Nippon Paper Industries Co. Announces Additional Contribution to Stock Compensation Plan

May 19, 2023

Trending News 🌥️

Nippon Paper Industries ($TSE:3863) Co., Ltd. announced on May 15, 2023 that it is adding the Stock Compensation Plan to its portfolio. The company is led by President Toru Nozawa and is one of the leading paper manufacturers in Japan, with a portfolio that includes paper, tissue, packaging, and other product lines. The Stock Compensation Plan is designed to reward employees for their hard work and dedication. Under the plan, eligible employees will be granted stock options and performance shares, which will vest upon certain performance milestones being met. The plan is intended to create a sense of ownership among employees by providing them with a financial stake in the company’s success. Nippon Paper Industries is committed to creating an environment where employees feel valued and appreciated.

The addition of the Stock Compensation Plan is part of this effort to ensure that employees are rewarded for their contributions. The company also offers a comprehensive benefits package and competitive salaries to attract and retain top talent. By introducing the Stock Compensation Plan, Nippon Paper Industries is further strengthening its commitment to its employees and its position as a leader in the paper industry. The company looks forward to seeing the positive impact the plan will have on employee morale and productivity.

Stock Price

Following the announcement, the company’s stock opened at JP¥1120.0 before closing at JP¥1100.0, resulting in a decrease of 1.7% from the last closing price of 1119.0. The contribution is expected to support the company’s long-term strategies and goals, and will help strengthen its corporate governance. The additional contribution is also aimed at rewarding long-term shareholders and incentivizing investors to maintain their loyalty to the company. Nippon Paper Industries Co. is confident that these measures will help to ensure continued growth and success in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Nippon Paper Industries. More…

| Total Revenues | Net Income | Net Margin |

| 1.12M | -26.1k | -2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Nippon Paper Industries. More…

| Operations | Investing | Financing |

| 49.73k | -61.25k | 54.31k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Nippon Paper Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.74M | 1.28M | 3.88k |

Key Ratios Snapshot

Some of the financial key ratios for Nippon Paper Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.2% | -14.9% | -0.8% |

| FCF Margin | ROE | ROA |

| 4.4% | -1.3% | -0.3% |

Analysis

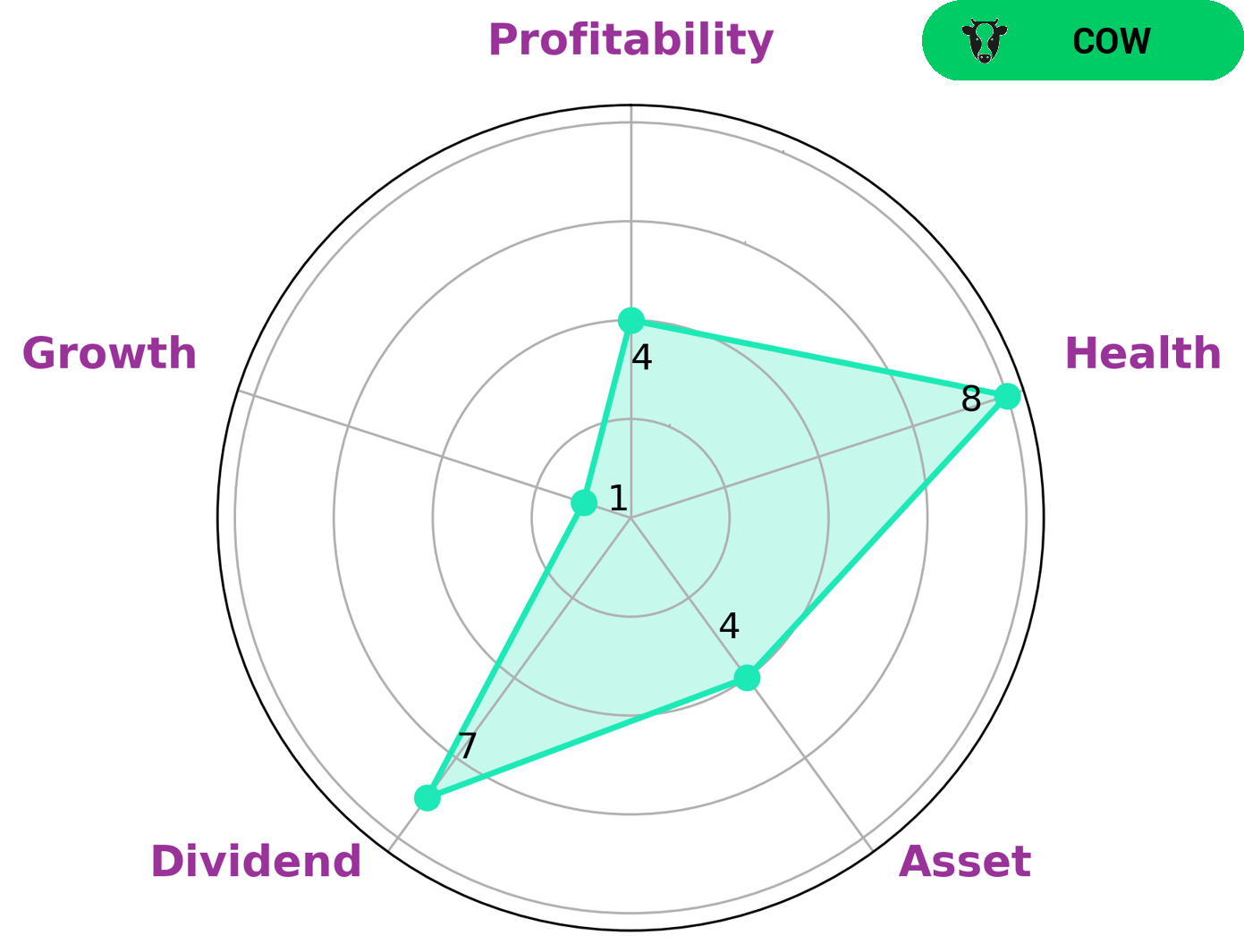

At GoodWhale, we specialize in analyzing companies’ fundamentals. NIPPON PAPER INDUSTRIES is one of those companies we have analyzed and classified as ‘cow’, which indicates that this company has a track record of paying out consistent and sustainable dividends. This makes NIPPON PAPER INDUSTRIES attractive to income investors who are looking for a steady stream of returns. We also noted that NIPPON PAPER INDUSTRIES has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is able to pay off debt and fund future operations. By examining the company’s Star Chart, we also found that the company is strong in dividend, medium in asset, profitability and weak in growth. Thus, investors who are looking for a steady stream of returns with the potential for some capital appreciation may find NIPPON PAPER INDUSTRIES to be an attractive investment opportunity. More…

Peers

These companies have been competing for market share and customers for many years, and the competition between them is fierce.

– Daio Paper Corp ($TSE:3880)

Daio Paper Corp is a leading manufacturer and distributor of paper products and related products in Japan. With a market capitalization of 170.73 billion as of 2023, the company is one of the largest companies in Japan. Its Return on Equity (ROE) of -3.15% indicates that the company has not been able to generate positive returns for shareholders. Daio Paper Corp is known for its high-quality products and innovative approaches to paper production. The company has a wide variety of products, ranging from paper cups and tissue paper to industrial paper and packaging materials. Daio Paper Corp has also been a leader in environmental sustainability, investing in renewable resources and developing strategies to reduce its environmental impact.

– ENCE Energia y Celulosa SA ($LTS:0K96)

Energia y Celulosa SA is a Spanish energy and paper company that operates in the production, distribution, and sale of energy, as well as the production and sale of paper products. The company has a market capitalization of 871.97 million Euros as of 2023, and has achieved a return on equity of 10.79%. This indicates that the company is performing well and has managed to generate returns on the amount of money shareholders have invested in the company. Energia y Celulosa SA has been able to maintain its market capitalization and ROE by investing in its core businesses, such as the production and sale of energy and paper products. The company’s commitment to investing in its core businesses has ensured long-term success and profitability.

– Mudanjiang Hengfeng Paper Co Ltd ($SHSE:600356)

Mudanjiang Hengfeng Paper Co Ltd is a Chinese paper manufacturer with a market cap of 2.48B as of 2023. The company has a Return on Equity (ROE) of 2.88%, which is a measure of a company’s profitability, reflecting the amount of profit generated for every dollar of shareholders’ equity. Mudanjiang Hengfeng Paper Co Ltd specializes in the production of various kinds of paper, including uncoated mechanical paper, coated mechanical paper, light coated paper and high-grade paper. The company’s products are widely used in the printing, packaging, stationery and other industries.

Summary

Nippon Paper Industries Co., Ltd. has announced an additional contribution to its stock compensation plan. This is in line with the company’s strategy to increase shareholder returns and strengthen corporate governance. The plan involves an increase in the amount of stock-based compensation and a decrease in the amount of cash-based compensation. According to the announcement, this move will better align the interests of shareholders and management while also improving performance incentives.

Furthermore, the company is confident that the new compensation structure will boost morale and attract top talent. Investors should consider the potential rewards from increased stock-based compensation when evaluating Nippon Paper Industries Co., Ltd. as a potential investment.

Recent Posts