Frontdoor Leads the Way in Home Service Innovation with Streem® Technology, Enhancing the Future and Environment.

March 2, 2023

Trending News ☀️

Frontdoor ($NASDAQ:FTDR), Inc. has revolutionized the home service industry with its innovative Streem® technology. This technology, which was developed in partnership with one of the top energy and technology companies, is a first-of-its-kind approach to managing home service plans, providing a more efficient and environmentally friendly way for customers to receive the services they need. By enabling customers to access services remotely via live video streaming, Frontdoor Inc. is helping to reduce both the environmental impact and the costs associated with in-person service visits. The Streem® technology also provides an improved customer experience and an enhanced level of safety and convenience at the same time.

Customers can simply connect and communicate with their technician in real-time wherever they are, all while saving time and money. Further, to ensure safety, all technicians must pass a detailed background check before they can utilize the platform.

Share Price

F r o n t d o o r I n c . i s l e a d i n g t h e w a y i n h o m e s e r v i c e i n n o v a t i o n w i t h i t s n e w S t r e e m ® T e c h n o l o g y . S i n c e i t s l a u n c h , t h e t e c h n o l o g y h a s a t t r a c t e d c o n s i d e r a b l e m e d i a a t t e n t i o n , w i t h a l a r g e l y p o s i t i v e r e s p o n s e . O n T h u r s d a y , t h e c o m p a n y ‘ s s t o c k o p e n e d a t $ 2 8 .

4 % f r o m i t s p r e v i o u s c l o s e o f 2 8 . T h i s i n d i c a t e s t h a t m a r k e t p a r t i c i p a n t s a r e c o n f i d e n t i n F r o n t d o o r I n c . a n d i t s t e c h n o l o g i e s , w h i c h a r e f o c u s e d o n e n h a n c i n g t h e f u t u r e a n d e n v i r o n m e n t. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Frontdoor. More…

| Total Revenues | Net Income | Net Margin |

| 1.66k | 69 | 9.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Frontdoor. More…

| Operations | Investing | Financing |

| 123 | -33 | -156 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Frontdoor. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.09k | 1.05k | 0.59 |

Key Ratios Snapshot

Some of the financial key ratios for Frontdoor are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.3% | -16.9% | 12.9% |

| FCF Margin | ROE | ROA |

| 5.1% | 280.1% | 6.9% |

Analysis

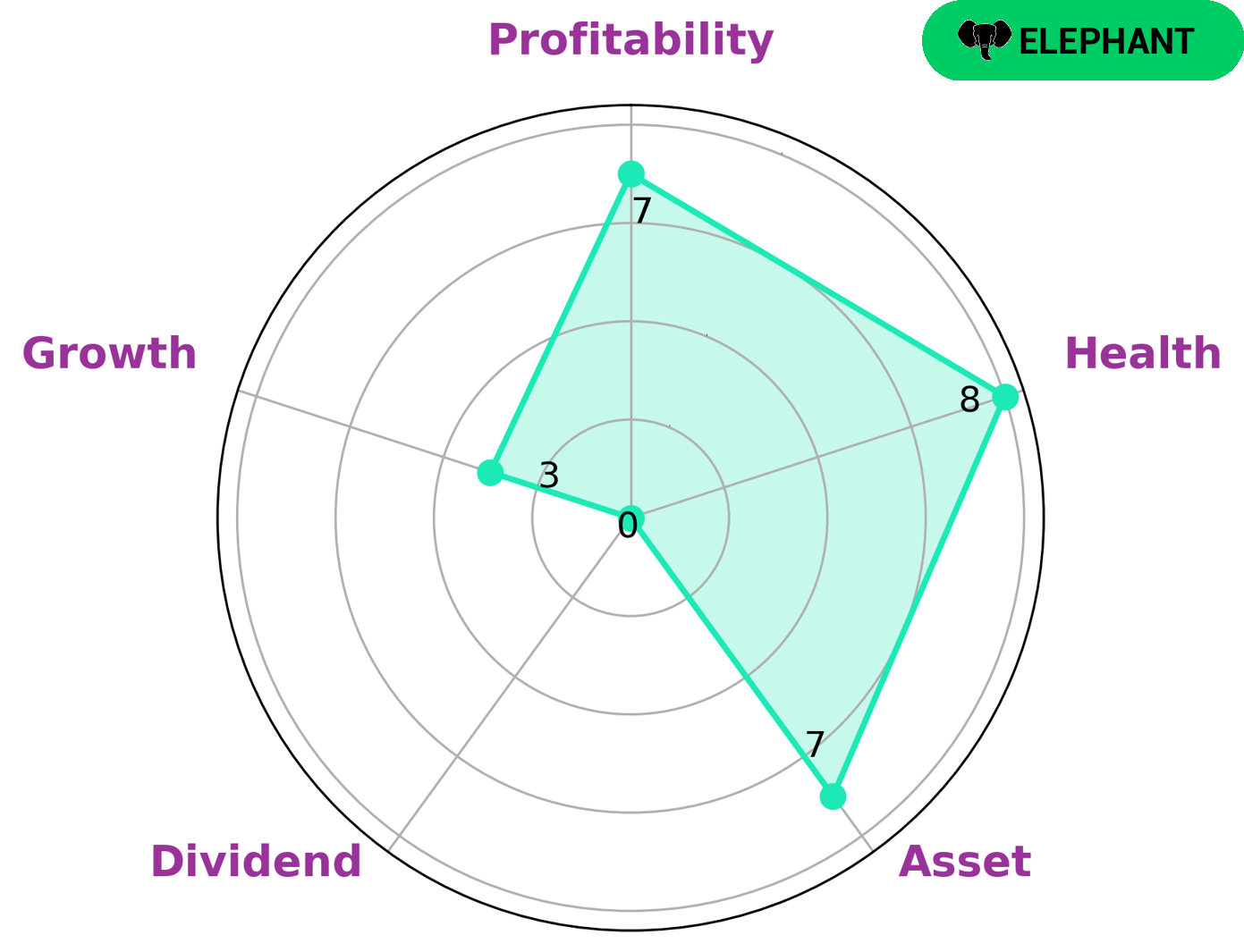

At GoodWhale, we’ve conducted an analysis of FRONTDOOR’s wellbeing and have categorized them as an “elephant”–a company with plentiful assets after deducting liabilities. According to our Star Chart, FRONTDOOR is strong in terms of asset and profitability, but weaker when it comes to dividend and growth. We’ve also assessed their health score with regard to cashflows and debt, and have concluded that FRONTDOOR has earned a score of 8/10. This indicates that the company is capable of navigating any crisis situation without the fear of bankruptcy. Given the nature of its financials, such an elephant can be attractive to many kinds of investors looking for long-term investments. It would be particularly attractive to those seeking a low-risk venture that is unlikely to be affected by economic turbulence. More…

Peers

Its competitors are E-Home Household Service Holdings Ltd, Buck Hill Falls Co, and Carriage Services Inc.

– E-Home Household Service Holdings Ltd ($NASDAQ:EJH)

E-Home Household Service Holdings Ltd is a provider of home healthcare services in China. The company offers a range of services, including nursing care, rehabilitation therapy, and health management. It also provides home-based services, such as home visits, home health education, and health assessment. The company operates in two segments: Home Healthcare Services and Health Management. It has a network of service outlets in Beijing, Shanghai, Guangzhou, and Shenzhen.

– Buck Hill Falls Co ($OTCPK:BUHF)

Carriage Services Inc is a publicly traded company that provides funeral and cemetery services. The company has a market capitalization of $353.16 million as of 2022 and a return on equity of 43.04%. Carriage Services Inc operates through two segments: Funeral and Cemetery Services. The Funeral segment provides funeral services, cremation services, and merchandise sales. The Cemetery segment provides cemetery property sales, interment services, and other related services.

Summary

Frontdoor Inc. is an innovative home services company that is gaining traction for its cutting-edge Streem® technology. This technology is designed to optimize both the future of home services, as well as the environment. Investors should be aware that FRONTDOOR‘s technology has been receiving positive media coverage recently, which may represent an opportunity for potential investment. In terms of financial position, FRONTDOOR remains profitable and its revenue appears to be growing.

It has high customer satisfaction ratings, providing a stable foundation for growth in the future. Overall, FRONTDOOR appears to be a solid investing prospect for those interested in home services technology.

Recent Posts