Deutsche Bank Aktiengesellschaft Recommends Purchase of Pearson PLC Stock

April 1, 2023

Trending News ☀️

Deutsche Bank Aktiengesellschaft has given a “Buy” rating to Pearson ($LSE:PSON) PLC (LON:PSON). Pearson PLC is an international media and publishing company based in London, England. It has interests in education, business and consumer publishing, as well as other media-related services. It is also one of the leading providers of professional qualifications in the UK. Pearson PLC has had a history of strong financial performance and consistent dividend payments for its investors.

Its share price has been steadily trending upwards in recent years, and Deutsche Bank’s “Buy” rating is a strong endorsement of the stock. This should provide confidence for new investors looking to capitalize on Pearson’s long-term growth prospects.

Market Price

Deutsche Bank Aktiengesellschaft has recommended the purchase of Pearson PLC stock, after the stock opened at £8.2 and closed at £8.3 on Monday, an increase of 1.6% from its previous closing price of 8.1. This marks a notable shift in the company’s share price, as Pearson PLC has seen its stock price struggle in the past few months. The endorsement from Deutsche Bank Aktiengesellschaft will likely provide a boost of confidence in the potential of Pearson PLC stock, and may lead to further increases in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pearson Plc. More…

| Total Revenues | Net Income | Net Margin |

| 3.84k | 242 | 4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pearson Plc. More…

| Operations | Investing | Financing |

| 361 | 13 | -804 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pearson Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.31k | 2.89k | 6.15 |

Key Ratios Snapshot

Some of the financial key ratios for Pearson Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.2% | -12.1% | 10.2% |

| FCF Margin | ROE | ROA |

| 5.6% | 5.5% | 3.4% |

Analysis

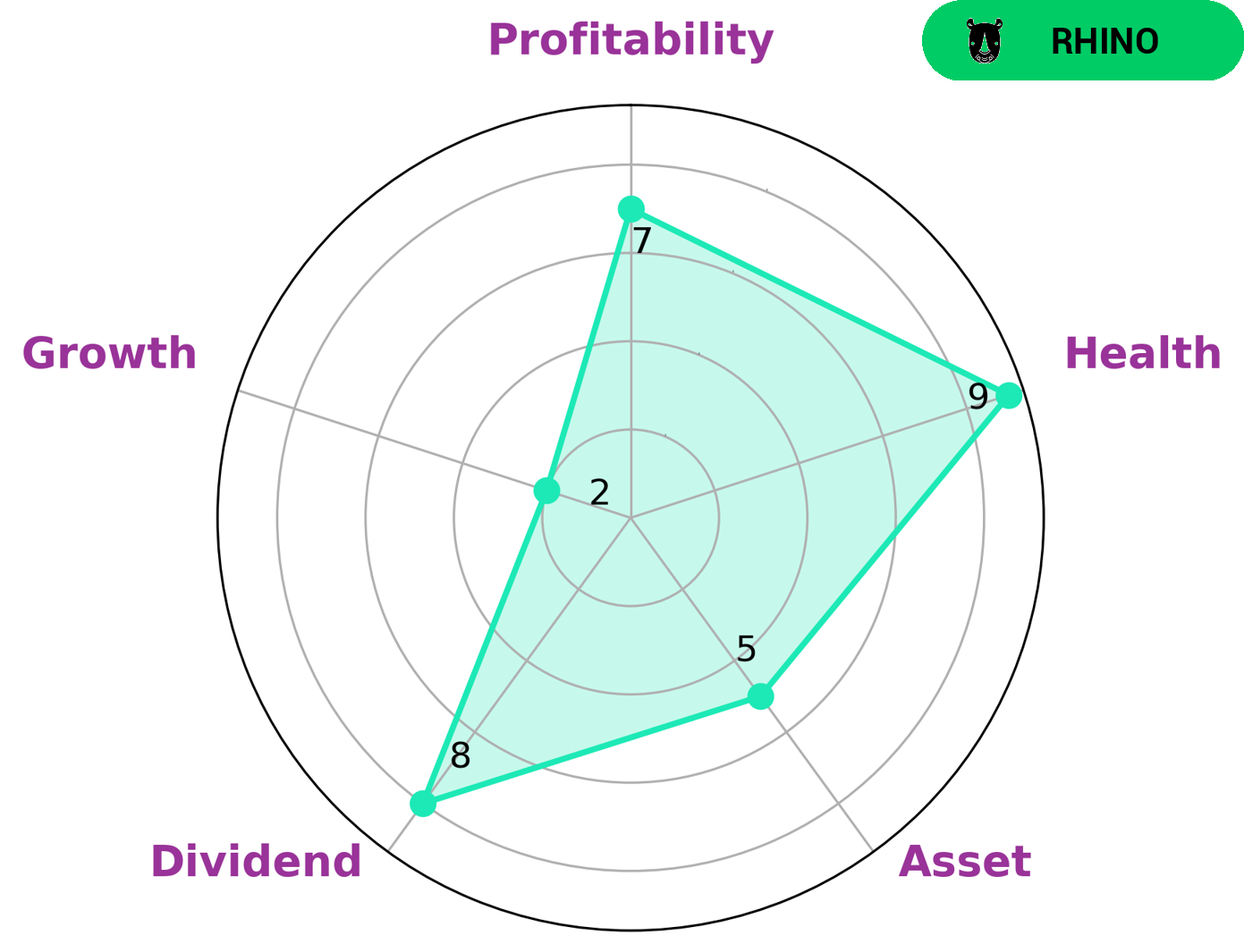

GoodWhale has conducted an analysis of PEARSON PLC‘s fundamentals and the results show that it is strong in dividend and profitability, medium in asset and weak in growth. On the Star Chart, PEARSON PLC is classified as ‘rhino’ which indicates that it has achieved moderate revenue or earnings growth. Additionally, PEARSON PLC has a high health score of 9/10 with regard to its cashflows and debt, which indicates its capability to sustain future operations in times of crisis. Based on these results, investors seeking stable returns and low-risk investments may be interested in investing in PEARSON PLC. The company’s dividend and profitability are strong, while its asset and growth are merely respectable. It is also capable of sustaining future operations even in challenging economic times. Therefore, investors may find this company to be a reliable investment option. More…

Peers

It is the largest education company in the world and was founded in 1844. The company is listed on the London Stock Exchange and is a constituent of the FTSE 100 Index. Its competitors include John Wiley & Sons Inc, Visang Education Inc, Sasbadi Holdings Bhd.

– John Wiley & Sons Inc ($NYSE:WLY)

Wiley is a global provider of knowledge and knowledge-enabled services that improve outcomes in areas of research, professional practice, and education. Through the Research segment, the company provides digital and print scientific, technical, medical, and scholarly journals, reference works, books, database services, and advertising. The Professional Development segment offers digital and print books, online assessment and training services, and education solutions in areas including accounting, finance, architecture, engineering, computing, nursing, and education. Wiley also serves the needs of individuals and institutions through the Education segment, which provides online program management services for higher education institutions and courses, as well as print and digital content and learning solutions for students and educators worldwide.

– Visang Education Inc ($KOSE:100220)

Visang Education Inc has a market cap of 72.28B as of 2022, a Return on Equity of 22.75%. The company is a provider of online education services in China. It offers a range of services, including online tutoring, test preparation, and consulting services. The company was founded in 2003 and is headquartered in Beijing, China.

– Sasbadi Holdings Bhd ($KLSE:5252)

Sasbadi Holdings Bhd is a Malaysia-based company engaged in the business of investment holding and the provision of management services. The Company’s segments include Publishing, which is engaged in the publication of educational books and marketing of learning aids; Property, which is engaged in property development and investment, and Others, which includes provision of ICT products and services, and manufacturing and trading of stationery.

Summary

Pearson PLC (LON:PSON) has been given a “Buy” rating by Deutsche Bank Aktiengesellschaft. Analysts have noted that Pearson PLC has seen strong growth in recent years, due to investments in educational content and services. As a result, the company has seen increased revenues and earnings. Pearson PLC is well-positioned to benefit from the increasing demand for digital educational content and services, which is expected to continue going forward.

Additionally, the company’s diversified portfolio of products and services provides it with a competitive advantage. The company’s balance sheet remains sound, with a healthy level of liquidity. Overall, Pearson PLC looks like an attractive investment opportunity, with potential for significant returns.

Recent Posts