Tomson Group Reports Record Earnings for 2022 with EPS of HK$0.009

April 9, 2023

Trending News 🌥️

The Tomson Group ($SEHK:00258) has reported record earnings for the year 2022. This marks a significant milestone for the Group and is a testament to its strong financial performance. Tomson Group is a global conglomerate with operations in a wide range of industries, including real estate, hospitality, infrastructure and telecommunications. The Group is also well-known for its commitment to corporate social responsibility, having made significant investments in education, healthcare and the environment.

The Group’s record earnings for the year 2022 are a major achievement and demonstrate the strength of the Group’s financial performance. The Group’s strong financial performance is attributable to a combination of factors, including its diversified portfolio of businesses and its focus on innovation and sustainability. This strong performance is expected to continue into the future, providing investors with further confidence in the Group’s prospects for continued growth.

Price History

The news sent the company’s stock soaring, with it opening at HK$1.8 and closing at the same price, up 4.0% from the previous day’s closing price of HK$1.7. Investors seem to have responded positively to the news of the record earnings, with many expecting the stock to continue to rise in the coming weeks and months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Tomson Group. More…

| Total Revenues | Net Income | Net Margin |

| 682.55 | 182.96 | 26.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Tomson Group. More…

| Operations | Investing | Financing |

| 296.94 | 11.6 | -165.44 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Tomson Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 19.4k | 6.2k | 6.53 |

Key Ratios Snapshot

Some of the financial key ratios for Tomson Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.9% | 15.7% | 60.6% |

| FCF Margin | ROE | ROA |

| 42.4% | 2.0% | 1.3% |

Analysis

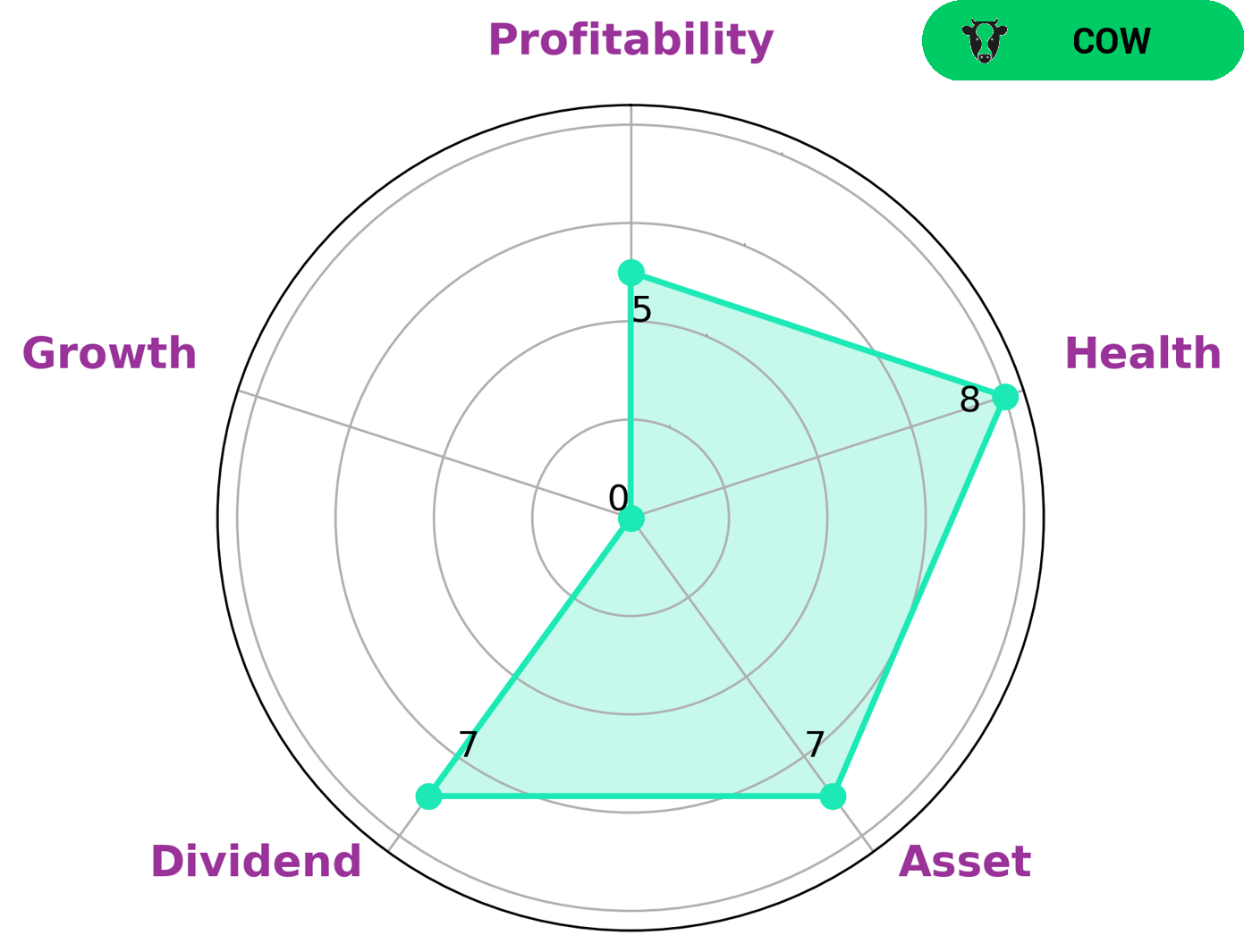

GoodWhale has conducted an in-depth analysis of TOMSON GROUP‘s wellbeing and the results are now available. According to the Star Chart, TOMSON GROUP is strong in asset and dividend, medium in profitability, and weak in growth. This information leads us to classify TOMSON GROUP as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends. This type of company is likely to attract a range of different investors, including those looking for long-term income or wanting to preserve capital while still generating returns. Additionally, TOMSON GROUP has a high health score of 8/10 with regard to its cash flows and debt, indicating that it has the capability to pay off its debt and fund future operations. More…

Peers

Tomson Group Ltd is one of the leading companies in its industry, alongside competitors such as Talent Property Group Ltd, Liu Chong Hing Investment Ltd, and China City Infrastructure Group Ltd. All of these companies are successful in their respective fields, providing quality goods and services to their customers. Tomson Group Ltd stands out by offering innovative solutions to various challenges in the market, while also ensuring reliable customer experiences.

– Talent Property Group Ltd ($SEHK:00760)

Talent Property Group Ltd is a Hong Kong-based integrated property developer focusing on residential and commercial properties. As of 2023, the company has a market capitalization of 185.28 million, indicating that the company has a strong presence in the Hong Kong property market. The company also has a return on equity of 1.96%, a measure of profitability that indicates how efficiently management is utilizing its shareholders’ equity to generate profits. This suggests that Talent Property Group Ltd is efficiently managing its assets to generate higher returns for its shareholders.

– Liu Chong Hing Investment Ltd ($SEHK:00194)

Liu Chong Hing Investment Ltd is a Hong Kong based investment holding company, mainly engaged in banking and financial services. With a market cap of 2.45B as of 2023, it has established itself as an important player in the industry. The company has also achieved a relatively impressive return on equity of 2.73%, indicating that the company has been successful in generating returns to its shareholders and investors.

– China City Infrastructure Group Ltd ($SEHK:02349)

China City Infrastructure Group Ltd is a leading infrastructure provider based in China. The company’s products and services include power, water, gas, and transportation infrastructure solutions. The company has a market capitalization of 206.47M as of 2023, indicating the size of the company and its market value. Its return on equity (ROE) is -4.49%, suggesting that the company is not generating a return on its equity investments. This is likely due to the high costs associated with its infrastructure solutions. Despite the negative ROE, China City Infrastructure Group Ltd is still a viable option for investors due to its strong market presence and product offerings.

Summary

Tomson Group has delivered strong financial results for the full year of 2022, with earnings per share (EPS) reaching HK$0.009. This is a significant improvement from the previous year and demonstrates the company’s commitment to increasing shareholder value. Investors have responded positively to these results, with the stock price increasing on the same day. It is likely that the higher EPS will draw more investors to Tomson Group’s stock, and analysts anticipate that the company may continue to produce such strong results over the coming years. Investors should be aware of the potential risks that come along with investing in Tomson Group. The company is exposed to high levels of competition and political pressures, along with the potential for economic downturns.

Additionally, investors should consider the company’s debt load and research into their management decisions. Overall, investing in Tomson Group comes with both potential rewards and risks. Investors should take a careful approach to researching and analyzing the stock before deciding whether or not to invest. For those willing to take the risk, Tomson Group may offer strong returns for investors in coming years.

Recent Posts