D.R. Horton: Homebuilding is Anything but Boring with a PE Ratio Near 6!

February 13, 2023

Trending News 🌧️

D.R. ($NYSE:DHI) Horton, Inc. is one of the largest homebuilding companies in the United States and is currently trading at a PE ratio of 6 with a forward PE of 9. This PE ratio is incredibly low compared to the S& P 500’s average PE ratio of 22—which means that there could be something interesting going on. It focuses on entry-level, move-up, luxury, and active adult housing in these markets, and also offers a variety of financial services through its mortgage and title divisions. The company is a leader in innovation, investing in technology to increase efficiency and reduce costs. It also offers a wide range of home designs, from single-family homes to resort-style apartments, to meet the needs of its diverse customer base. D.R. Horton is a company that has been consistently profitable, even during economic downturns.

It has a strong balance sheet with no debt and a strong cash flow. It is also well-positioned to benefit from the current housing market boom in the United States, with an experienced management team that is focused on both short-term and long-term growth. Overall, D.R. Horton is an exciting company to watch for investors who are looking for an undervalued stock with great long-term potential.

Market Price

D.R. Horton is an American homebuilding company that has had mostly mixed news lately. On Tuesday, their stock opened at $97.2 and closed at $99.4, up by 1.3% from the last closing price of 98.2. This is a good sign for the company, and with a PE ratio near 6, it is clear that investing in D.R. Horton is anything but boring. Due to their long-standing commitment to excellence, they have become one of the largest homebuilding companies in the U.S., and are consistently ranked among the top five builders by Builder magazine.

With a focus on quality, innovation, and customer service, it is easy to see why D.R. Horton has been successful for so long. The company’s stock recently has had some mixed news, but the stock opening and closing higher on Tuesday is certainly a sign that investors are still interested in investing in this reliable homebuilding company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for D.r. Horton. More…

| Total Revenues | Net Income | Net Margin |

| 33.68k | 5.67k | 16.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for D.r. Horton. More…

| Operations | Investing | Financing |

| 1.56k | -531.3 | -885.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for D.r. Horton. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 30.26k | 9.71k | 56.39 |

Key Ratios Snapshot

Some of the financial key ratios for D.r. Horton are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 23.0% | 50.3% | 21.7% |

| FCF Margin | ROE | ROA |

| 4.2% | 23.1% | 15.1% |

Analysis

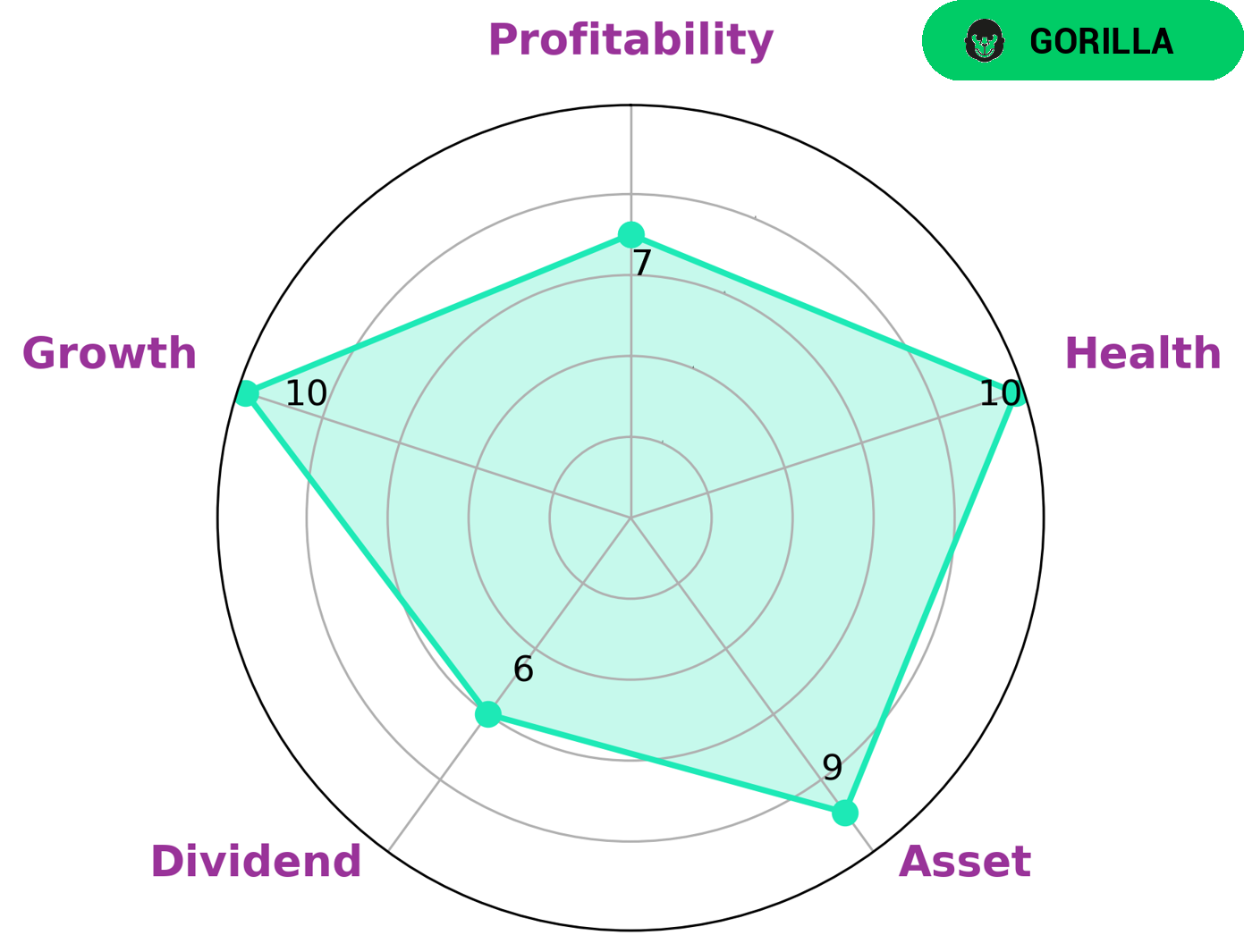

GoodWhale recently conducted a detailed analysis of D.R. HORTON‘s wellbeing. According to Star Chart, D.R. HORTON is strong in assets, growth, and profitability, and medium in dividend. This classification places D.R. HORTON in the ‘gorilla’ category, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in such companies should look for high health scores, as this is indicative of the company’s ability to sustain future operations in times of crisis. Fortunately, D.R. HORTON scored a 10/10 in GoodWhale’s cashflows and debt assessment, a sign that it is capable of continuing to generate returns in the future. Additionally, investors should seek out companies with strong asset components, as well as growth and profitability. D.R. HORTON clearly meets this criteria with its high scores in all these categories; its ability to generate returns and remain competitive are clear signs of a successful investment opportunity. Overall, D.R. HORTON is an attractive investment option for those looking for a stable and high-earning company with the potential for long-term returns. Its strong competitive advantage and impressive health score are further indicators of its potential for continued success in the future. More…

Peers

The competition in the homebuilding industry is fierce, with many large companies vying for market share. D.R. Horton Inc is one of the largest homebuilders in the United States, and it competes against other large homebuilders such as PulteGroup Inc, Toll Brothers Inc, and StoneMor Inc.

– PulteGroup Inc ($NYSE:PHM)

PulteGroup is one of the largest homebuilders in the United States. The company has a market cap of $9.17 billion as of 2022 and a return on equity of 24.25%. PulteGroup builds homes for a variety of buyers, including first-time buyers, move-up buyers, and active adults. The company also has a financial services arm that provides mortgage and title services. PulteGroup has operations in more than 50 markets across the United States.

– Toll Brothers Inc ($NYSE:TOL)

Toll Brothers Inc is a homebuilding company that was founded in 1967. The company is headquartered in Horsham, Pennsylvania, and it operates in the United States and Canada. As of 2022, the company has a market cap of 4.88B and a Return on Equity of 15.37%. The company builds single-family detached homes, townhomes, and condominiums. It also develops master-planned communities.

– StoneMor Inc ($NYSE:STON)

StoneMor Inc. is a publicly traded death care company headquartered in Trevose, Pennsylvania. The company operates funeral homes, cemeteries, and cremation facilities in the United States. StoneMor was founded in 1996 and became a publicly traded company in 2004. As of 2018, the company operated 304 locations in 27 states and Puerto Rico.

Summary

D.R. Horton is a homebuilding company with a current price-earnings ratio near 6. Analysts have been reporting a mix of positive and negative news about the company, but overall, it looks to be a good investment for those looking for a low-risk option with potential for higher returns. D.R. Horton has a strong reputation in the industry, with experienced leadership and a track record of successful projects.

The company is also well-funded and has access to resources that can help them keep up with changing trends in the homebuilding market. Investors may wish to consider D.R. Horton as an option in their portfolio.

Recent Posts