$10000 Prize Up For Grabs For Creative Chief ‘Barketing’ Officer at PetMeds!

April 27, 2023

Trending News ☀️

PETMED ($NASDAQ:PETS): PetMeds Express is an online pet supply and pharmacy store that is well-known for its wide selection of products and convenient delivery services. Now, the company is taking their commitment to pet health and happiness even further by launching a competition for a Chief Barketing Officer. The successful candidate will receive a reward of $10,000 for coming up with creative ways to promote PetMeds. This is a great way for PetMeds to show their appreciation for pets and those who care for them. The chosen Chief Barketing Officer will be responsible for coming up with innovative ideas to engage pet owners and encourage them to use PetMeds services. They will also develop creative campaigns and content to spread awareness of the company.

Not only is this an amazing opportunity to win $10,000 while doing something you love, it is also a chance to make a meaningful contribution to the pet-loving community. PetMeds is looking for someone who has a passion for animals and enjoys coming up with innovative strategies to reach pet owners. If you are interested in applying for this position, don’t hesitate to get in touch with PetMeds to find out more about the application process. Don’t miss out on the chance to win big and help make life better for our furry friends!

Stock Price

On Wednesday, PETMED EXPRESS made headlines when it announced an exciting new promotion in search of a Creative Chief ‘Barketing’ Officer. The winner of this competition will receive a prize of $10,000. The competition opens to all PETMED EXPRESS customers and requires that entrants demonstrate their creative marketing talents by designing a unique campaign to promote the company’s products and services. The company hopes to find the best and most creative ideas that will help it continue to grow.

Meanwhile, on the stock market front, the company had a minor increase in its stock value. On Wednesday, PETMED EXPRESS stock opened at $15.1 and closed at $15.2, up by 0.1% from prior closing price of 15.2. Hopefully this will be a sign of increased growth for the company in the coming year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Petmed Express. More…

| Total Revenues | Net Income | Net Margin |

| 260.45 | 11.4 | 4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Petmed Express. More…

| Operations | Investing | Financing |

| 26.8 | -8.81 | -24.46 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Petmed Express. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 165.12 | 31.54 | 6.34 |

Key Ratios Snapshot

Some of the financial key ratios for Petmed Express are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.7% | -25.1% | 4.9% |

| FCF Margin | ROE | ROA |

| 8.8% | 5.9% | 4.8% |

Analysis

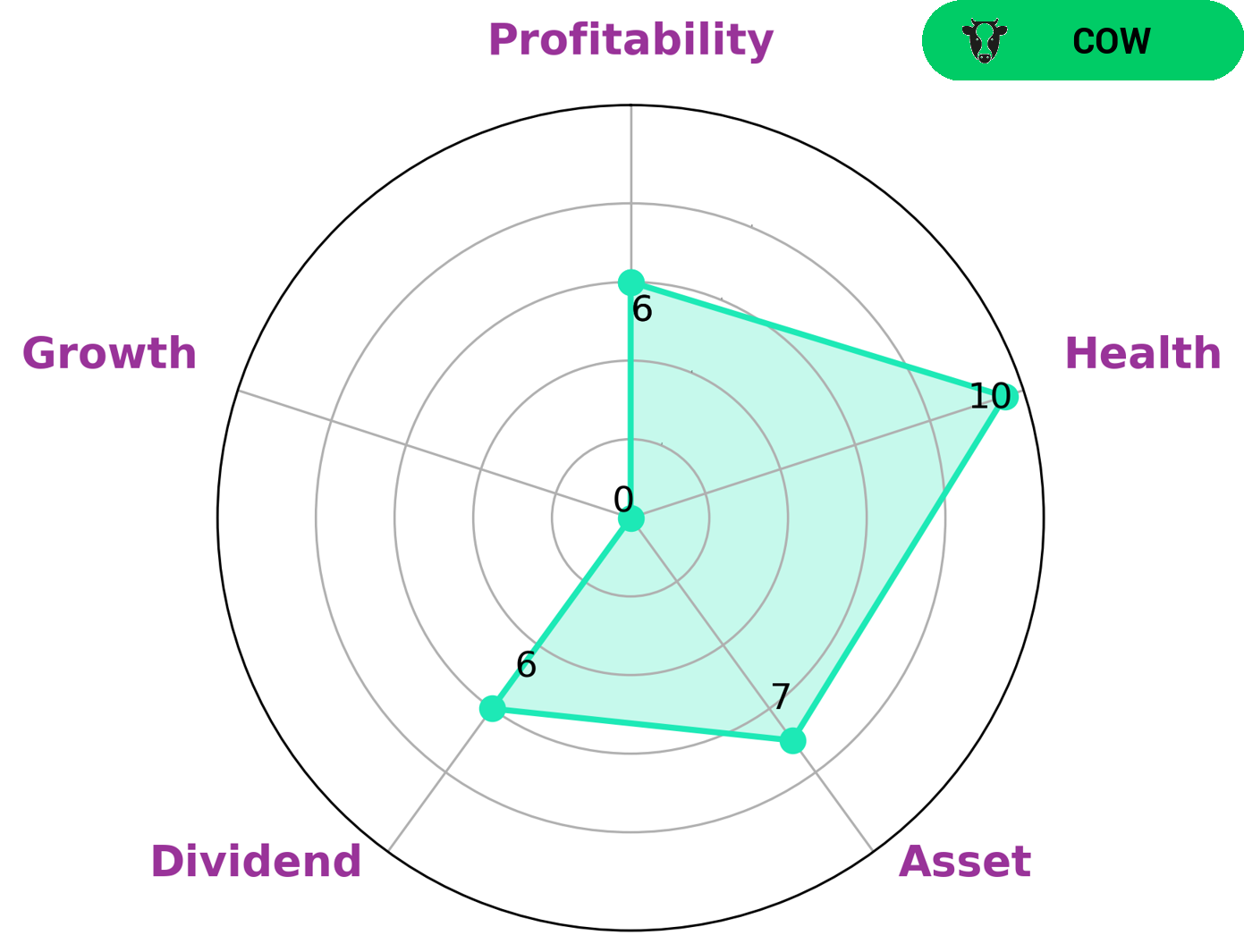

GoodWhale has conducted an analysis of PETMED EXPRESS‘s wellbeing. According to our Star Chart, PETMED EXPRESS has a high health score of 10/10 considering its cashflows and debt, meaning the company is capable to safely ride out any crisis without the risk of bankruptcy. Despite this positive result, PETMED EXPRESS is strong in asset, medium in dividend, profitability and weak in growth. As such we classify PETMED EXPRESS as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. We believe that this type of company may be of interest to conservative investors, as well as those looking for steady returns and dividends. We would also suggest that those looking for long-term investments or those who value the security and stability of a reliable dividend payer should consider PETMED EXPRESS. More…

Peers

PetMed Express Inc is one of the largest online pet pharmacies in the United States. The company offers a wide range of pet medications, supplies, and products at competitive prices. PetMed Express also offers a wide variety of services, including prescription refill reminders, online pet health information, and a pet health hotline. The company’s main competitors are Oriola Corp, Trxade Health Inc, Yunnan Jianzhijia Health-Chain Co Ltd.

– Oriola Corp ($LTS:0NER)

Oriola Corporation is a Finnish company that provides branded pharmaceuticals and services to the pharmaceutical industry and retail pharmacies. The company has a market capitalization of €330.77 million and a return on equity of 7.73%. Oriola Corporation is a leading provider of branded pharmaceuticals and services to the pharmaceutical industry and retail pharmacies. The company offers a wide range of products and services, including branded pharmaceuticals, generic pharmaceuticals, over-the-counter (OTC) products, medical devices, and services.

– Trxade Health Inc ($NASDAQ:MEDS)

Trxade Health Inc is a healthcare company that focuses on providing services and products to the healthcare industry. The company has a market cap of 8.16M as of 2022 and a Return on Equity of -110.47%. Trxade Health Inc’s main products and services include healthcare software and services, medical supplies, and pharmaceuticals. The company operates in the United States and Canada.

– Yunnan Jianzhijia Health-Chain Co Ltd ($SHSE:605266)

Yunnan Jianzhijia Health-Chain Co Ltd is a Chinese company that focuses on the development and application of health-related big data technology. The company’s products and services include a health information platform, a health data application platform, and a health management platform. As of 2022, Yunnan Jianzhijia Health-Chain Co Ltd has a market cap of 5.46B and a Return on Equity of 11.7%.

Summary

PETMED EXPRESS, Inc. is an innovative company that provides pet medications and health care products. The company is looking for a Chief Barketing Officer to help drive its marketing initiatives and increase brand awareness. In return, the company is offering a $10,000 prize to the winner. Investors can expect to benefit from PETMED’s ability to provide quality pet products at competitive prices. The company has a proven track record of delivering strong revenues and profits, which can be seen in its recent financial statements.

In addition, PETMED has a strong presence in the online and retail pet markets. With its focus on innovation and customer service, PETMED is well-positioned for future success.

Recent Posts