Innospec Experiences Growth in Returns on Capital

June 2, 2023

☀️Trending News

Innospec Inc ($NASDAQ:IOSP). is an international specialty chemicals company that manufactures and distributes a broad range of products to a variety of industries. It operates in three segments – Performance Products, Fuel Specialties, and Oilfield Services. Recently, Innospec’s Returns On Capital (ROC) have seen a significant increase, making it an attractive stock for investors. The company has been able to achieve this impressive growth in returns on capital by focusing on cost reduction and efficiency initiatives. These initiatives have allowed Innospec to remain competitive in the marketplace and increase profitability. Additionally, the company has invested in new technology and product offerings to better serve its customers. This has enabled them to capitalize on trends in the industry and expand their market share. Innospec’s management team has done an excellent job of leveraging their strengths and profitability to create value for their shareholders. Its diversified portfolio of products and services have provided steady returns over time.

In addition, its strong balance sheet and cash flow have allowed it to invest in long-term growth opportunities. Overall, Innospec Inc. has experienced strong growth in returns on capital over the last few years due to its cost reduction and efficiency initiatives as well as its investments in technology and product offerings. This has made it an attractive stock for investors looking for a profitable and stable company to invest in.

Share Price

Innospec Inc. experienced growth in returns on capital on Tuesday, as the stock opened at $94.9 and closed at $94.1, down by 0.9% from the previous closing price of 95.0. This was indicative of strong returns on capital for the company and a strong showing in the market despite the drop in closing price. With a solid market presence, Innospec Inc. is well positioned for continued growth and success in the future as it strives to continue to deliver exceptional returns to its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Innospec Inc. More…

| Total Revenues | Net Income | Net Margin |

| 2k | 129.7 | 6.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Innospec Inc. More…

| Operations | Investing | Financing |

| 132.5 | -55.7 | -34.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Innospec Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.62k | 543.5 | 41.61 |

Key Ratios Snapshot

Some of the financial key ratios for Innospec Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.1% | 6.0% | 8.9% |

| FCF Margin | ROE | ROA |

| 3.8% | 10.7% | 6.9% |

Analysis

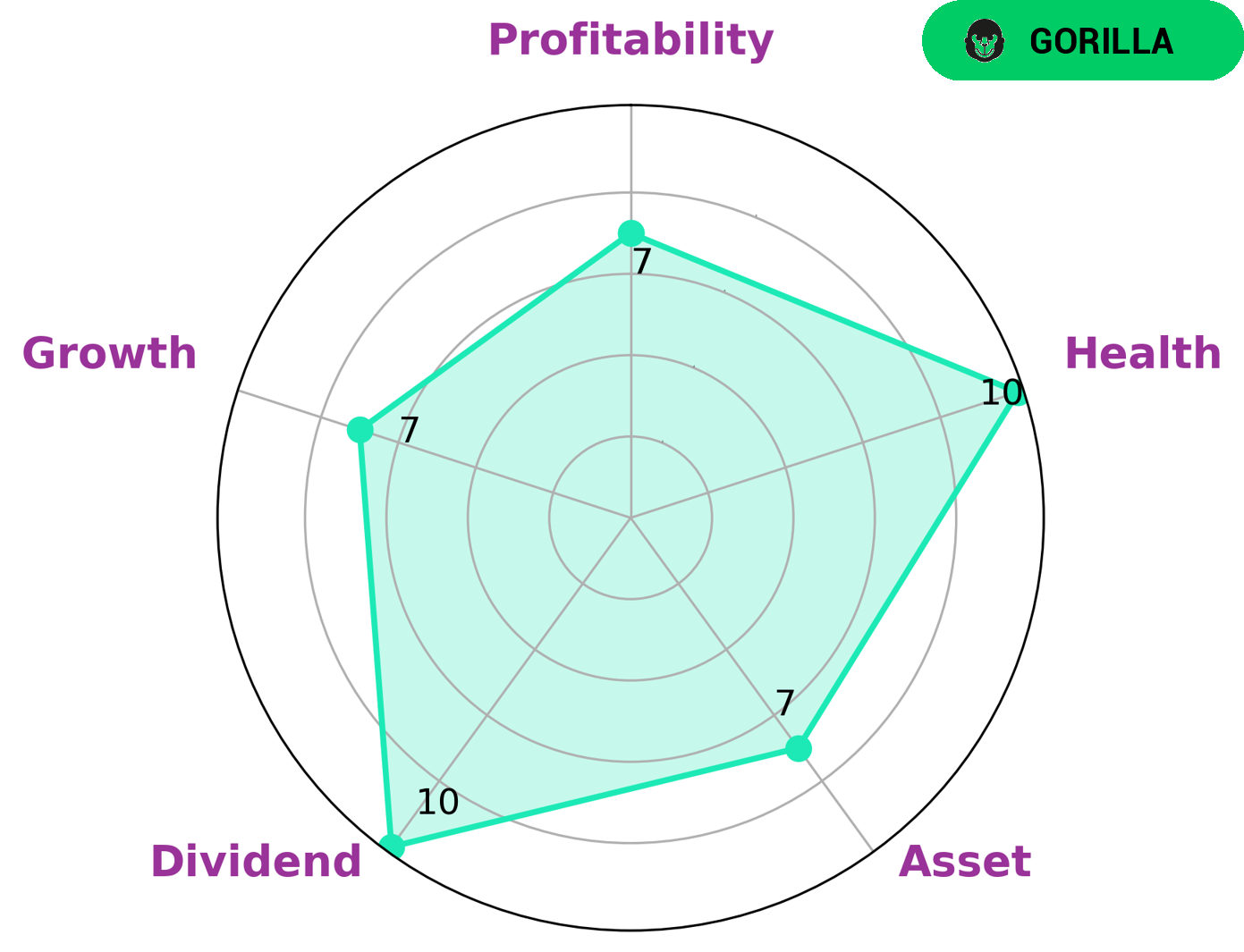

GoodWhale has recently conducted an analysis of INNOSPEC INC‘s wellbeing. Our findings have revealed that INNOSPEC INC is classified as a ‘gorilla’ company according to the Star Chart. This means that INNOSPEC INC has achieved stable and high revenue or earning growth due to its strong competitive advantage. INNOSPEC INC’s GoodWhale score is 10/10, indicating that it is in good health in regards to cashflows and debt, and is capable of riding out any crisis without risking bankruptcy. Additionally, GoodWhale has determined that INNOSPEC INC is strong in terms of assets, dividends, growth, and profitability. Such a strong company may be attractive to a variety of investors, such as value investors, growth investors, or dividend investors. Value investors may be attracted to the stability of the company, while growth investors may be interested in the strong revenue and earning growth that INNOSPEC INC has achieved. Dividend investors may find the strong dividends provided by INNOSPEC INC to be an attractive investment option. More…

Peers

Innospec Inc is an international specialty chemicals company that produces and markets fuel additives, specialty chemicals, and oilfield chemicals for a variety of industries worldwide. It is one of several major competitors in the specialty chemical industry, along with Atul Ltd, Elementis PLC, and Mitsui Chemicals Inc. All four companies are focused on developing innovative solutions and technologies to improve the quality of products and services offered to customers.

– Atul Ltd ($BSE:500027)

Atul Ltd is an Indian chemical company established in 1947 that specializes in providing dyes, polymers, surfactants, and other specialty chemicals. The company has a market capitalization of 246.29 billion as of 2022. This makes it one of the largest chemical companies in India. Atul Ltd also has a strong Return on Equity (ROE) of 11.43%, which reflects the company’s profitability and ability to generate positive returns for its shareholders. The company’s impressive market cap and ROE reflect its successful business operations and ability to remain competitive in the industry.

– Elementis PLC ($LSE:ELM)

Elementis PLC is a British specialty chemicals business, focusing on the manufacture and supply of surfactants and rheology additives for use in the cosmetics and personal care, paint and coatings, oil and gas, and agricultural industries. The company has a market capitalization of 714.72 million as of 2022 and a return on equity of 1.72%. This is an indicator of the company’s ability to generate earnings for its shareholders relative to the amount of equity that investors have placed in the business. Elementis PLC has managed to maintain a steady rate of return on equity, which is an important metric for investors in determining the company’s financial health.

– Mitsui Chemicals Inc ($TSE:4183)

Mitsui Chemicals Inc is a major chemical company based in Japan, with a market cap of 575.41B as of 2022. The company provides a wide range of chemical products and services, ranging from monomers and polymers to specialty chemicals and materials. The company has a Return on Equity (ROE) of 11.04%, which is higher than the industry average and shows that the company is able to generate profits relative to its shareholder equity. This indicates that the company is managed efficiently and is able to return value to its shareholders.

Summary

INNOSPEC INC is a consistently growing company that has seen great returns on its capital investments. Over the past few years, INNOSPEC INC has seen a steady increase in profits and its stock prices have been on a positive trend. Analysts have noted the company’s strong balance sheet and attractive dividend yield as further indications of continued success. In addition, the company has diversified its operations and expanded its presence in the global market, which should allow it to benefit from future growth opportunities.

Recent Posts