Five Point Holdings Sees Decrease in Short Interest in March

April 6, 2023

Trending News ☀️

Five Point ($NYSE:FPH) Holdings, LLC (NYSE:FPH), is a diversified real estate development company that creates and supports vibrant, sustainable communities in California. In March, there was a 6.0% decrease in Short Interest in the company’s stock. This decrease reflects investors’ sentiment that the stock will continue to increase in value as Five Point develops more communities and pursues additional real estate projects. The decrease in Short Interest comes at an ideal time for Five Point, as the company looks to expand its portfolio with additional projects such as the Orange County Great Park project. With the decrease in Short Interest, Five Point is well positioned to capitalize on new opportunities and increase investor confidence. Five Point’s recent success has been partially fueled by a strong management team and a focus on sustainability.

The company’s long-term strategy is designed to create lasting value for its shareholders, while at the same time fostering vibrant and sustainable communities. With the decrease in Short Interest, Five Point is showing investors that it has a bright future and that its stock is an attractive investment option. With its long-term strategy, strong management team, and focus on sustainability, Five Point is well positioned to capitalize on new opportunities and create lasting value for its shareholders. This decrease in Short Interest is reflective of the confidence investors have in the company’s ability to achieve future success.

Stock Price

On Monday, Five Point Holdings (FIVE POINT) stock opened at $2.4 and closed at $2.4, up by 0.4% from the previous closing price of 2.4. This closing price marks a decrease in short interest for FIVE POINT that has been observed since the beginning of March. With this decrease in short interest, it appears that investors are beginning to recognize the potential growth that FIVE POINT offers in the long term. This trend also indicates that investors are beginning to have more confidence in FIVE POINT’s future prospects and are becoming more optimistic about the company’s growth potential.

The decrease in short interest is a positive trend for FIVE POINT and could lead to an increase in share price as investors become more confident and bullish on the stock. This upcoming trend could also lead to more investors getting involved and taking a stake in FIVE POINT. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Five Point. More…

| Total Revenues | Net Income | Net Margin |

| 42.69 | -15.31 | 7.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Five Point. More…

| Operations | Investing | Financing |

| -188.3 | 63.99 | -9.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Five Point. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.89k | 992.74 | 8.95 |

Key Ratios Snapshot

Some of the financial key ratios for Five Point are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -38.6% | – | -92.3% |

| FCF Margin | ROE | ROA |

| -441.1% | -4.0% | -0.9% |

Analysis

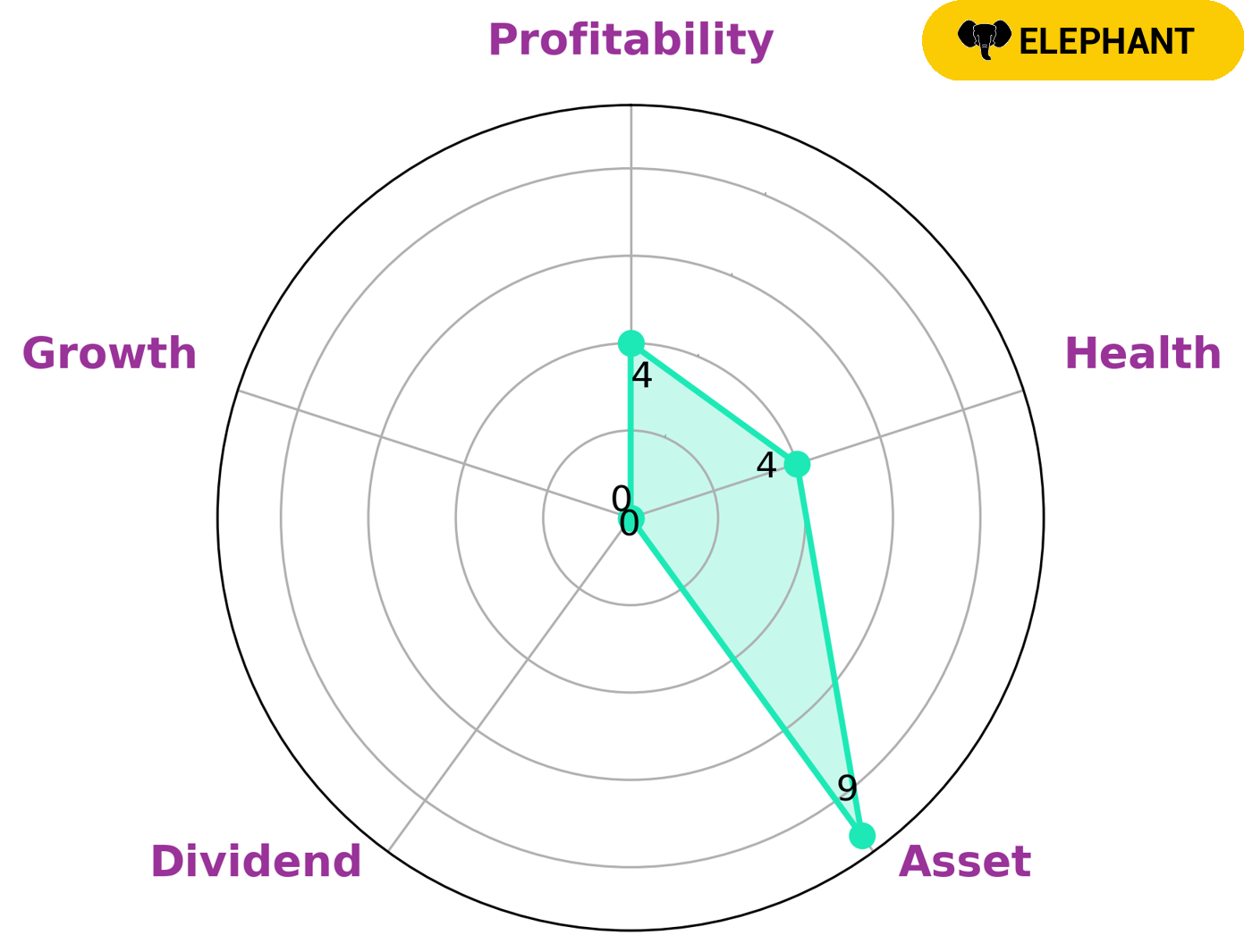

As part of our analysis for FIVE POINT, we have conducted a Star Chart assessment, which gives the company a health score of 4/10. This score reflects the company’s cashflows and debt and suggests that FIVE POINT is likely to be able to pay off its debt and fund future operations. In terms of classification, FIVE POINT is classed as an ‘elephant’, a type of company that is rich in assets after deducting its liabilities. This makes it an attractive proposition for investors, who may be interested in a company with strong assets and medium levels of profitability and weak dividend growth. More…

Peers

The Company owns, develops and manages mixed-use properties in the U.S. West Coast region. As of December 31, 2016, the Company’s portfolio consisted of four master planned communities, which were entitled for the development of approximately 26,200 residential units and 19.6 million square feet of commercial space. The Company’s master planned communities are located in coastal California, including Huntington Beach, San Clemente, Irvine and Newhall.

– Golden MV Holdings Inc ($PSE:HVN)

MV Holdings Inc is a holding company that operates in the financial services industry. The company has a market capitalization of 367.15 billion as of 2022 and a return on equity of 9.29%. The company provides a range of financial services including investment banking, asset management, and insurance. MV Holdings Inc is headquartered in New York, NY.

– One Heritage Group PLC ($LSE:OHG)

Heritage Group PLC is a holding company that engages in the provision of financial services. It operates through the following segments: Banking, Insurance, and Asset Management. The Banking segment offers personal and corporate banking products and services. The Insurance segment provides life insurance, general insurance, and health insurance products. The Asset Management segment offers discretionary investment management, fiduciary, and advisory services. The company was founded on November 10, 1992 and is headquartered in London, the United Kingdom.

– Echo Investment SA ($LTS:0LTK)

Echo Investment SA is a real estate company that focuses on the development, construction, and management of commercial and residential properties. The company has a market capitalization of 1.24 billion as of 2022 and a return on equity of 17.01%. Echo Investment SA is headquartered in Warsaw, Poland.

Summary

This is positive news for FPH investors, as a decrease in short interest indicates that fewer investors think the stock price will fall in the near future. Additionally, FPH has seen year-over-year growth in earnings per share, revenue and net income. In light of these factors, investors may want to consider Five Point Holdings as a potential long-term investment opportunity.

Recent Posts