Fuel Tech Beats Street Estimates with GAAP EPS and Revenue

May 10, 2023

Trending News 🌥️

Fuel Tech ($NASDAQ:FTEK), Inc. (FUEL) recently released its quarterly earnings report and surprised investors by beating expectations. The company reported a GAAP earnings per share of -$0.01, which surpassed the forecast by $0.01, and revenue of $7.29M exceeded the expected figure by $0.94M. Fuel Tech is a global provider of air pollution control solutions for industrial and utility applications. The company creates innovative technologies to help industrial customers reduce their environmental footprint and comply with regulations.

Fuel Tech has a strong presence in North America, Europe, Asia, and Latin America and is committed to improving air quality around the world. Going forward, the company will continue to focus on developing new technologies to help its customers meet their environmental goals.

Earnings

Fuel Tech Inc. released their fourth quarter earnings report of FY2022 as of December 31 2022, revealing an 8.8% increase in total revenue from 6.22M USD to 7.02M USD in the past three years. Despite the increase in revenue, FUEL TECH reported a net income loss of 0.4M USD. Despite this, FUEL TECH’s performance still exceeded the street estimates, with both GAAP EPS and revenue surpassing expectations. The increased total revenue for FUEL TECH demonstrates the company’s continued success and strong financial performance.

The company has grown at a steady rate over the past three years, with an 8.8% increase in total revenue year-over-year. This is a testament to the hard work of FUEL TECH’s dedicated employees and their commitment to the company’s success. This shows that FUEL TECH is in a strong financial position and is well-positioned to continue its growth into the future.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Fuel Tech. More…

| Total Revenues | Net Income | Net Margin |

| 26.94 | -1.44 | -5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Fuel Tech. More…

| Operations | Investing | Financing |

| -4.14 | -9.48 | -0.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Fuel Tech. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 50.12 | 5.28 | 1.48 |

Key Ratios Snapshot

Some of the financial key ratios for Fuel Tech are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -4.0% | 26.7% | -5.1% |

| FCF Margin | ROE | ROA |

| -16.1% | -1.9% | -1.7% |

Market Price

The stock opened at $1.3, and closed the day at the same price on the back of the positive news. The company reported that their GAAP earnings per share were up significantly from the previous quarter and that their revenue was also up. These figures indicate that FUEL TECH is performing well and that investors are confident in the company’s future prospects. The strong financial performance is a testament to the strength of the company’s products and services, and investors are likely to continue to show interest in the stock. Live Quote…

Analysis

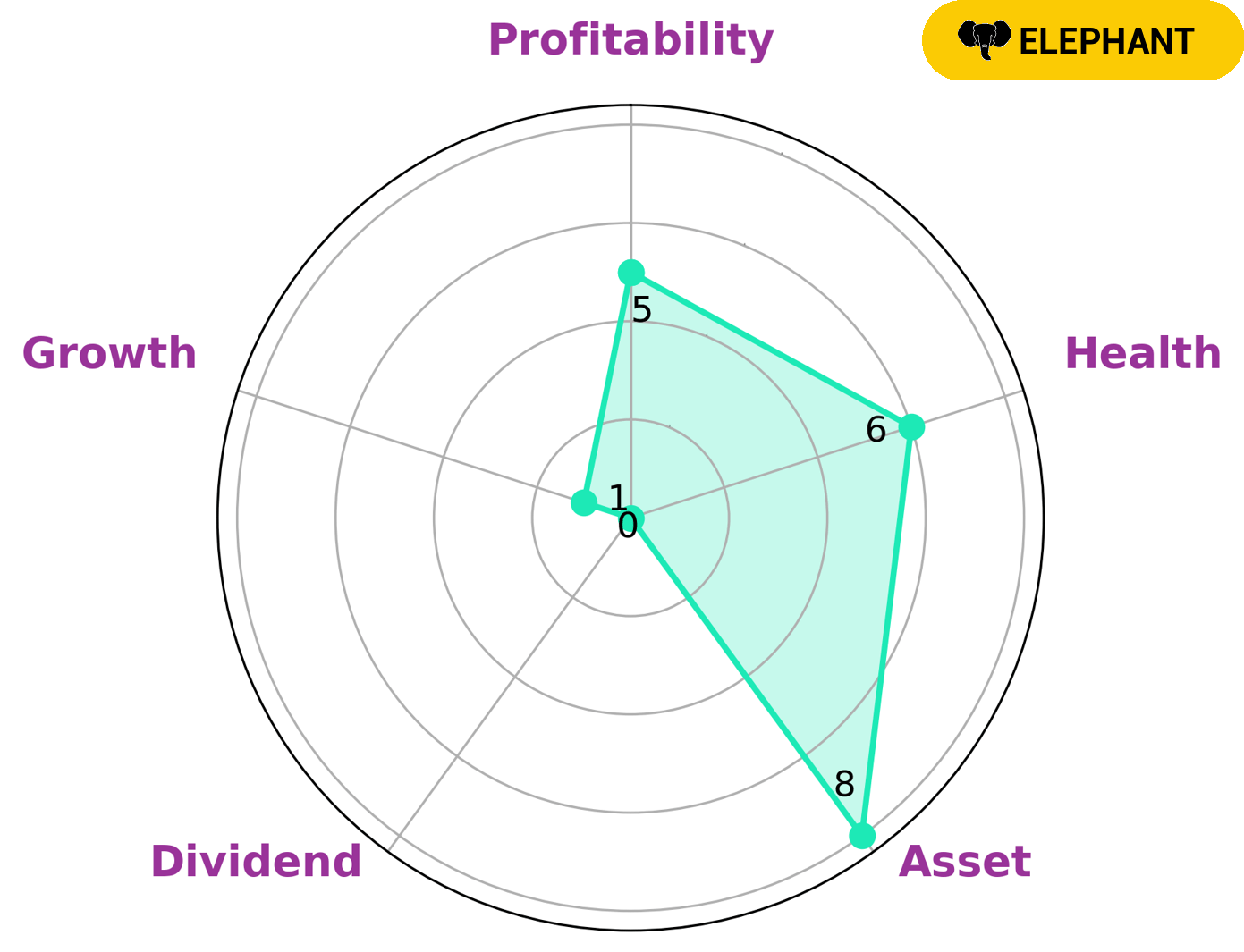

GoodWhale has conducted an analysis of FUEL TECH‘s financials and drawn some conclusions. According to Star Chart, FUEL TECH is classified as an ‘elephant’, a type of company which is rich in assets after deducting off liabilities. This could make it of interest to investors looking for a steady asset-heavy investment. Additionally, FUEL TECH has an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting it might be able to safely ride out any crisis without the risk of bankruptcy. However, FUEL TECH is weak in dividend, growth and profitability, which might not be attractive to some investors. Ultimately, the decision lies with individual investors depending on their risk appetite and portfolio preferences. More…

Peers

Along with Fuel Tech Inc, Atmofizer Technologies Inc, Molekule Group Inc, and East Morgan Holdings Inc are also major players in the energy technology industry, offering their own unique products and services. All four companies have worked hard to remain competitive in the ever-evolving energy technology sector.

– Atmofizer Technologies Inc ($OTCPK:ATMFF)

Atmofizer Technologies Inc is a software company that specializes in providing solutions for businesses to improve their customer service, marketing, and overall efficiency. The company’s market cap of 936.88k as of 2023 indicates its current size and financial position. Atmofizer Technologies Inc has a Return on Equity of -347.2%, which suggests it is not currently a profitable business and is not efficiently utilizing its resources to generate positive returns for shareholders.

– Molekule Group Inc ($NASDAQ:MKUL)

Molekule Group Inc is a technology company that specializes in the development of innovative air purification systems. With a market cap of 48.68 million as of 2023, the company has managed to expand its operations through the development of cutting-edge technology. Additionally, Molekule Group Inc has a negative ROE of -49.81%, indicating that the company is not able to generate returns on its equity investments. Despite this, the company has managed to stay financially afloat due to its successful sales of air purification systems and other products.

Summary

Investors in Fuel Tech have reason to remain optimistic following their most recent earnings report. The company reported GAAP EPS of -$0.01, which beat the estimates by $0.01. Revenue was also better than expected, coming in at $7.29M, which beat by $0.94M.

These results point to a company that is continuing to experience solid growth despite challenging market conditions. Looking ahead, investors can continue to expect positive results from Fuel Tech as they take advantage of their strong fundamentals and industry-leading capabilities.

Recent Posts