Morgan Stanley Analyst Maintains Hold Rating on Ardagh Metal Packaging S.A. Despite Positive Outlook

May 16, 2023

Trending News 🌧️

As of May 10, 2023, Angel Castillo, an analyst at Morgan Stanley, has kept his Hold rating on Ardagh Metal Packaging ($NYSE:AMBP) S.A.

However, despite this rating, Castillo maintains a positive outlook for the company. Ardagh Metal Packaging S.A is a Luxembourg-based metal packaging manufacturer that specializes in the production of food and beverage cans. Castillo’s analysis of Ardagh Metal Packaging S.A is based on their impressive growth in recent years. Despite having a positive outlook for the company, Castillo has maintained his Hold rating due to concerns about their operational efficiency. Ardagh Metal Packaging S.A’s operating expenses have been increasing at a faster rate than their revenue in recent years, causing their operating margins to decline. As a result, Castillo advocates for the company to focus on improving their operational efficiency in order to improve their profitability. While he has some concerns about their operational efficiency, Castillo believes that the company has strong potential for future growth due to their impressive revenue growth and strong gross profit margins.

Market Price

On Wednesday, the stock of ARDAGH METAL PACKAGING S.A opened at $3.7 and closed at $3.6, down by 3.2% from the last closing price of 3.7. Despite this, Growe believes that the company still holds potential and has strong fundamentals moving forward. Growe noted that ARDAGH METAL PACKAGING S.A has a high debt-to-equity ratio and is exposed to currency exchange rate fluctuations that could limit the company’s growth potential. He also pointed out that while the company has seen strong demand for aluminum cans in recent months, their high price could be an issue for their long-term prospects.

However, Growe believes that ARDAGH METAL PACKAGING S.A will be able to meet demand and remain competitive in the market. He believes that the company still has potential for growth and has strong fundamentals despite the recent decline in its stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AMBP. More…

| Total Revenues | Net Income | Net Margin |

| 4.68k | 156 | 3.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AMBP. More…

| Operations | Investing | Financing |

| 142 | -604 | 369 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AMBP. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.66k | 5.29k | 0.76 |

Key Ratios Snapshot

Some of the financial key ratios for AMBP are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.9% | -3.9% | 7.8% |

| FCF Margin | ROE | ROA |

| -9.9% | 49.9% | 4.0% |

Analysis

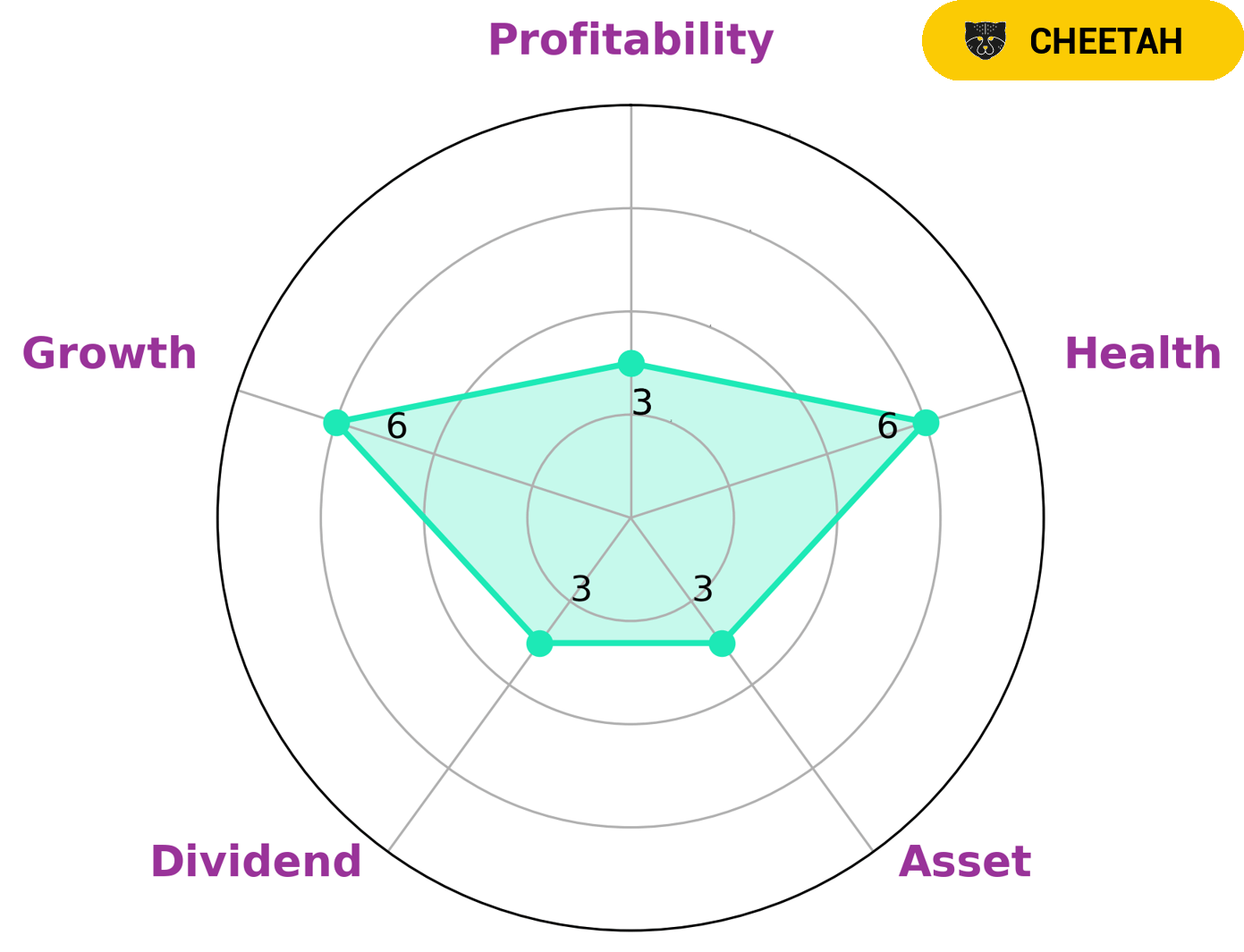

As GoodWhale, we have conducted an analysis of ARDAGH METAL PACKAGING S.A’s fundamentals and found that the company has an intermediate health score of 6/10 according to our Star Chart. This indicates that ARDAGG METAL PACKAGING S.A is likely to safely ride out any crisis without the risk of bankruptcy due to its cashflows and debt. We have classified ARDAGH METAL PACKAGING S.A as a ‘cheetah’ – a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. This type of company may be of interest to investors who are looking for a high-growth potential opportunity, but who are also aware of the associated risk. We concluded that ARDAGH METAL PACKAGING S.A is strong in terms of its cashflows, medium in growth and weak in asset, dividend, and profitability. More…

Peers

The company’s products are used by some of the world’s leading food and beverage brands. Ardagh Metal Packaging SA’s main competitors are Shetron Ltd, Kingcan Holdings Ltd, and Greatview Aseptic Packaging Co Ltd.

– Shetron Ltd ($BSE:526137)

Shetron Ltd is a publicly traded company with a market capitalization of $658.59 million as of 2022. The company has a return on equity of 17.0%. Shetron Ltd is engaged in the business of providing engineering and construction services. The company operates in two segments: Engineering and Construction, and Equipment Leasing and Rental.

– Kingcan Holdings Ltd ($TWSE:8411)

Kingcan Holdings Ltd is a food and beverage company with a market cap of 2.26B as of 2022. The company has a ROE of 3.55%. Kingcan Holdings Ltd is engaged in the business of production, marketing and sale of food and beverage products. The company’s products include processed meat, canned fruits and vegetables, dairy products, beverages, and other food products. Kingcan Holdings Ltd is headquartered in Hong Kong.

– Greatview Aseptic Packaging Co Ltd ($SEHK:00468)

Greatview Aseptic Packaging Co Ltd is a leading international manufacturer of aseptic carton packaging solutions. The company has a market capitalization of 1.52 billion as of 2022 and a return on equity of 6.65%. Greatview Aseptic Packaging Co Ltd designs, manufactures and sells a range of aseptic carton packaging solutions for the food and beverage industry. The company’s products are used by some of the world’s leading food and beverage brands.

Summary

Investors should take notice of analyst Angel Castillo’s Hold rating on Ardagh Metal Packaging S.A. While the stock price dropped on May 10th of 2023, Castillo is still confident in the outlook of the company. He believes that the company is still a good investment for the long term. Investors should be cautious when considering investments in Ardagh Metal Packaging S.A. as volatility in the market could cause the stock to move either way. It is important to do research and analyze the risk-reward ratio before investing.

Recent Posts