Medavail Holdings Stock Intrinsic Value – MedAvail Holdings Reports Q3 Profits Exceeding Expectations

April 15, 2023

Trending News ☀️

MEDAVAIL ($NASDAQ:MDVL): The company reported a GAAP EPS of -$0.14, beating expectations of -$0.15 by a margin of $0.01. Revenue also exceeded expectations, coming in at $11.35M as opposed to estimates of $11.00M, an increase of $0.35M. MedAvail Holdings is a healthcare technology company that provides innovative solutions to the pharmacy industry. Their cloud-based platform enables pharmacists to easily manage their operations, improve patient outcomes, and increase patient satisfaction.

Price History

MedAvail Holdings reported a strong third quarter with profits exceeding expectations. On Thursday, MEDAVAIL HOLDINGS stock opened at $0.3 and closed at $0.3, indicating a 29.4% increase from the prior closing price of 0.3. This gain was driven by the better-than-expected results of the quarter, which saw overall revenues increasing significantly.

Additional contributing factors included strong demand for the company’s products, as well as increased efficiency in operations. These positive indicators led to a surge in MEDAVAIL HOLDINGS’ stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Medavail Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 39.04 | -49.17 | -126.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Medavail Holdings. More…

| Operations | Investing | Financing |

| -51.63 | -2.94 | 46.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Medavail Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 49.85 | 18.55 | 0.39 |

Key Ratios Snapshot

Some of the financial key ratios for Medavail Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -123.1% |

| FCF Margin | ROE | ROA |

| -139.8% | -93.7% | -60.2% |

Analysis – Medavail Holdings Stock Intrinsic Value

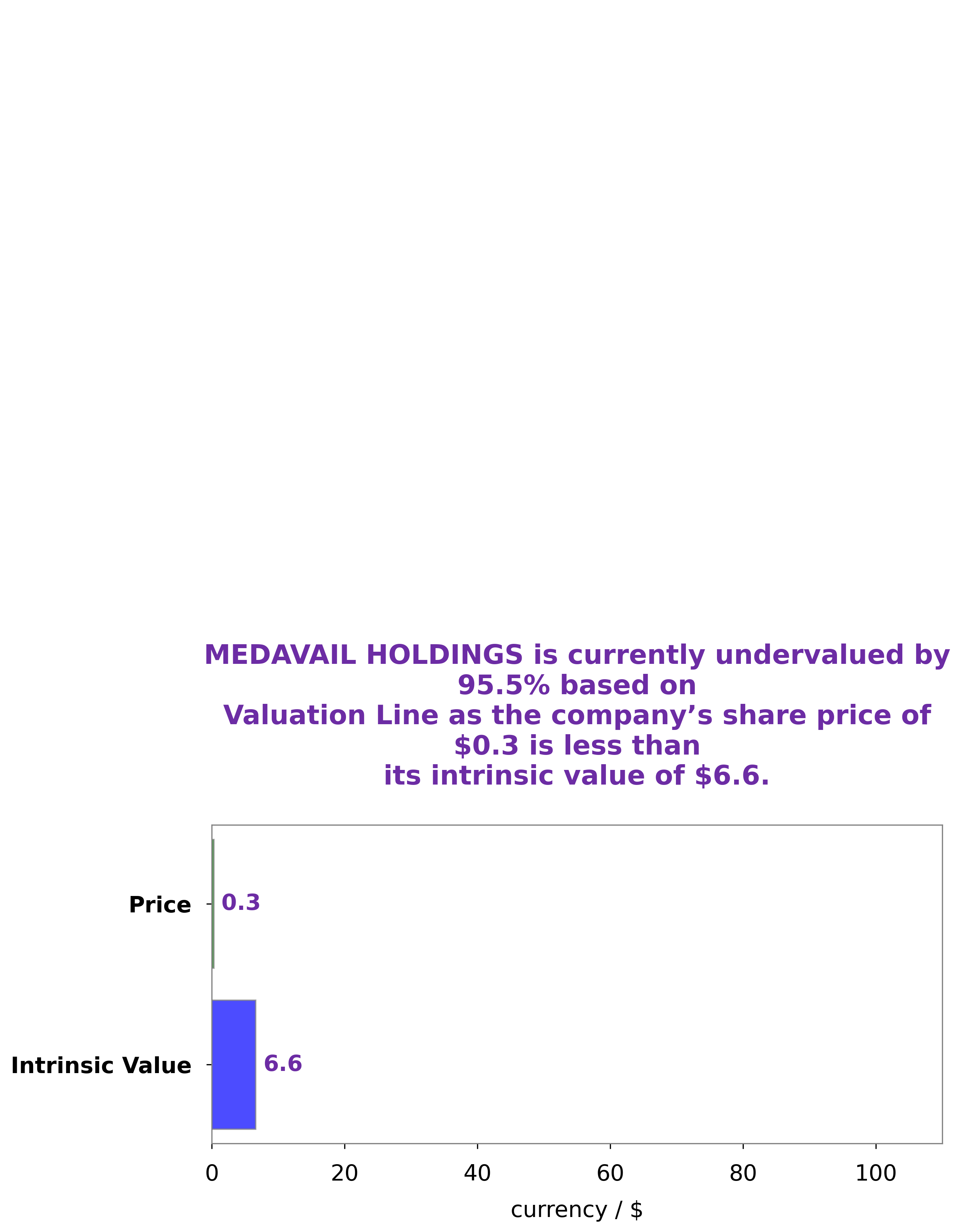

GoodWhale recently conducted an analysis of MEDAVAIL HOLDINGS‘ wellbeing. After running our proprietary Valuation Line, we have determined the intrinsic value of the MEDAVAIL HOLDINGS share to be around $6.6. Interestingly, MEDAVAIL HOLDINGS stock is currently traded at $0.3, which means that it is undervalued by 95.5%. We believe that this discrepancy presents an exciting opportunity for potential investors to purchase the stock at a discounted rate. More…

Peers

The competition in the pharmaceutical retail industry is heating up. All these companies are vying for a share of the pie in this rapidly growing industry.

– China Jo-Jo Drugstores Inc ($NASDAQ:CJJD)

China Jo-Jo Drugstores Inc is a holding company that operates through its subsidiaries. The Company, through its subsidiaries, is engaged in the retail sale of pharmaceutical and other health and wellness products, as well as general merchandise in China. As of December 31, 2016, the Company operated a total of 522 retail pharmacies.

– Rite Aid Corp ($NYSE:RAD)

Rite Aid Corp is a pharmacy chain in the United States. As of 2022, it has a market capitalization of 334.12 million and a return on equity of 240.91%. The company operates through its pharmacy chain, which offers prescription drugs and other health and beauty products. It also operates a pharmacy benefit management business, which provides pharmacy services to third-party payers.

– Vaso Corporation ($OTCPK:VASO)

Vaso Corporation is a medical device company that develops, manufactures, and markets medical products for the treatment of vascular diseases and disorders. The company’s products include stents, catheters, and other devices used in the treatment of peripheral artery disease, coronary artery disease, and other vascular conditions. Vaso’s products are sold in over 50 countries worldwide. The company has a market cap of 33.33M as of 2022 and a Return on Equity of 28.83%.

Summary

MEDAVAIL HOLDINGS recently reported quarterly earnings, with a GAAP EPS of -$0.14, beating market expectations by $0.01. The company also reported revenue of $11.35M, beating estimates by $0.35M. This news was met with a positive response in the markets, and the stock price rose the same day.

Investors seem to be optimistic about MEDAVAIL HOLDINGS’ prospects, as the company’s performance continues to exceed expectations in spite of challenging market conditions. With continued strong financial results, MEDAVAIL HOLDINGS appears to be a sound investment opportunity, and investors should keep an eye on the stock price as it may continue to rise.

Recent Posts