RLX Technology Reports Non-GAAP EPADS of $0.02, Revenue of RMB188.9M

May 18, 2023

Trending News 🌥️

RLX ($NYSE:RLX) Technology, a leading Chinese cloud computing and big data solutions provider, recently announced reported Non-GAAP earnings per American Depository Share of $0.02 on revenue of RMB188.9M. This marked the company’s fifth consecutive quarter of positive Non-GAAP EPS. The positive earnings report came as a pleasant surprise for investors who were expecting a slightly lower revenue figure. RLX Technology has been growing rapidly over the past few years. RLX Technology’s core businesses are focused on providing innovative cloud computing and big data solutions to enterprises across the Chinese market.

The company is well-positioned to capitalize on the increasing demand for cloud computing and big data solutions in the Chinese market. RLX Technology is also investing heavily in research and development as it looks to become a leader in the industry. With a strong focus on innovation, RLX Technology is set to continue its impressive growth in the coming years.

Earnings

RLX TECHNOLOGY recently reported their earnings for FY2022 Q4, with a total revenue of RMB188.9M and a non-GAAP EPADS of $0.02. This was a significant decrease from last year, with an 82.1% decrease in total revenue and a 146.3% decrease in net income. In the last three years, their total revenue has dropped from RMB1618.45M to RMB340.01M. This marks a major downturn in RLX TECHNOLOGY’s financial performance, which must be addressed by the company.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rlx Technology. More…

| Total Revenues | Net Income | Net Margin |

| 5.33k | 1.44k | 25.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rlx Technology. More…

| Operations | Investing | Financing |

| 486.83 | -4.13k | -477.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rlx Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.38k | 838.45 | 8.76 |

Key Ratios Snapshot

Some of the financial key ratios for Rlx Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 51.0% | 166.2% | 19.9% |

| FCF Margin | ROE | ROA |

| 9.1% | 4.3% | 4.1% |

Stock Price

This was in line with market expectations. The company’s stock opened on Wednesday at $2.2 and closed at $2.4, up 3.8% from the previous closing price of 2.4. This was mainly attributed to the positive earnings report released by the company, which had beaten market expectations.

This comes as a welcome relief to investors who have been cautious about investing in the tech giant since it reported disappointing results earlier this year. As the company continues to expand its operations and report strong financials, investors can remain confident in the long-term prospects of this innovative technology company. Live Quote…

Analysis

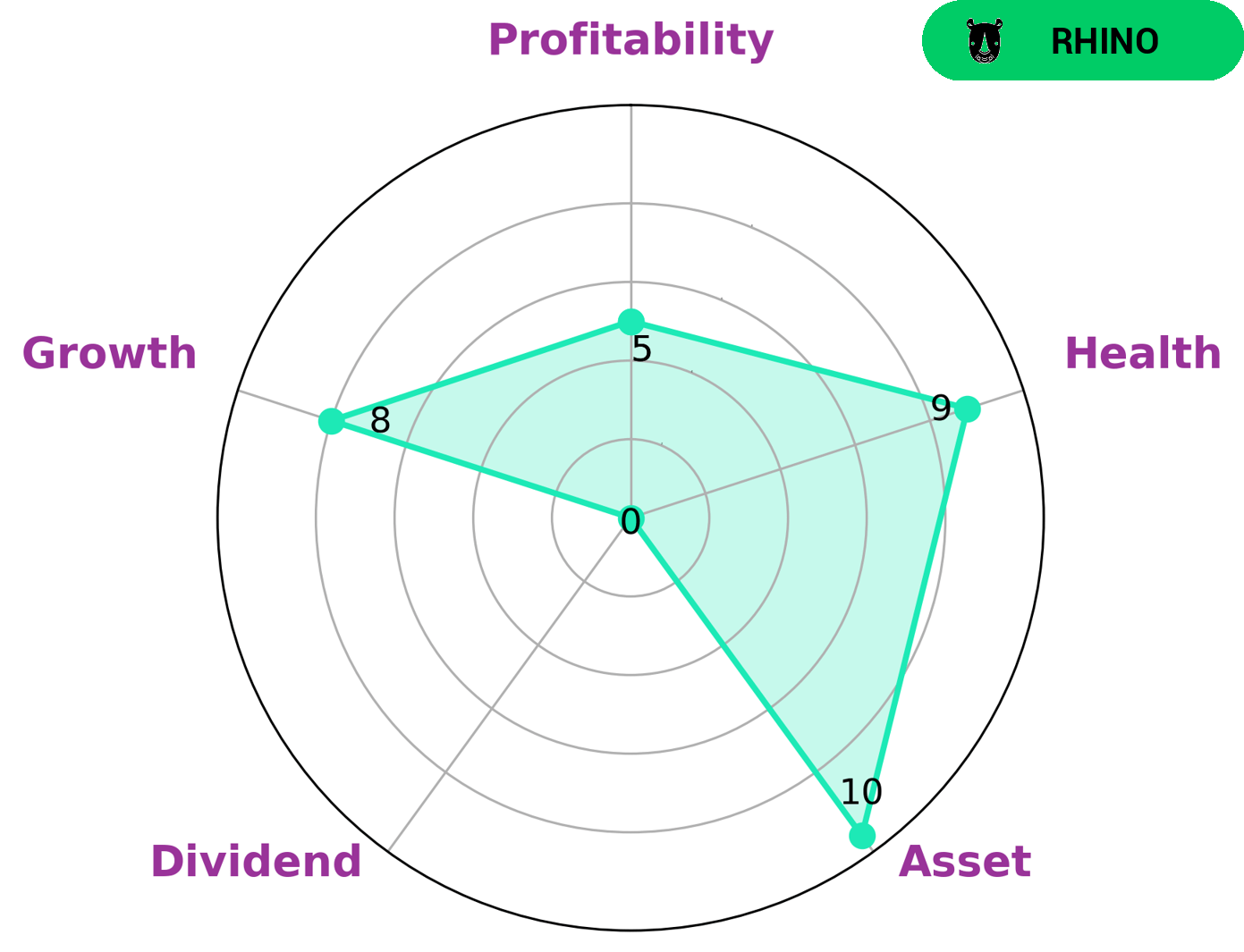

GoodWhale’s analysis of RLX TECHNOLOGY‘s fundamentals has revealed that the company is classified as ‘rhino’ according to the Star Chart, meaning that it has achieved moderate revenue or earnings growth. This makes it an attractive investment option for investors looking for steady returns over the long-term. RLX TECHNOLOGY also has strong assets, growth and medium profitability. However, its dividend is weak. Despite this, its high health score of 9/10, taking into account its cashflows and debt, suggests that the company has the capability to pay off debt and fund future operations. This makes it an attractive investment opportunity for those investors looking for steady returns over the long-term. More…

Peers

In the technology industry, RLX Technology Inc competes against Kim Teck Cheong Consolidated Bhd, Crown Confectionery Co Ltd, and White Organic Retail Ltd. All of these companies are striving to be the best in the industry and provide the best products and services to their customers. Each company has its own strengths and weaknesses, and it is up to the consumer to decide which company they want to purchase from.

– Kim Teck Cheong Consolidated Bhd ($KLSE:0180)

Founded in 1957, Kim Teck Cheong Consolidated Bhd is one of Malaysia’s leading suppliers of construction materials. The company has a market cap of 163.65M as of 2022 and a Return on Equity of 12.59%. Its products include cement, sand, aggregate, bricks, and tiles. The company also provides environmental solutions such as waste management and recycling services.

– Crown Confectionery Co Ltd ($KOSE:264900)

As of 2022, Crown Confectionery Co Ltd has a market cap of 106.92B and a Return on Equity of 11.73%. The company manufactures and sells confectionery products under the Crown, Meiji, and Morinaga brands. It offers chocolates, biscuits, crackers, cookies, candies, gum, and other confectionery products. The company also operates supermarkets and convenience stores.

– White Organic Retail Ltd ($BSE:542667)

White Organic Retail Ltd is a publicly traded company with a market capitalization of 4.89 billion as of 2022. The company has a return on equity of 16.17%. White Organic Retail Ltd is engaged in the business of retailing organic food and other products. The company operates a chain of stores under the name “White Organic Markets.”

Summary

RLX Technology (RLX) has recently reported its non-GAAP earnings per-share (EPADS) of $0.02 and revenue of RMB188.9 million. This news was met positively by the market with the company’s stock price moving up on the same day. Investors will want to look at RLX’s financial performance to assess the stock’s value. The company has relatively low debt compared to its peers and has seen a steady increase in revenue over the past few years. Furthermore, its profitability has been consistent over the past few quarters, suggesting it may be a good investing option.

Additionally, RLX’s competitive position should be considered. The company’s products are widely used by customers in the fast-growing technology sector, which could give it an edge over other players in the industry. Overall, RLX Technology looks like a good investing option, given the company’s strong financial performance and competitive position in the industry. Investors should carefully consider these factors before making any investing decisions.

Recent Posts