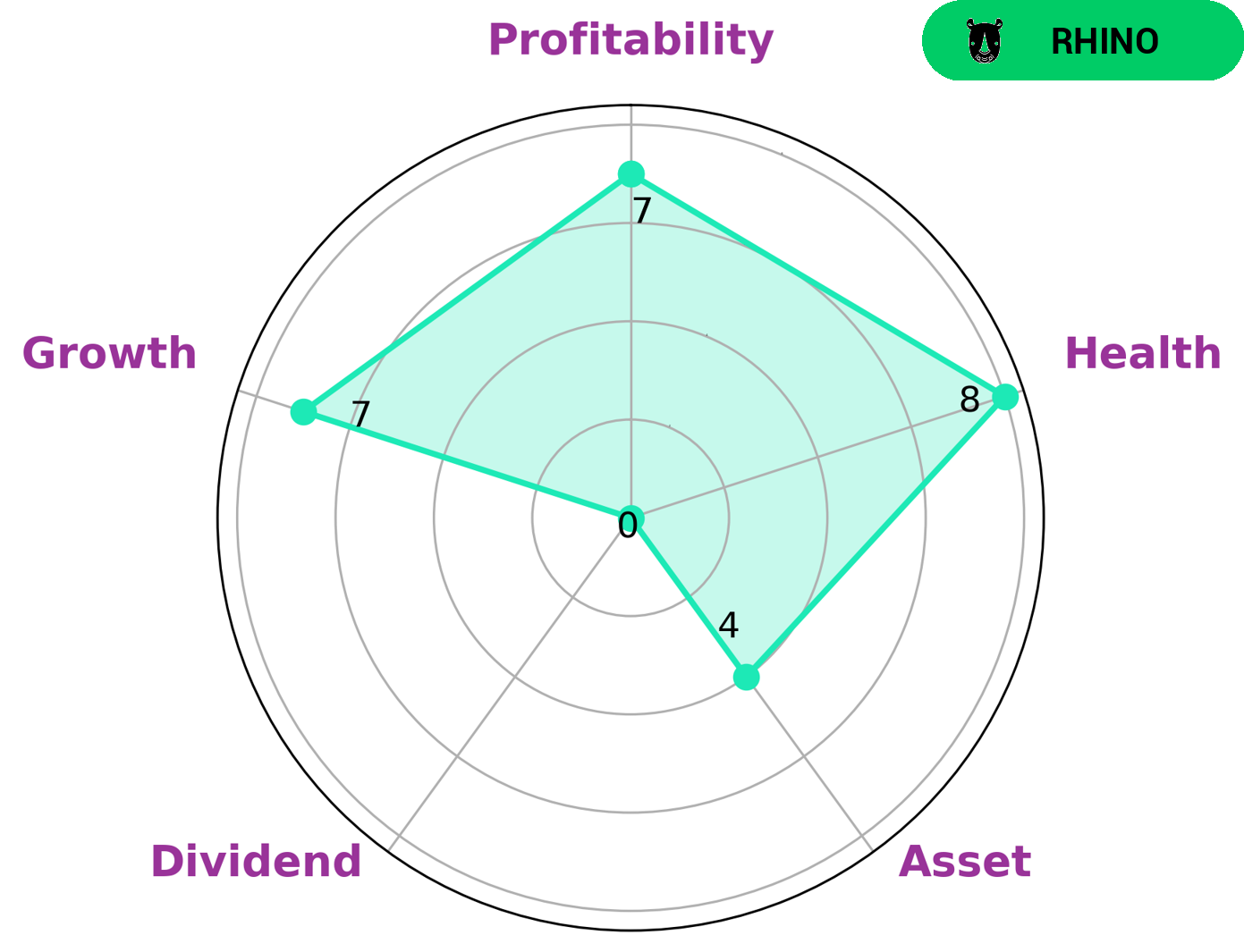

At GoodWhale, we recently conducted an analysis of CBRE GROUP‘s financials. By looking at the Star Chart, we determined that CBRE GROUP is strong in terms of growth and profitability, but weak in terms of dividend. We have classified CBRE GROUP as a ‘rhino’, which we define as a company that has achieved moderate revenue or earnings growth. Based on our analysis, we believe that this company may be of interest to investors who are looking for businesses with consistent performance and moderate growth prospects. Additionally, CBRE GROUP has a high health score (8/10) with regard to its cashflows and debt, suggesting that the company is capable of weathering any crisis without the risk of bankruptcy. More…

Peers

CBRE Group Inc is the world’s largest commercial real estate services firm, with 2018 revenue of $23.9 billion and more than 90,000 employees in over 700 offices worldwide. The company provides a broad range of services to occupiers and investors, including leasing, property and facilities management, investment sales and capital markets, valuation, consulting, research and appraisal, and mortgage banking. CBRE’s competitors in the commercial real estate services industry include Jones Lang LaSalle Inc, Newmark Group Inc, and Cushman & Wakefield PLC. These companies are all large, global firms with a broad range of services and a significant presence in the commercial real estate market.

– Jones Lang LaSalle Inc ($NYSE:JLL)

JLL is a professional services and investment management company specializing in real estate. It has a market cap of $7.43B and a ROE of 13.87%. The company has over 230 offices in 80 countries and offers a variety of services such as property management, facilities management, project and development management, lease administration, and investment management.

– Newmark Group Inc ($NASDAQ:NMRK)

The Newmark Group is a publicly traded company with a market capitalization of 1.51 billion as of 2022. The company has a return on equity of 35.51%. The Newmark Group is a provider of commercial real estate services in the United States. The company offers a range of services, including leasing, property and facilities management, lending, valuation, consulting, and capital markets services.

– Cushman & Wakefield PLC ($NYSE:CWK)

Cushman & Wakefield PLC is a commercial real estate services company. It has a market cap of 2.5B as of 2022 and a Return on Equity of 27.74%. The company provides services such as property management, leasing, capital markets, valuation, and other advisory services.

Summary

CBRE Group is a leading global commercial real estate services and investment firm, providing a full range of services to real estate occupiers, owners and investors. In their latest earnings report, CBRE’s Non-GAAP EPS of $0.92 beat expectations by $0.02 and its revenue of $7.41B beat projections by $320M. This was reflected in the stock price, which moved up the same day. Analysts suggest that the strong results demonstrate that CBRE is well-positioned to capitalize on the recovery of the global economy from the pandemic, given its wide-ranging services and strong customer relationships.

The company has seen a steady increase in demand for its services, particularly within the leasing and sales space, and has continued to make strategic acquisitions to bolster its portfolio. With unemployment decreasing, consumer confidence increasing and the global market looking increasingly favorable, CBRE’s future looks promising.

Recent Posts