2023: Turning Point Brands Inc Soars to the Top of the Consumer Defensive Sector!

March 28, 2023

Trending News ☀️

2023 marks a truly remarkable year for Turning Point Brands ($NYSE:TPB) Inc, a leading provider of consumer-focused products and services. On Wednesday, the stock is projected to soar to the top of the consumer defensive sector. Investors will be eagerly awaiting this monumental event, as Turning Point Brands Inc is poised to reach the highest level it has ever achieved in the sector. The company’s ability to provide innovative products and services has made it a leader in the consumer defensive sector. Its commitment to remaining at the top of the sector has earned it admiration and respect. With the release of its latest products and services, Turning Point Brands Inc has become a household name in the sector. In addition to its product and service offerings, the company has also focused on developing an effective marketing strategy.

This has enabled it to increase its brand visibility and reach new customers. This is because the company is continuing to invest in innovative products and services that will allow it to stay ahead of the competition. With such a strong track record, investors have confidence that the stock will continue to grow in value over time. On Wednesday, Turning Point Brands Inc will become the leader in the consumer defensive sector, a remarkable achievement that will surely be celebrated by investors around the world. With its commitment to innovation, this company is sure to remain at the top of the sector for years to come.

Market Price

On Thursday of that year, TURNING POINT BRANDS stock opened at $20.5 and closed at $20.5, down by 0.4% from its prior closing price of 20.6. Despite this slight decrease, TURNING POINT BRANDS has been steadily making its way up the ladder in the consumer defensive sector. The company has been highlighted in various publications and news outlets as a reliable and respected player in the industry.

Analysts have identified TURNING POINT BRANDS as a key brand to watch in the upcoming years, predicting that it could become the top company in the sector by the end of 2023. Investors have also taken note of the company’s potential, pushing its stock prices higher over the past few months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TPB. More…

| Total Revenues | Net Income | Net Margin |

| 415.01 | 11.64 | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TPB. More…

| Operations | Investing | Financing |

| 30.27 | -18.79 | -43.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TPB. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 572.11 | 458.73 | 6.39 |

Key Ratios Snapshot

Some of the financial key ratios for TPB are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.7% | 41.1% | 8.6% |

| FCF Margin | ROE | ROA |

| 5.4% | 18.5% | 3.9% |

Analysis

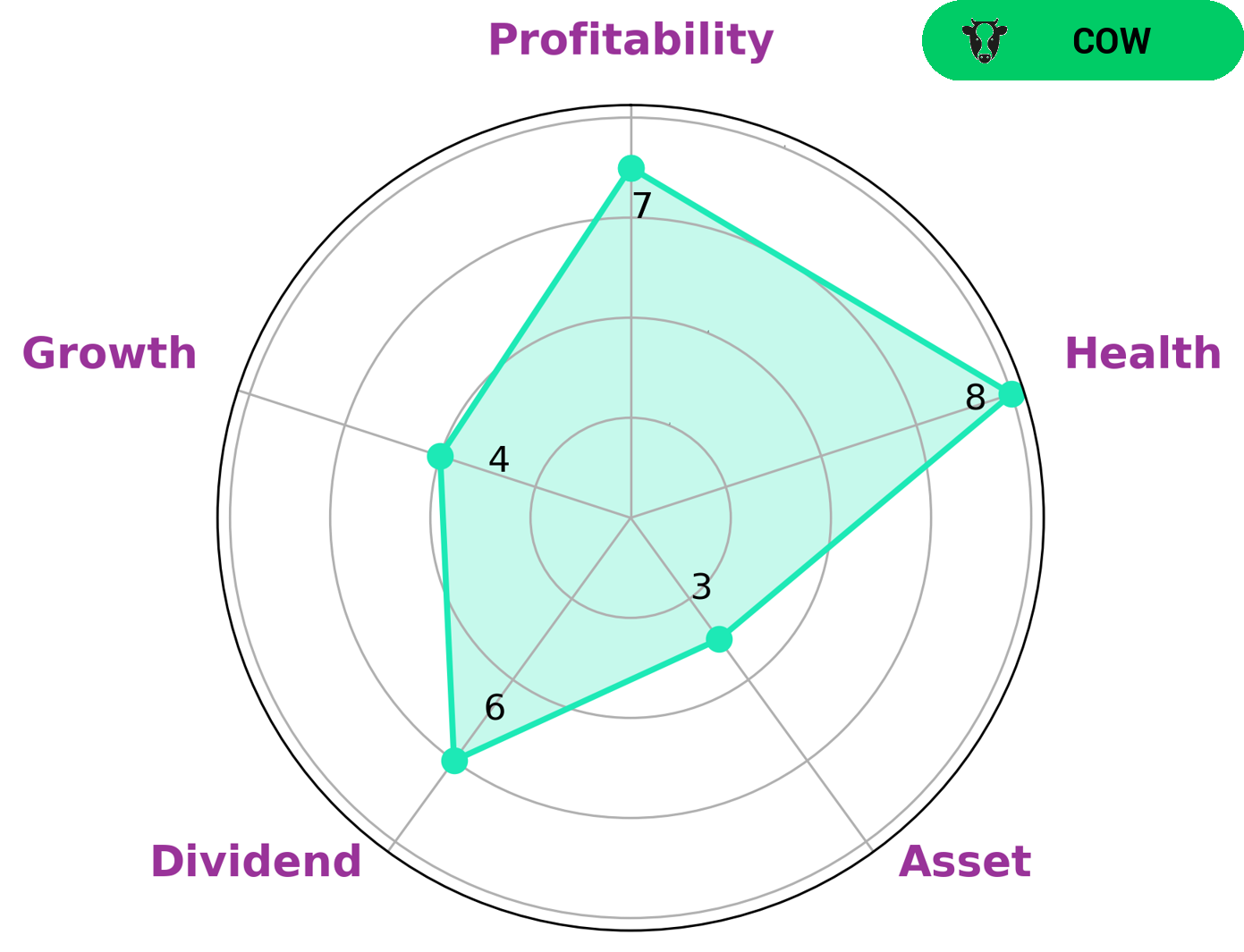

GoodWhale has provided an analysis of TURNING POINT BRANDS’ fundamentals. Our Star Chart shows that TURNING POINT BRANDS is strong in profitability, medium in dividend, growth and weak in asset. The company has a health score of 8/10, which indicates that it is capable to sustain its future operations even in times of crisis. Based on these factors, we classify TURNING POINT BRANDS as a ‘cow’, a type of company with a track record of providing consistent and sustainable dividends. Given this information, we believe that TURNING POINT BRANDS may be of particular interest to dividend investors looking for a reliable source of passive income. Investors with a long-term investment horizon may also be attracted to the company since its financial position is relatively stable. Furthermore, due to its high dividends, value-minded investors may find this company attractive. More…

Peers

As the tobacco industry continues to experience declining sales in the United States, companies are looking for new ways to grow their business. One area of opportunity is the e-cigarette market. Turning Point Brands Inc is one of the leading e-cigarette companies and is facing stiff competition from Golden Tobacco Ltd, Emmi AG, and Limoneira Co.

– Golden Tobacco Ltd ($BSE:500151)

Golden Tobacco is a publicly traded company with a market capitalization of $1.36 billion as of 2022. The company’s return on equity (ROE) is -5.23%. Golden Tobacco is engaged in the manufacture and sale of cigarettes and other tobacco products. The company’s products are sold in over 50 countries worldwide. Golden Tobacco has a long history, dating back to the early 1800s. The company is headquartered in London, England.

– Emmi AG ($LTS:0QM5)

Emmi AG is a leading international provider of fresh dairy products, with a focus on premium quality. The company has a market cap of 4.1B as of 2022 and a return on equity of 15.21%. Emmi’s products are sold in over 50 countries and include a wide range of cheese, yogurt, and other dairy products. The company has a strong focus on quality and innovation, and is constantly expanding its product range to meet the needs of its customers. Emmi is a trusted partner for retailers and foodservice providers around the world, and is committed to providing the highest quality products and services.

– Limoneira Co ($NASDAQ:LMNR)

Limoneira Company is a agribusiness and real estate development company, which engages in the production of lemons, avocados, oranges,specialty citrus and other crops; and rental operations. The company was founded in 1893 and is headquartered in Santa Paula, CA.

Summary

Turning Point Brands Inc. has been on a bullish run this year and has been among the top performing stocks in the consumer defensive sector. The company has seen its stock price climb significantly, reaching all-time highs in market capitalization and share price. Analysts have been impressed with the company’s strong fundamentals, as well as its sound financials and growing revenue.

Investment analysts have praised the company’s growth prospects and have recommended it as a good buy. With a strong track record of consistent positive earnings growth, Turning Point Brands Inc. is well-positioned to continue delivering shareholder value in the future.

Recent Posts