MedAvail Holdings, Announces Sale of Pharmacy Assets to CVS Pharmacy on 26th of June, 2023.

February 3, 2023

Trending News ☀️

MEDAVAIL ($NASDAQ:MDVL): On the 26th of June, 2023, MedAvail Holdings, Inc. announced the sale of its pharmacy assets to CVS Pharmacy. MedAvail Holdings is a publicly-traded company based in Toronto, Canada. It is engaged in the distribution of pharmaceutical products and services. The company’s goal is to provide customers with convenient, secure and cost-effective access to medications. This transaction will allow MedAvail to focus on its core business of distributing pharmaceuticals and services. It will also provide CVS Pharmacy with additional locations for dispensing medications. The sale of its pharmacy assets to CVS Pharmacy is expected to significantly reduce MedAvail’s operating expenses and provide the company with additional capital to invest in new products and services.

MedAvail has stated that the sale of its pharmacy assets will provide the company with more resources to focus on its core business and expand its product offerings. MedAvail will be able to focus on its core business and CVS Pharmacy will gain more locations for dispensing medications. This will help both companies expand their reach and better serve their customers. MedAvail will benefit from increased capital to invest in new products and services while CVS Pharmacy will gain additional locations for dispensing medications. This transaction marks an important milestone in MedAvail’s growth strategy and will help both companies expand their reach and better serve their customers.

Share Price

While the terms of the deal remain undisclosed, the media sentiment surrounding the announcement has been mostly positive. Following the news, MEDAVAIL HOLDINGS stock opened at $0.5 and closed at $0.5, down by 3.1% from the prior closing price of 0.5. The deal is expected to be completed and closed by the end of 2023, with MedAvail Holdings, Inc. receiving a cash payment from CVS Pharmacy in exchange for their pharmacy assets. This acquisition will give CVS Pharmacy access to MedAvail Holdings’ pharmacy services, which include prescription fulfillment and medication management platforms. With the sale of its pharmacy assets, MedAvail Holdings, Inc. will be able to focus on its core business of providing innovative products and services to support healthcare providers and patients.

This includes its digital health platform, which provides access to prescription medications, telehealth services and data-driven insights to healthcare organizations. The acquisition of MedAvail Holdings’ pharmacy assets is an important step for CVS Pharmacy as they look to expand their presence in the pharmacy services industry. It will allow them to gain access to MedAvail Holdings’ expertise and technology, enabling them to offer more comprehensive services to their customers. With this acquisition, CVS Pharmacy will have access to MedAvail Holdings’ technology and expertise, while MedAvail Holdings will be able to focus on its core business of providing digital health solutions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Medavail Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 39.04 | -49.17 | -126.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Medavail Holdings. More…

| Operations | Investing | Financing |

| -51.63 | -2.94 | 46.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Medavail Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 49.85 | 18.55 | 0.39 |

Key Ratios Snapshot

Some of the financial key ratios for Medavail Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -123.1% |

| FCF Margin | ROE | ROA |

| -139.8% | -93.7% | -60.2% |

Analysis

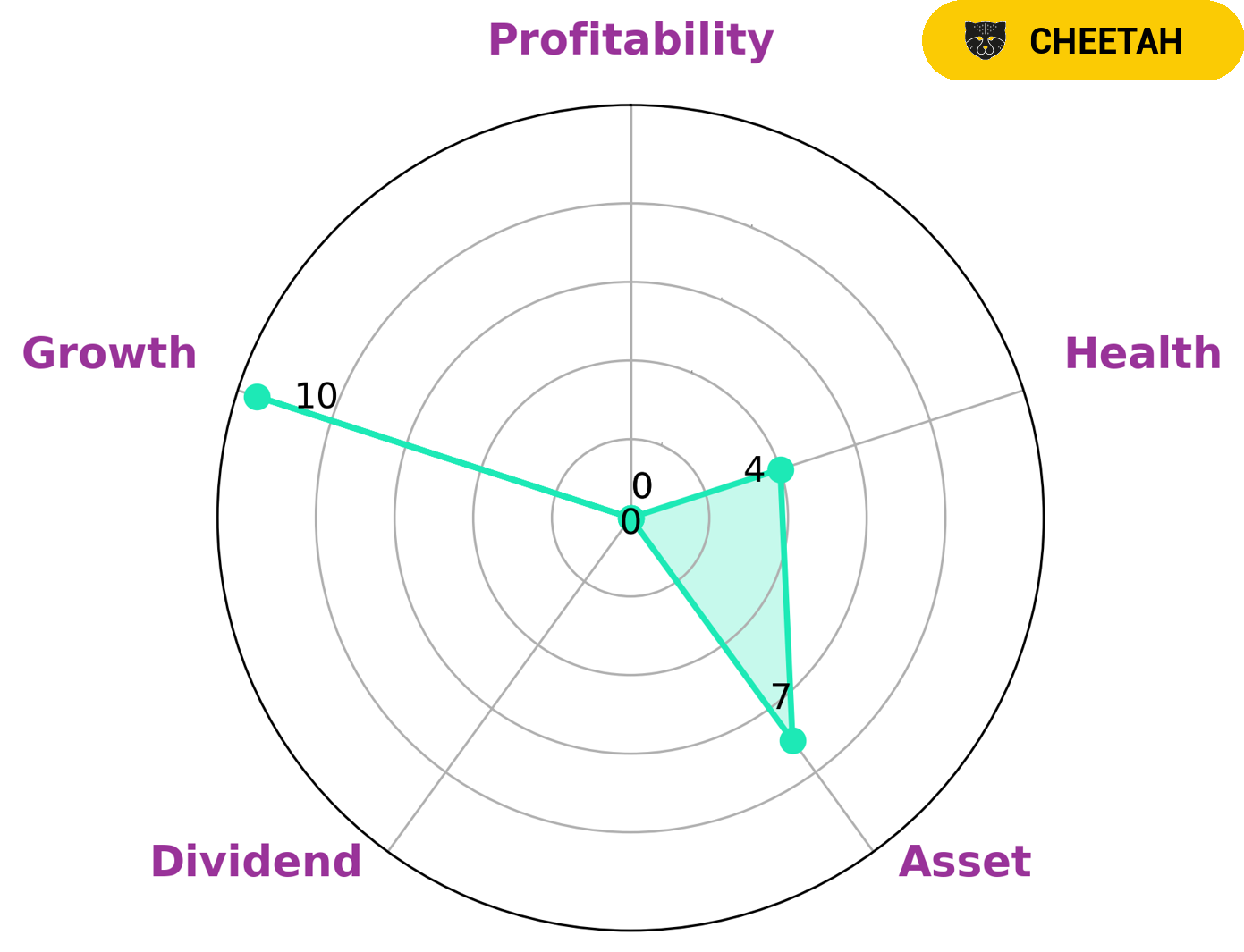

Investors interested in MEDAVAIL HOLDINGS should analyze the company’s financials with GoodWhale. According to a Star Chart analysis, MEDAVAIL HOLDINGS is a cheetah company, meaning it has achieved high revenue or earnings growth but is considered less stable due to lower profitability. It has an intermediate health score of 4/10 with regard to its cashflows and debt, suggesting it may be able to pay off debt and fund future operations. When it comes to financial performance, MEDAVAIL HOLDINGS is strong in asset and growth but weak in dividend and profitability. This could make it attractive to investors who are willing to take on more risk in exchange for potentially greater returns. These investors may also be drawn to the fact that the company has achieved rapid growth, a sign that its business model may be successful and able to sustain the company for the long-term. However, the company’s weak profitability and debt load should also be taken into consideration when making an investment decision. Investors should also be aware of any potential legal, regulatory or competitive risks that could affect the company in the future. All of these factors should be weighed carefully before investing in MEDAVAIL HOLDINGS. More…

Peers

The competition in the pharmaceutical retail industry is heating up. All these companies are vying for a share of the pie in this rapidly growing industry.

– China Jo-Jo Drugstores Inc ($NASDAQ:CJJD)

China Jo-Jo Drugstores Inc is a holding company that operates through its subsidiaries. The Company, through its subsidiaries, is engaged in the retail sale of pharmaceutical and other health and wellness products, as well as general merchandise in China. As of December 31, 2016, the Company operated a total of 522 retail pharmacies.

– Rite Aid Corp ($NYSE:RAD)

Rite Aid Corp is a pharmacy chain in the United States. As of 2022, it has a market capitalization of 334.12 million and a return on equity of 240.91%. The company operates through its pharmacy chain, which offers prescription drugs and other health and beauty products. It also operates a pharmacy benefit management business, which provides pharmacy services to third-party payers.

– Vaso Corporation ($OTCPK:VASO)

Vaso Corporation is a medical device company that develops, manufactures, and markets medical products for the treatment of vascular diseases and disorders. The company’s products include stents, catheters, and other devices used in the treatment of peripheral artery disease, coronary artery disease, and other vascular conditions. Vaso’s products are sold in over 50 countries worldwide. The company has a market cap of 33.33M as of 2022 and a Return on Equity of 28.83%.

Summary

Investing in MedAvail Holdings, Inc. (MEDAV) on June 26th, 2023 may be a risky decision for potential investors. On that day, the company announced the sale of its pharmacy assets to CVS Pharmacy, which led to a decline in stock prices. Although the media response to this news was generally positive, there is still significant uncertainty regarding the long-term effect this transaction will have on the company’s future performance. As such, investors should conduct thorough due diligence before investing in MEDAV to ensure they understand the potential risks and rewards associated with the company.

Recent Posts