J.B. Hunt Transport Services Reports Decreased Revenue But Increased Net Income for FY2022 Q4

January 19, 2023

Earnings report

J.B. ($NASDAQ:JBHT) Hunt Transport Services is a major transportation and logistics company that operates throughout North America. On January 18th 2023, J.B. Hunt Transport Services reported their FY2022 Q4 earnings results as of December 31 2022. Total revenue was USD 201.3 million, a decrease of 16.9% compared to the same quarter the previous year. Despite the decrease in revenue, net income saw an increase of 4.4% year over year to USD 3649.6 million. This was due to cost-saving initiatives and improved efficiency across its divisions.

The company has also been investing heavily in technology solutions to enhance its operations and customer service. These investments are expected to drive further efficiency and cost savings in the future. Overall, J.B. Hunt Transport Services reported a decrease in revenue for FY2022 Q4 but managed to achieve an increase in net income. The company’s investments in technology solutions will be key in helping them increase efficiency and savings in the future.

Price History

On Wednesday, J.B. Hunt Transport Services reported its financial results for the fourth quarter of fiscal year 2022, revealing a decrease in revenue but an increase in net income. The company’s stock opened at $177.0 and closed at $185.0, up by 5.0% from its last closing price of 176.3. This decrease was mainly driven by a decline in capacity utilization, which was partially offset by higher contract rates and an increase in volume in the company’s Intermodal segment. This increase was mainly due to lower operating expenses and a lower effective tax rate in the fourth quarter. Looking forward, J.B. Hunt remains cautiously optimistic about the future, citing a strong backlog of freight orders and increased demand for intermodal services as drivers of long-term growth.

The company also noted that it is continuing to invest in technology to improve efficiency and customer experience. Overall, J.B. Hunt’s financial results for the fourth quarter of fiscal year 2022 indicate that despite a decrease in revenue, net income increased due to cost savings and lower tax rates. The company is optimistic that the long-term outlook remains positive, and is investing in technology to ensure its continued success in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JBHT. More…

| Total Revenues | Net Income | Net Margin |

| 14.81k | 969.35 | 6.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JBHT. More…

| Operations | Investing | Financing |

| 1.61k | -877.02 | -304.63 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JBHT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.74k | 4.08k | 30.11 |

Key Ratios Snapshot

Some of the financial key ratios for JBHT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.4% | 22.0% | 9.0% |

| FCF Margin | ROE | ROA |

| 1.0% | 26.7% | 10.7% |

VI Analysis

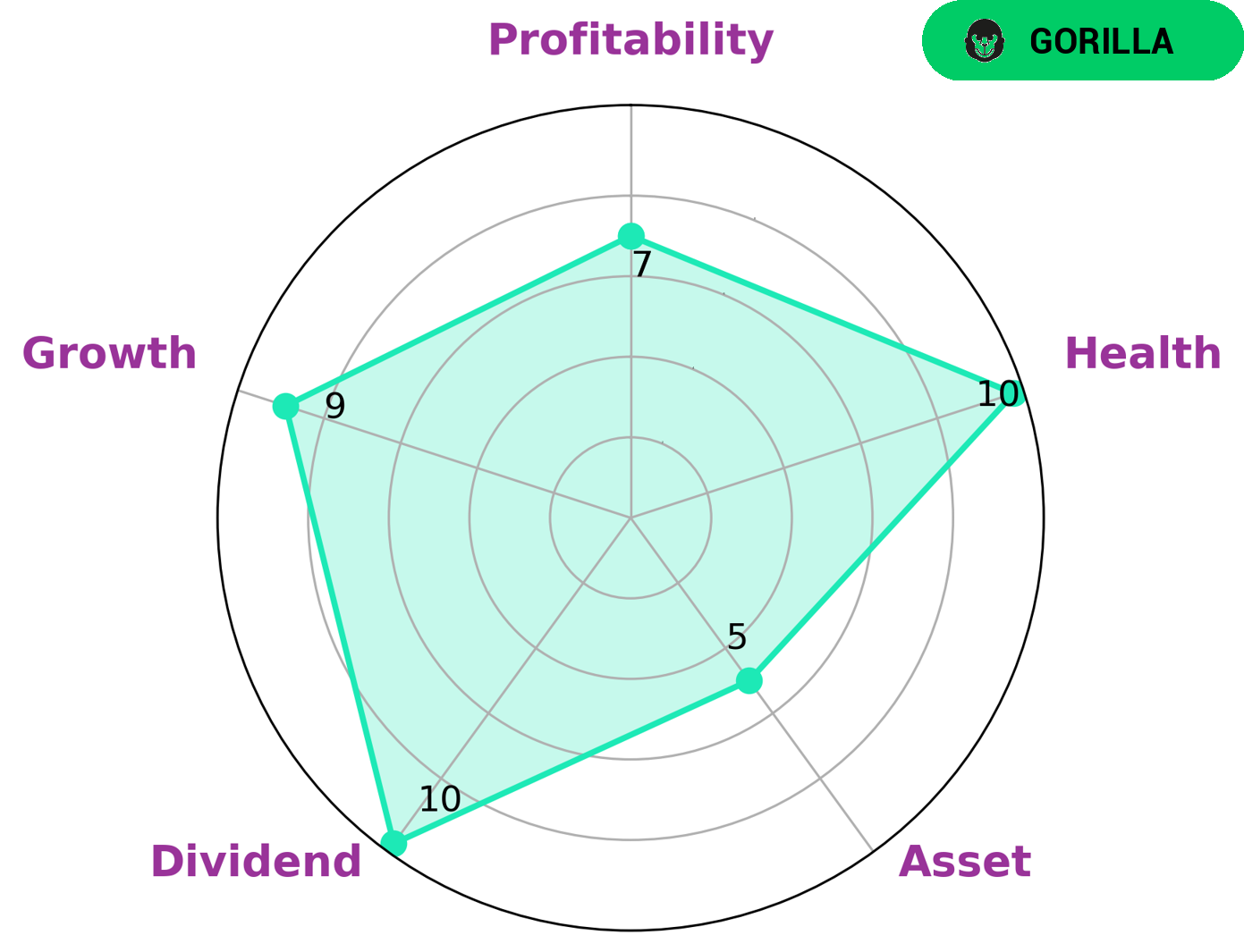

Investors looking for a strong and stable company should consider J.B. Hunt Transport Services. According to the VI Star Chart, the company has a high health score of 10/10 when it comes to cashflows and debt, indicating that it is well-positioned to withstand any future economic crisis. J.B. Hunt also boasts strong dividend, growth, and profitability, as well as medium asset levels. Additionally, the company is classified as a ‘gorilla’, a type of business that has achieved consistent and high revenue and earning growth thanks to its strong competitive edge. Investors interested in such a company should look for a few key features. First, the company should have strong cash flows and debt levels, as well as an attractive dividend and growth rate. Second, it should have a healthy amount of assets so that it can continue to invest in its business and stay competitive. Finally, the company should have a competitive advantage that helps it outperform its competitors. J.B. Hunt Transport Services appears to meet all of these criteria, making it an attractive option for investors looking for a strong and stable company. Its high health score, strong dividend and growth rate, and competitive edge make it an attractive option for those seeking financial stability. More…

VI Peers

JB Hunt Transport Services Inc is a leading transportation provider in North America. The company operates in four segments: Intermodal (JBHT), Dedicated Contract Services (DCS), Integrated Capacity Solutions (ICS), and Truck (JBT). The company has a fleet of over 16,000 trucks and more than 48,000 trailers. JBHT offers a wide range of transportation services including intermodal, dedicated contract, and truckload. The company has a strong market position in the United States and Canada.

JBHT competes with Hub Group Inc, Yang Ming Marine Transport Corp, Rinko Corp, and other transportation companies in the United States and Canada. The company has a strong market position and a large fleet of trucks and trailers. JBHT offers a wide range of transportation services. The company has a strong financial position and is expected to grow at a fast pace in the coming years.

– Hub Group Inc ($NASDAQ:HUBG)

Hub Group is a transportation management company that provides intermodal, truck brokerage and logistics services. Hub Group’s intermodal services include rail-to-truck and truck-to-rail transloading, as well as drayage service. The company’s truck brokerage services provide full truckload, less-than-truckload and dedicated contract carriage. Hub Group’s logistics services include supply chain management and warehouse management.

As of 2022, Hub Group’s market cap is $2.59 billion. The company’s return on equity is 21.81%. Hub Group is a transportation management company that provides intermodal, truck brokerage and logistics services. The company’s intermodal services include rail-to-truck and truck-to-rail transloading, as well as drayage service. The company’s truck brokerage services provide full truckload, less-than-truckload and dedicated contract carriage. Hub Group’s logistics services include supply chain management and warehouse management.

– Yang Ming Marine Transport Corp ($TWSE:2609)

As of 2022, Yang Ming Marine Transport Corp has a market cap of 220B and a Return on Equity of 62.35%. The company is a leading provider of international ocean transportation services. It operates a modern fleet of container vessels and provides integrated logistics services. The company has a strong market position in the Far East, Europe, and the Middle East.

– Rinko Corp ($TSE:9355)

Rinko Corp is a Japanese company that manufactures and sells construction materials. The company has a market cap of 3.82B as of 2022 and a return on equity of 4.29%. Rinko Corp is a well-established company with a strong financial position. The company’s products are in high demand, and its products are used in a wide variety of applications. Rinko Corp has a strong market presence and is a market leader in its industry.

Summary

Investors in J.B. Hunt Transport Services have reason to be optimistic following the release of the company’s fourth quarter 2022 earnings results. Despite a 16.9% year-over-year decline in total revenue, net income increased by 4.4%. This increase in profitability was enough to send the company’s stock price up on the day the earnings were released. Going forward, investors should consider the fact that the company’s net income is increasing despite a decrease in total revenue. This could indicate that the company is becoming more efficient and cost-effective, and as a result, more profitable.

Investors should also watch for any major changes in the company’s operating costs, as well as any new initiatives or investments that could help drive revenue growth in the future. Overall, J.B. Hunt Transport Services appears to be a strong investment opportunity. With the company becoming increasingly efficient and its net income continuing to grow, it could be a great option for investors looking for long-term returns. The stock price has already risen following the release of the latest earnings report, and there could be more upside potential if the company can continue to increase its profitability.

Recent Posts