Gelex and Frasers Property Vietnam Team Up to Create Premium Industrial Zones.

March 5, 2023

Trending News ☀️

Gelex and Frasers Property ($SGX:TQ5) Vietnam have teamed up to capitalise on the nation’s growing economy, with plans to create premium industrial zones. This collaboration is expected to have a positive effect on the progress of the industrial sector in Vietnam, opening up new job opportunities and boosting economic development. The industrial zones will be located in strategic areas with easy access to transportation and customer networks. They will offer the highest-standard facilities such as modern warehouses, efficient water supply and state-of-the-art labour management systems for companies operating within them.

This venture is expected to bring about high-yield returns for both parties. Furthermore, Gelex and Frasers Property Vietnam will also be providing technical advice and support services to help investors and companies in the industrial zones reduce their costs and increase their efficiency. This joint venture promises to bring about a new wave of development and growth for the industrial sector in Vietnam, offering a more productive and modernized business environment tailored to the evolving needs of commercial enterprises.

Stock Price

The media sentiment has been largely positive since the news was made public. FRASERS PROPERTY opened at SG$0.9 and closed at the same price, 0.6% lower than it closed at the day prior. This venture holds great promise for both companies and is likely to generate increased revenue streams for each side. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Frasers Property. More…

| Total Revenues | Net Income | Net Margin |

| 3.88k | 871.43 | 19.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Frasers Property. More…

| Operations | Investing | Financing |

| 1.18k | 49.8 | -1.57k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Frasers Property. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 40.17k | 20.79k | 2.95 |

Key Ratios Snapshot

Some of the financial key ratios for Frasers Property are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.7% | 4.0% | 65.1% |

| FCF Margin | ROE | ROA |

| 4.9% | 13.9% | 3.9% |

Analysis

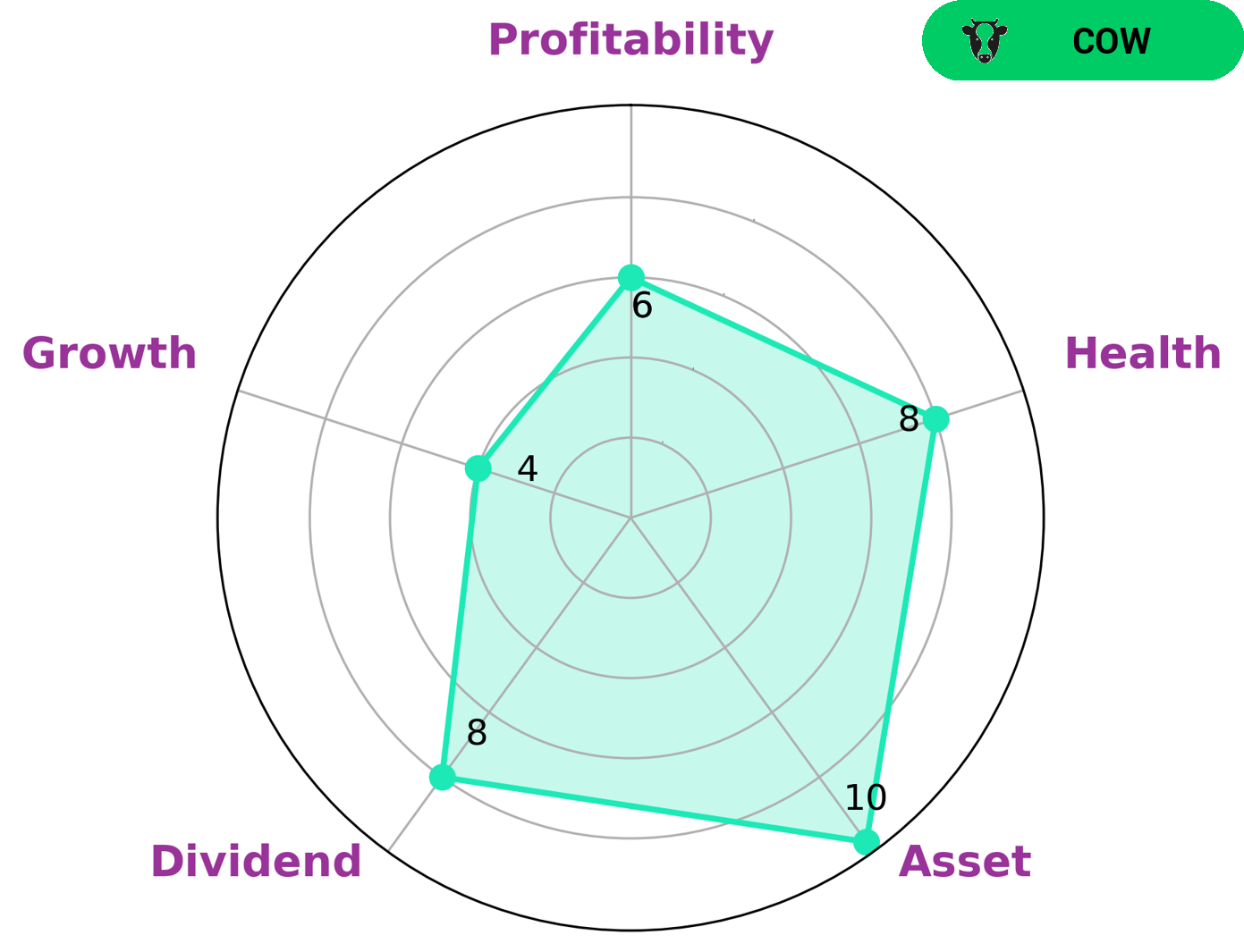

GoodWhale’s analysis of the wellbeing of FRASERS PROPERTY has revealed that it is classified as a ‘cow’ type of company according to Star Chart, signifying its track record in providing consistent and sustainable dividend payments. This is an attractive proposition for investors looking to receive a steady income from their investments. Furthermore, FRASERS PROPERTY has earned a health score of 8/10 based on its cashflows, debt and ability to pay off future debts, as well as fund future operations. We have also determined that FRASERS PROPERTY is strong in terms of assets and dividends and medium in terms of growth and profitability. All of these factors make FRASERS PROPERTY a prime investment opportunity for those looking for a stable and profitable return. More…

Peers

Frasers Property Ltd is one of the leading companies in the real estate and property development industry, operating in Australia, Europe, and Asia. The company is a major player in the industry, competing with Cedar Woods Properties Ltd, Hufvudstaden AB, and Redco Properties Group Ltd. All of these companies are committed to providing innovative property solutions and delivering high-quality residential and commercial developments.

– Cedar Woods Properties Ltd ($ASX:CWP)

Cedar Woods Properties Ltd is a property developer and investor based in Perth, Western Australia, focused on residential development projects. The company has a market capitalisation of 378.17 million as of 2023, indicating that it is a well-established and successful organisation. Cedar Woods’ Return on Equity (ROE) of 8.14% indicates the company’s efficiency in generating profits from its investments, demonstrating its financial strength and stability.

– Hufvudstaden AB ($LTS:0GW3)

Hufvudstaden AB is a real estate company based in Sweden. Its market capitalization stands at 32.73 billion as of 2023, making it one of the largest companies in the country. The company’s Return on Equity (ROE) for the same period is 7.73%, indicating that it has been able to generate sizeable profits from its equity investments. Hufvudstaden owns and manages a large portfolio of office buildings, shopping centers, and residential properties across Sweden. It also develops new properties and invests in other real estate-related businesses.

– Redco Properties Group Ltd ($SEHK:01622)

Redco Properties Group Ltd is an international real estate investment and development firm. The company is known for its aggressive expansion strategy, with investments in multiple countries across the globe. As of 2023, Redco Properties Group Ltd has a market capitalization of 5.97 billion dollars. This is indicative of the company’s successful business model and growth trajectory. Additionally, Redco Properties Group Ltd has a Return on Equity (ROE) of 18.64%. This indicates that the company is able to generate a significant amount of profit from its investments in the real estate sector.

Summary

Frasers Property, a leading real estate firm in Southeast Asia, has entered into a joint venture with Gelex to create and develop premium industrial zones in Vietnam. The venture is expected to benefit both companies, with Frasers Property able to leverage Gelex’s experience and local knowledge to expand its presence in the country. Market sentiment towards the venture has been mostly positive, with investors expecting that it will bring increased value for Frasers Property, as well as provide them with access to high-yield industrial zones in Vietnam. Long-term, the project could serve as a win-win situation for both companies and provide more attractive opportunities for investors.

Recent Posts