Service Corporation Stock Intrinsic Value – Service Corporation’s Q2 Results Show Positive Earnings and Steady Revenue

May 2, 2023

Trending News ☀️

Service Corporation ($NYSE:SCI)’s second quarter results demonstrate their financial stability and strength in the industry. The company reported a non-GAAP earnings per share of $0.93, beating analyst expectations by $0.02. Revenue for the quarter was $1.03 billion, which is in line with forecasts. SERVICE CORPORATION is a publicly traded company that provides services related to death care and cemetery operations. This quarter’s results demonstrate the company’s ability to generate strong and consistent earnings.

It also reflects the ongoing success of their long-term strategies to drive growth and profitability. Overall, these results demonstrate the strength of Service Corporation’s business fundamentals and are indicative of the company’s continued success in the coming quarters. Investors can expect the company to remain a market leader in the industry and to continue to generate positive results in the future.

Price History

The positive news saw the company’s stock open at $70.5 and close at $71.6, representing a 2.0% increase from the previous closing price of 70.2. Analysts have expressed optimism about the company’s outlook for the future, citing the solid financial performance in the past quarter. With the company continuing to produce strong financial results, it looks set to continue its upward trajectory in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Service Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 4.02k | 490.59 | 12.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Service Corporation. More…

| Operations | Investing | Financing |

| 713.12 | -487.12 | -359.41 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Service Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.34k | 13.72k | 10.59 |

Key Ratios Snapshot

Some of the financial key ratios for Service Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.5% | 9.4% | 20.8% |

| FCF Margin | ROE | ROA |

| 8.0% | 31.8% | 3.4% |

Analysis – Service Corporation Stock Intrinsic Value

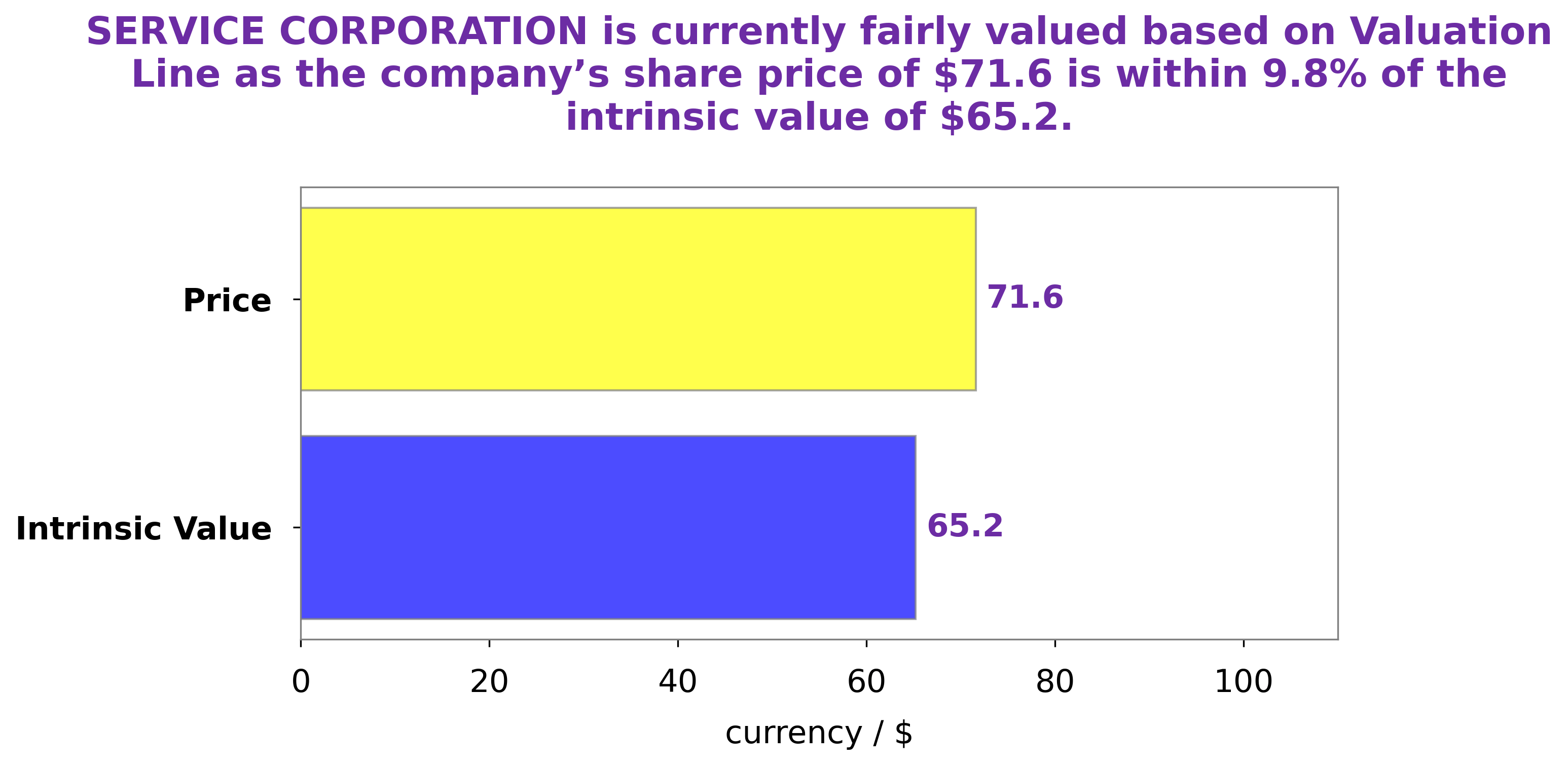

At GoodWhale, we recently conducted a comprehensive analysis of SERVICE CORPORATION‘s wellbeing. We used our proprietary Valuation Line to calculate the intrinsic value of SERVICE CORPORATION shares, which comes out to be around $65.2. At present, SERVICE CORPORATION stock is being traded at $71.6, which implies that the market is valuing the company over its intrinsic value. This is evidenced by our fair price being 9.8% higher than the current market price. Nevertheless, with the current market conditions and investor sentiment, SERVICE CORPORATION stock may be able to maintain its pricing level. Nonetheless, investors should exercise caution when it comes to investing in SERVICE CORPORATION. More…

Peers

Service Corp International is the largest provider of death care services and products in North America. The company operates more than 2,000 funeral homes and crematories in the United States and Canada. LE Lavoir Ltd is a provider of funeral and cremation services in Japan. HEIAN CEREMONY SERVICE Co Ltd is a leading provider of funeral services in China.

– Park Lawn Corp ($TSX:PLC)

Park Lawn Corporation is a provider of death care products and services in North America. The Company owns and operates cemeteries, funeral homes, crematoria, burial vaults, urn gardens, memorialization products and services, and cemetery property. Park Lawn’s products and services include interment rights, such as graves, crypts or niches in cemeteries, and funeral and cremation services.

– LE Lavoir Ltd ($BSE:539814)

In 2022, the market capitalization of Lavoir Ltd was 108.86 million, with a return on equity of 1.66%. The company provides laundry and dry-cleaning services.

– HEIAN CEREMONY SERVICE Co Ltd ($TSE:2344)

The Heian Ceremony Service Co Ltd has a market capitalization of 9.16 billion as of 2022. The company has a return on equity of 4.27%. Heian Ceremony Service Co Ltd is a company that provides services for ceremonies.

Summary

Service Corporation has reported a non-GAAP earnings per share (EPS) of $0.93, beating analysts’ expectations by $0.02. Revenue for the quarter was reported to be $1.03 billion, which met the expectations of analysts. This positive financial performance is likely to be welcomed by investors as it suggests that the company is in a strong financial position.

The revenue figure of $1.03 billion indicates that the company is continuing to generate revenue despite the current economic downturn. The report of strong financial performance is likely to increase investor confidence in Service Corporation, and could result in increased investments in the company.

Recent Posts