10 Years Later: See How Much a $1000 Investment in NXP Semiconductors is Worth Now!

June 14, 2023

☀️Trending News

When looking at the performance of NXP ($NASDAQ:NXPI) Semiconductor’s stock over the past decade, it’s easy to see why it is such a popular investment. This impressive return is a testament to the company’s long-term success and stability. NXP has seen a number of changes in the past decade, including multiple acquisitions of other companies, such as Freescale Semiconductor and Standard Microsystems Corporation. The company has also made a number of investments in new technology, such as the development of autonomous driving systems and the expansion of its Internet of Things division.

In addition to its impressive growth over the past decade, NXP has also been praised for its commitment to sustainability. This commitment, combined with its strong financial performance, makes NXP a great choice for long-term investors. This impressive return, combined with the company’s commitment to sustainability, makes NXP a great choice for long-term investors.

Share Price

Today marks 10 years since NXP Semiconductors N.V first started trading on the stock market. On Monday, the company opened at $187.0 and closed at $189.4, representing a 2.4% increase from its prior closing price of $185.0. In the past decade, NXP Semiconductors has grown immensely in size and scope, expanding into new markets and establishing itself as a leader in the semiconductor industry. This growth has driven the company’s stock price up steadily, making it an attractive investment opportunity for many.

As we look to the future, it is clear that NXP Semiconductors is poised to continue its impressive growth trajectory. With its cutting-edge technology, strong customer base, and expanding product portfolio, the company’s stock should remain a worthwhile investment for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NXPI. More…

| Total Revenues | Net Income | Net Margin |

| 13.19k | 2.75k | 21.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NXPI. More…

| Operations | Investing | Financing |

| 3.67k | -1.27k | -1.14k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NXPI. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.73k | 15.48k | 30.6 |

Key Ratios Snapshot

Some of the financial key ratios for NXPI are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.4% | 92.9% | 28.6% |

| FCF Margin | ROE | ROA |

| 18.8% | 30.6% | 9.9% |

Analysis

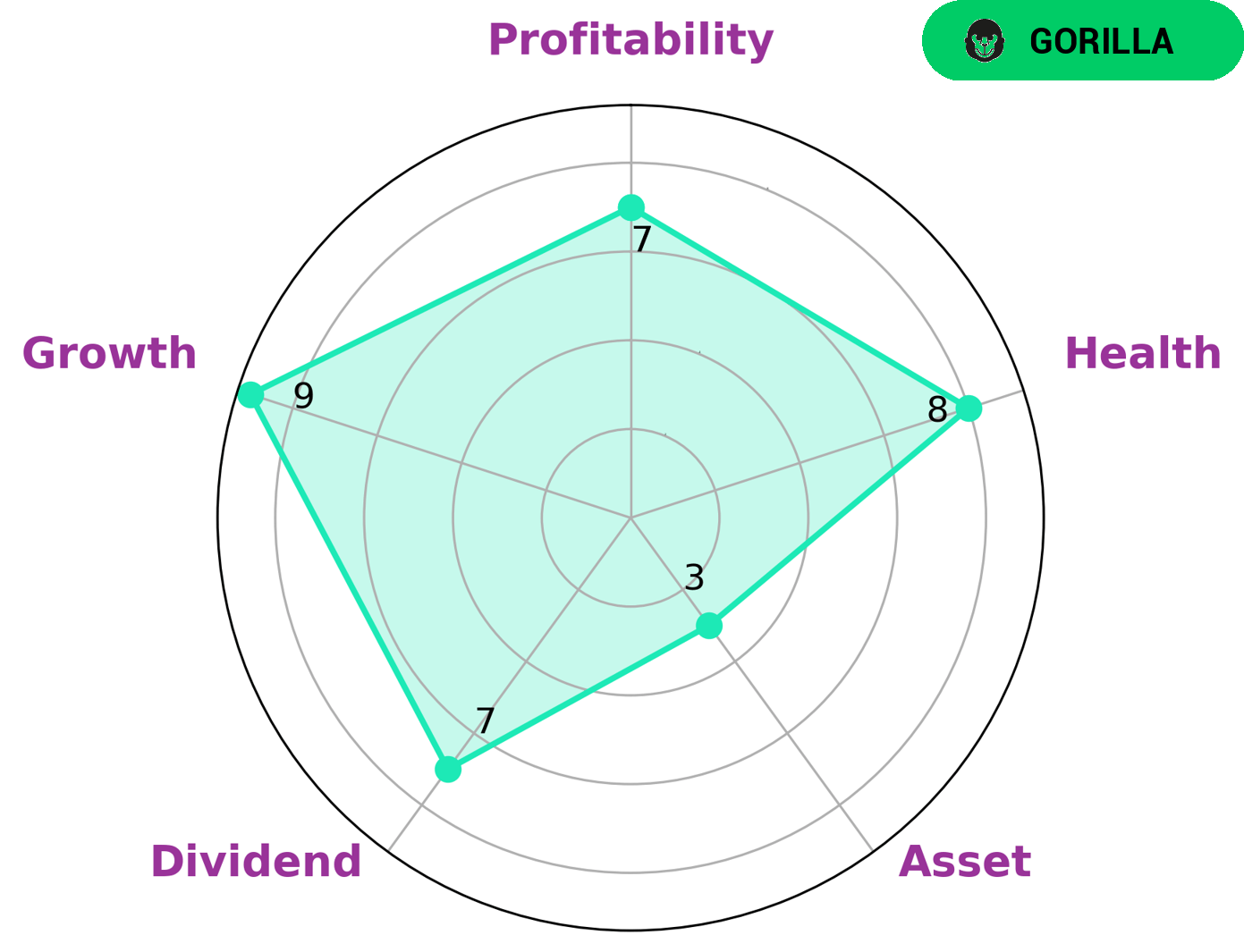

GoodWhale has carried out an analysis of NXP SEMICONDUCTORS N.V’s fundamentals, and based on our Star Chart, we conclude that it has a high health score of 8/10, considering its cashflows and debt. We further classify it as a ‘gorilla’ type of company – one that has achieved stable and high revenue or earning growth due to its strong competitive advantage. This makes NXP SEMICONDUCTORS N.V an attractive investment option for investors looking for steady dividend income, growth, and profitability. However, it is important to note that in terms of asset, NXP SEMICONDUCTORS N.V is weaker compared to the other criteria mentioned above, so investors should be mindful of this when considering investing in the company. More…

Peers

NXP Semiconductors NV is a leading semiconductor company that offers a wide range of products and services. The company has a strong presence in the automotive, industrial, and consumer markets. NXP Semiconductors NV is a major competitor of STMicroelectronics NV, ON Semiconductor Corp, and Analog Devices Inc.

– STMicroelectronics NV ($OTCPK:STMEF)

STMicroelectronics NV is a global semiconductor company that designs, develops, manufactures and markets a broad range of semiconductor products, including integrated circuits, discrete devices and microelectronic components. The company has a market cap of 29.33B as of 2022 and a Return on Equity of 20.91%. STMicroelectronics NV is a leading provider of semiconductor solutions for a wide range of applications, including automotive, computing, consumer, industrial, networking, power and security. The company’s products are used in a variety of end-markets, including automotive, computing, consumer, industrial, networking, power and security.

– ON Semiconductor Corp ($NASDAQ:ON)

NXP Semiconductors N.V. is a holding company, which engages in the provision of semiconductor solutions that enable secure connections for a smarter world. It operates through the following segments: High Performance Mixed Signal (HPMS), Standard Products (SP), and Corporate and Other. The HPMS segment offers radio frequency power amplifiers, low noise amplifiers, filters, power management and protection devices, audio and voice processing devices, data management devices, and microcontrollers. The SP segment provides logic, analog, and power devices. The Corporate and Other segment comprises of activities of the group that cannot be allocated to the reportable segments. The company was founded by Frans van Houten and Klaas P.L. Wildeboer on August 6, 2006 and is headquartered in Eindhoven, Netherlands.

– Analog Devices Inc ($NASDAQ:ADI)

Analog Devices Inc. is a technology company that manufactures and sells semiconductor products. The company has a market cap of $72.69B as of 2022 and a return on equity of 3.56%. Analog Devices Inc. designs, manufactures, and markets a range of products used in various end markets, including automotive, communications, computing, consumer, industrial, medical, and military/aerospace.

Summary

Investing in NXP Semiconductors N.V. can be a rewarding experience for those looking to capitalize on the company’s expansive technology portfolio. NXP is renowned for its expertise in semiconductor technology and related applications such as automotive, mobile & consumer, industrial, digital networking & computing and communications. Many of these products have been integral to the development of autonomous vehicles and the Internet of Things (IoT). The company’s impressive growth is driven by ongoing investments in research and development as well as partnerships with industry leaders.

NXP also benefits from strategic acquisitions that further expand its technology offerings. As such, investors should consider allocating a portion of their portfolios to this innovative and rapidly growing company.

Recent Posts