Greif Inc: Unlocking the Power of Potential

April 29, 2023

Trending News 🌥️

Greif ($NYSE:GEF) Inc is a leader in the industrial packaging industry, delivering innovative and reliable products and services to customers around the world. As a publicly traded company on the New York Stock Exchange (NYSE: GEF), Greif has a long history of success and growth, making it an attractive investment opportunity. With its “Unlocking the Power of Potential” slogan, Greif seeks to maximize its potential as a global provider of packaging solutions for a wide range of industries. By combining decades of experience and expertise with advanced technology and innovative polymers, Greif has been able to provide customers with high-quality packaging solutions that exceed their expectations. With its focus on creating value for customers, Greif continues to expand its product portfolio, offering a wide range of products and services to meet customer needs. From paperboard containers to plastic drums, Greif provides an extensive selection of container and packaging options that are designed to meet the exact needs of customers.

Greif also offers a variety of services, such as custom printing and labeling, to ensure that customers get exactly the product they need. Greif is dedicated to meeting customer needs and helping them succeed in their business endeavors. By unlocking the boundless potential of its resources, Greif is committed to providing customers with the highest quality products and services possible. With its focus on innovation and customer service, Greif is well-positioned to continue unlocking its potential and delivering value to customers around the world.

Market Price

Greif Inc., a global leader in industrial packaging products and services, is an organization that strives to unlock the power of potential for its employees and its stakeholders. On Friday, the company’s stock opened at $61.8 and closed at $62.8, up by 1.2% from its last closing price of $62.0. The stock performance reflects the company’s commitment to continuously innovate, develop, and deliver the highest quality products and services to meet customers’ needs. Greif is poised to take advantage of its growing customer base and strong financial position and continues to be an attractive long-term investment opportunity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Greif. More…

| Total Revenues | Net Income | Net Margin |

| 6.06k | 456.3 | 7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Greif. More…

| Operations | Investing | Financing |

| 668 | -251.5 | -345.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Greif. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.69k | 3.79k | 31.63 |

Key Ratios Snapshot

Some of the financial key ratios for Greif are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.0% | 13.4% | 11.1% |

| FCF Margin | ROE | ROA |

| 8.0% | 23.2% | 7.4% |

Analysis

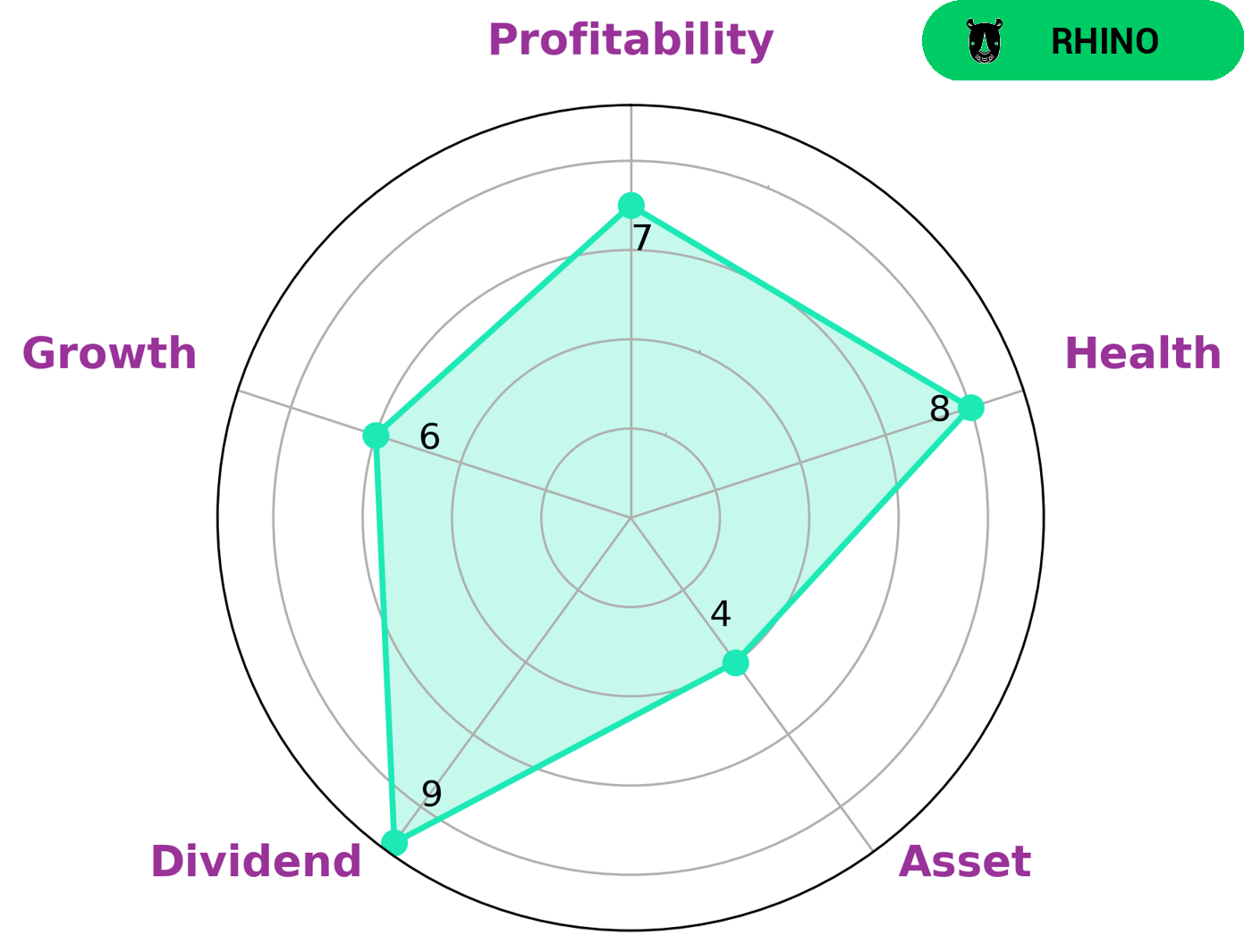

As part of our analysis of GREIF’s fundamentals, GoodWhale found that the company has strong ratings in dividend, profitability and medium levels in asset, growth. Based on our Star Chart, we concluded that GREIF is classified as a ‘rhino’, which is a type of company that has achieved moderate revenue or earnings growth. Given its strong ratings in dividend and profitability, investors who are seeking to gain passive income through dividends may find GREIF’s stock interesting. Additionally, its moderate growth ratings means that investors who are looking to invest in a company with potential for future growth would also find it appealing. Finally, we are pleased to note that GREIF has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. This could be attractive to investors who are looking for stability during uncertain times. Greif_Inc_Unlocking_the_Power_of_Potential”>More…

Peers

In the global market for industrial packaging, there are a few major players. Among them, Greif Inc. competes with Shanghai Xintonglian Packing Co Ltd, SCG Packaging PCL, and Southern Packaging Group Ltd. While each company has its own strengths, Greif Inc. has been able to maintain a leading position in the market.

– Shanghai Xintonglian Packing Co Ltd ($SHSE:603022)

Shanghai Xintonglian Packing Co Ltd is a leading manufacturer of packaging products in China. The company has a market cap of 1.85B as of 2022 and a ROE of 2.72%. The company’s products are used in a wide range of industries, including food, beverage, pharmaceutical, cosmetics, and industrial packaging.

– SCG Packaging PCL ($SET:SCGP)

SCG Packaging PLC is a leading provider of packaging solutions with a market cap of 226.46B as of 2022. The company has a strong focus on innovation and sustainability, and offers a wide range of packaging products and services to meet the needs of its customers. SCG Packaging PLC has a strong commitment to environmental responsibility and is committed to reducing the impact of its operations on the environment. The company has a return on equity of 7.4%.

– Southern Packaging Group Ltd ($SGX:BQP)

Southern Packaging Group Ltd is a packaging company that manufactures and supplies paperboard packaging products. The company has a market cap of 28.13M as of 2022 and a Return on Equity of 1.31%. Southern Packaging Group Ltd operates in two segments: Paperboard Packaging and Flexible Packaging. The Paperboard Packaging segment manufactures and sells paperboard packaging products, including corrugated containers, folding cartons, and solid fiber boxes. The Flexible Packaging segment manufactures and sells flexible packaging products, such as laminated films, laminates, and pouches.

Summary

Greif Inc. is a global leader in industrial packaging products and services, and offers investors a promising opportunity for growth. With a strong balance sheet and solid cash flow, Greif provides investors with a reliable and consistent return. The company has been able to weather economic downturns, maintain a healthy dividend and focus on organic growth initiatives. Greif’s core business is highly competitive, but the company is well positioned to capitalize on certain trends in the industry. Furthermore, Greif has implemented cost-cutting measures and made strategic acquisitions in order to boost profitability.

Additionally, the firm has invested in advanced technology to increase productivity and increase market share, which could lead to long-term growth. Overall, Greif looks attractive as an investment option due to its strong financials, competitive advantages, and potential for long-term growth.

Recent Posts