Zurcher Kantonalbank Zurich Cantonalbank Sells 16,656 Shares of The Hain Celestial Group,

May 10, 2023

Trending News ☀️

The Hain Celestial ($NASDAQ:HAIN) Group, Inc. recently had 16,656 of its shares sold by Zurcher Kantonalbank Zurich Cantonalbank at Defense World. The Hain Celestial Group, Inc. is a leading natural, organic, and specialty food and personal care products company, whose mission is to make people’s lives healthier and more enjoyable. The company is comprised of numerous brands that offer products such as plant-based beverages, plant-based snacks, frozen items, juices, health and beauty care items, and many more. The company is listed on the Nasdaq and has seen an increase in its stock price year-over-year.

Price History

However, it is important to note that despite this recent dip in stock prices, HAIN has seen significant growth over the past year and remains a strong player in the food industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hain Celestial. More…

| Total Revenues | Net Income | Net Margin |

| 1.85k | 45.46 | 2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hain Celestial. More…

| Operations | Investing | Financing |

| 9.56 | -21.98 | -6.95 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hain Celestial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.44k | 1.33k | 11.66 |

Key Ratios Snapshot

Some of the financial key ratios for Hain Celestial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -6.1% | 0.1% | 5.1% |

| FCF Margin | ROE | ROA |

| -0.9% | 5.5% | 2.4% |

Analysis

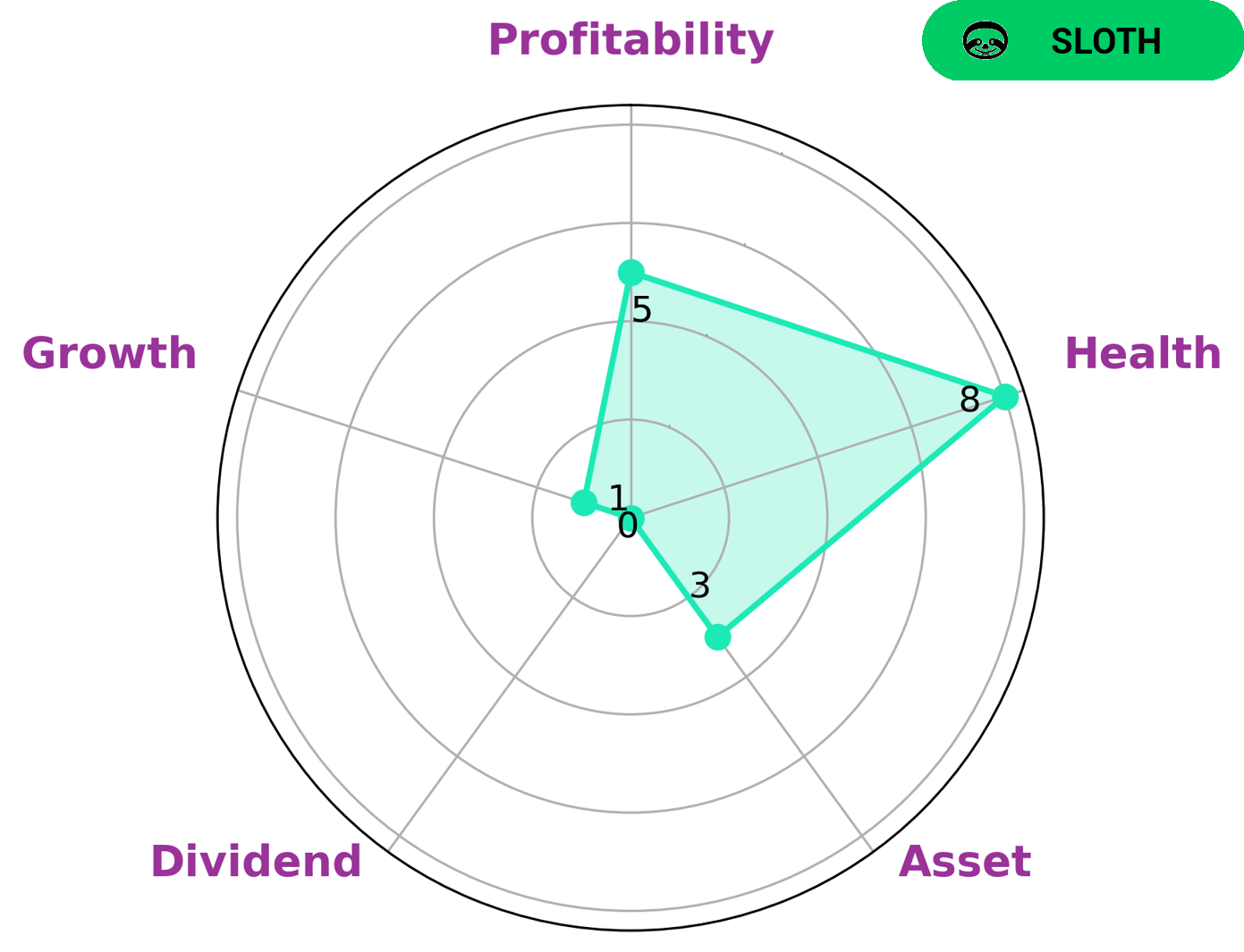

As GoodWhale, we analyzed HAIN CELESTIAL‘s wellbeing and discovered that it was classified as a ‘sloth’ company, which indicates that it has experienced slower revenue or earnings growth than the overall economy. This could make it attractive to value investors or those looking for a low-risk investment opportunity. We also determined that HAIN CELESTIAL has a health score of 8/10 with regard to its cashflows and debt, meaning it is capable of paying off debt and funding future operations. However, when looking at the other factors that comprise its wellbeing, such as asset, dividend, and growth, HAIN CELESTIAL is strong in medium in profitability and weak in those areas. More…

Peers

The four companies mentioned are all in competition with one another. MamaMancini’s Holdings Inc is a close second, followed by Shinozakiya Inc and Twinlab Consolidated Holdings Inc. All four companies are constantly innovating and expanding their product lines in order to gain an edge over the competition.

– MamaMancini’s Holdings Inc ($NASDAQ:MMMB)

MamaMancini’s Holdings Inc is a marketer and producer of slow-cooked, frozen and refrigerated Italian style foods sold under the MamaMancini’s brand. The company offers a range of products, including meatballs, chicken parmesan, lasagna, stuffed peppers, and ravioli. As of 2022, the company had a market cap of 39.95M and a return on equity of -14.63%.

MamaMancini’s Holdings Inc has been facing some challenges in recent years, including a decline in sales and an increase in debt. However, the company remains committed to its mission of providing quality Italian-style food products to its customers.

– Shinozakiya Inc ($TSE:2926)

Shinozakiya Inc is a Japanese company that manufactures and sells a variety of products, including cosmetics, food, and beverages. The company has a market capitalization of 1.32 billion as of 2022 and a return on equity of -2.09%. The company’s products are sold in a variety of countries, including Japan, China, and the United States.

– Twinlab Consolidated Holdings Inc ($OTCPK:TLCC)

Twinlab Consolidated Holdings Inc is a holding company that engages in the manufacture, marketing, and distribution of nutritional supplements. Its products include vitamins, minerals, and herbs. The company was founded in 1968 and is headquartered in Hauppauge, New York.

Summary

The Zurcher Kantonalbank Zurich Cantonalbank recently sold 16,656 shares of The Hain Celestial Group, Inc., at the current market price. This provides insight into their long-term investment strategy and their outlook on the company. The Hain Celestial Group is a leading organic and natural food and personal care products company with products in many categories, including juice and teas, frozen and refrigerated foods, personal care products, and baby food. Analysts have noted that the company’s financial performance has been strong in recent quarters, with total sales, operating income, and net income all increasing year-over-year.

The company has grown through acquisitions as well as new product launches, which has helped them to remain competitive in the fast-growing organic and natural food products industry. Investors should note that The Hain Celestial Group carries a moderate amount of debt, but it has a businesses model that is resilient to the cyclicality of the food industry.

Recent Posts