monday.com Sees Profitable Growth Through Product Innovation

May 25, 2023

Trending News ☀️

Monday.com Ltd ($NASDAQ:MNDY) is a leading provider of cloud-based project collaboration and work management solutions. With their commitment to product innovation, monday.com sees itself as a leader in providing an intuitive and comprehensive suite of tools for managing projects from start to finish. Monday.com is driving profitable growth through product innovation. Their innovative tools are designed to help customers easily manage projects and tasks, track progress, and collaborate with team members in real-time. With their intuitive design and expansive feature set, monday.com can help customers save time and money while increasing productivity.

Additionally, monday.com offers an impressive portfolio of integrations with other popular software solutions, allowing customers to seamlessly connect their project management system to their existing workflow. From its inception, monday.com has committed itself to product innovation, constantly striving to make their software more powerful and user-friendly. As a result of this commitment, they have seen significant profits year-over-year as more users turn to monday.com for their project management needs. With their vision of transforming how teams work together, monday.com is poised to continue to drive profitable growth in the future.

Stock Price

MONDAY.COM LTD has seen a surge in their stock prices this week, with a 4.2% increase from the previous closing price. On Wednesday, MONDAY.COM LTD opened at $154.9 and closed at $164.3. This is attributed to the company’s product innovation, which have allowed them to increase their profit margins and gain more traction in the market.

The company’s focus on product innovation has helped them stay ahead of competitors and remain profitable during a difficult economic period. This has in turn caused investors to be more confident in MONDAY.COM LTD’s offerings and led to an increased demand for their product offerings, further driving up the stock prices. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Monday.com Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 572.79 | -84.86 | -15.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Monday.com Ltd. More…

| Operations | Investing | Financing |

| 82.78 | -19.77 | 22.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Monday.com Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.1k | 402.39 | 14.24 |

Key Ratios Snapshot

Some of the financial key ratios for Monday.com Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 88.0% | – | -14.8% |

| FCF Margin | ROE | ROA |

| 11.0% | -7.7% | -4.8% |

Analysis

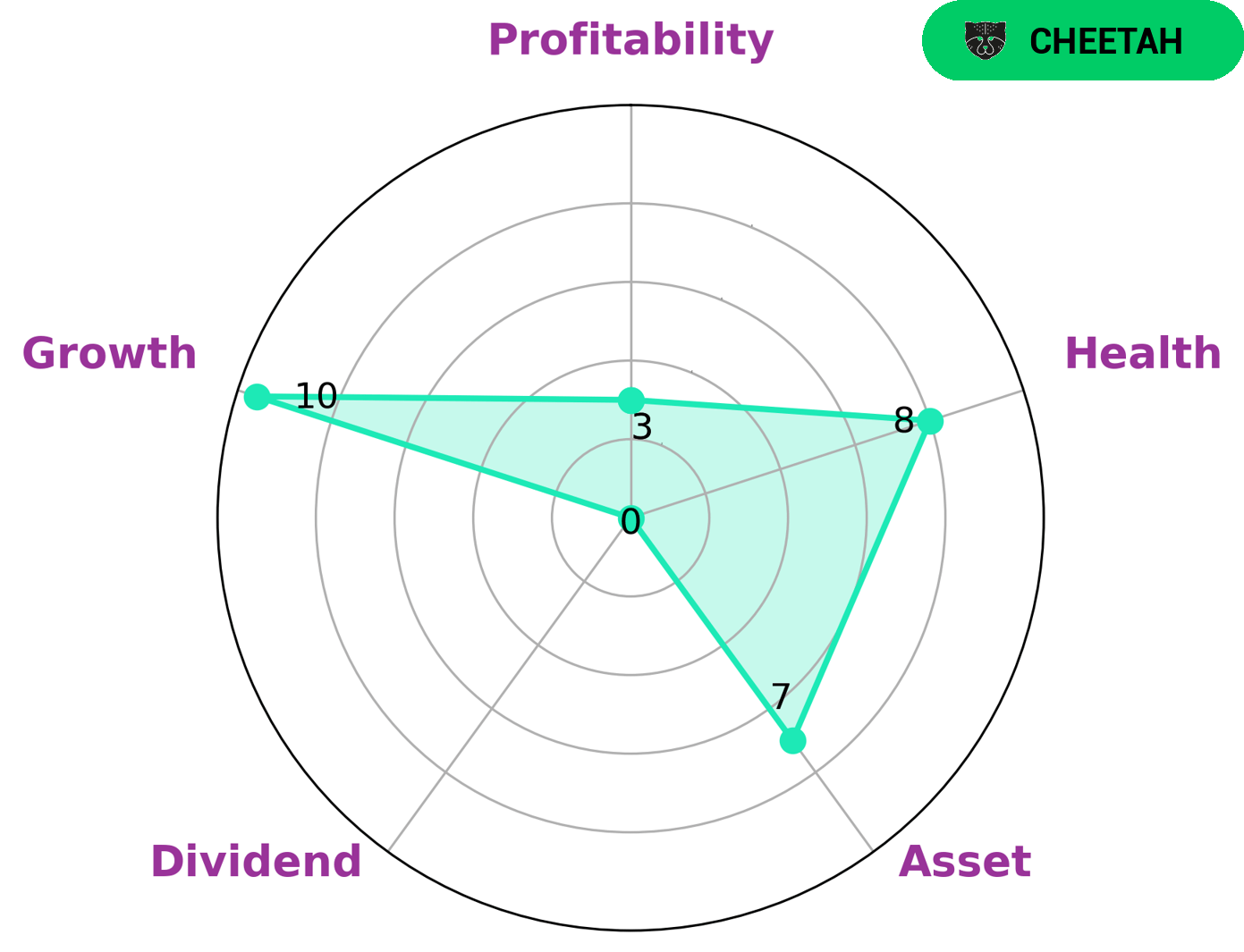

As GoodWhale, we performed an analysis of MONDAY.COM LTD‘s fundamentals. Our Star Chart classified MONDAY.COM LTD as a ‘cheetah’, which suggests that the company has achieved high revenue or earnings growth but is considered to be less stable due to lower profitability. This makes us believe that investors who prefer high growth potential yet are able to manage slightly higher risks may be interested in such company. Moreover, MONDAY.COM LTD has been given a high health score of 8/10 with regard to its cashflows and debt, which demonstrates that it is capable of safely riding out any crisis without the risk of bankruptcy. Furthermore, our analysis has revealed that the company is strong in terms of asset and growth, while it is weak when it comes to dividend and profitability. More…

Peers

The company was founded in 2012 and is headquartered in Tel Aviv, Israel. Monday.com has over 1,000 employees and serves customers in over 180 countries. The company offers a free trial of its software and has a monthly subscription model. Monday.com competes with Asana, Salesforce, and Atlassian Corporation.

– Asana Inc ($NYSE:ASAN)

Asana is a work management platform that helps teams organize, track, and manage their work. It has a market cap of 3.63B as of 2022 and a Return on Equity of -184.09%. The company was founded in 2008 and is headquartered in San Francisco, California.

– Salesforce Inc ($NYSE:CRM)

Salesforce Inc is a cloud-based software company that provides customer relationship management (CRM) and other enterprise software applications. As of 2022, the company has a market capitalization of 139.77 billion dollars and a return on equity of 0.08%. Salesforce was founded in 1999 and is headquartered in San Francisco, California.

– Atlassian Corporation PLC ($NASDAQ:TEAM)

Atlassian Corporation PLC is a publicly traded company with a market capitalization of over 31 billion as of early 2021. The company provides software development and collaboration tools to businesses and organizations of all sizes. Its products include the JIRA software development tool, Confluence collaboration software, and HipChat messaging service. The company has been profitable since its inception in 2002 and has a strong track record of delivering shareholder value.

Summary

Monday.com Ltd is an Israeli software developer that specializes in the development of project management and collaboration tools. The company’s stock has seen significant gains over the last few months, with the stock price moving up on the same day as news of the company’s product innovation driving profitable growth. This indicates a bullish outlook for this stock and shows investors that this could be a good long-term investment. Analysts point to the company’s expanding customer base, strong revenue growth, and cash reserves as further evidence that monday.com is a reliable stock choice.

The company’s focus on customer satisfaction and its low-cost business model are also likely to drive continued growth in the near future. Overall, monday.com looks to be a promising investment option for investors looking for a technology-driven stock.

Recent Posts