Truist Financial Corp increases stake in Flowers Foods by 3.0% in latest quarter

October 11, 2024

🌥️Trending News

Flowers Foods ($NYSE:FLO) is a leading bakery company headquartered in Thomasville, Georgia. The company’s stock, listed as FLO on the New York Stock Exchange, has been steadily growing over the past few years. This move was revealed in Truist’s 13F filing, which discloses the investment holdings of institutional investors. Truist Financial Corp, formerly known as BB&T and SunTrust Banks, is one of the largest financial services companies in the United States. It offers a wide range of banking and investment services to both individual and corporate clients. With a strong reputation and extensive expertise in the financial industry, Truist’s decision to increase its stake in Flowers Foods speaks volumes about the company’s potential.

This increase in investment may come as no surprise to those following Flowers Foods’ recent performance. This growth was driven by strong demand for the company’s fresh bakery products, especially during the ongoing pandemic when consumers turned to comfort foods like bread and pastries. Furthermore, Flowers Foods has been actively expanding its market presence through strategic acquisitions and partnerships with other food companies. This move is expected to further boost Flowers Foods’ sales and market share in the baked goods industry. With a reputation for high-quality products and strategic investments, Flowers Foods continues to be a leading player in the bakery industry and a promising stock for investors.

Analysis

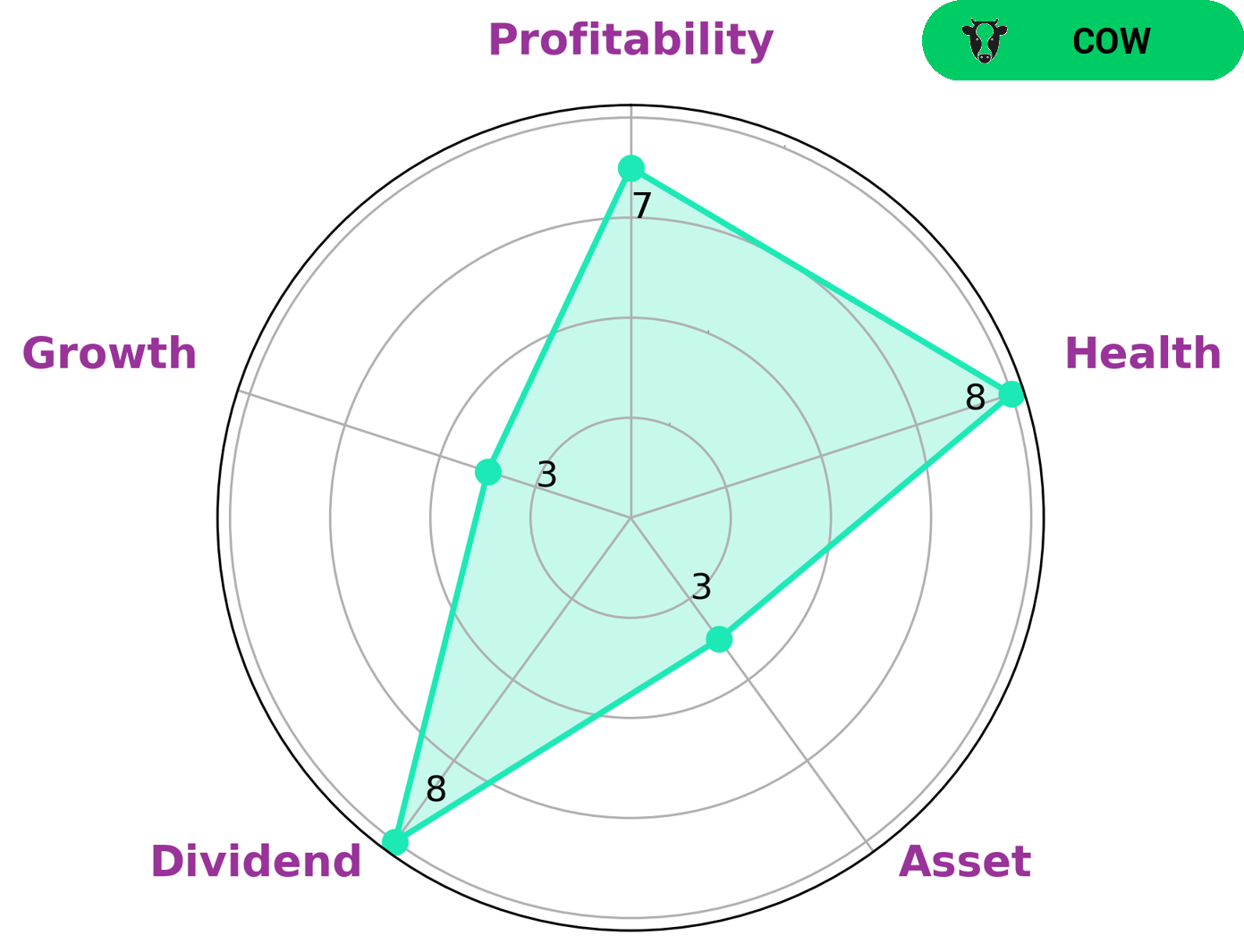

In fact, based on its Star Chart, FLOWERS FOODS has a high health score of 8/10. This indicates that the company’s cashflows and debt are well managed, and it is capable of safely navigating any crisis without the risk of bankruptcy. As a company, FLOWERS FOODS excels in areas such as dividend payouts and profitability. This means that investors can expect consistent and sustainable dividends from the company. However, FLOWERS FOODS may not be as strong in terms of its assets and growth potential. This could be due to various factors such as market conditions or the industry in which the company operates. Based on our analysis, FLOWERS FOODS can be classified as a ‘cow’ company. This type of company has a track record of consistently paying out dividends and is considered stable and secure. Therefore, investors who are looking for a safe and reliable investment may be interested in FLOWERS FOODS. In summary, FLOWERS FOODS is a financially sound company with a strong hold on its cashflows and debt. It offers consistent dividends and is considered a safe investment option. However, investors should also consider the company’s lower growth potential and asset strength when making their investment decisions. Overall, FLOWERS FOODS may be attractive to investors seeking stability and steady returns. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Flowers Foods. More…

| Total Revenues | Net Income | Net Margin |

| 5.09k | 123.42 | 2.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Flowers Foods. More…

| Operations | Investing | Financing |

| 349.35 | -403.81 | -88.15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Flowers Foods. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.43k | 2.08k | 6.51 |

Key Ratios Snapshot

Some of the financial key ratios for Flowers Foods are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.1% | -19.4% | 3.4% |

| FCF Margin | ROE | ROA |

| 4.3% | 7.9% | 3.2% |

Peers

Flowers Foods Inc is one of the leading producers of packaged bakery products in the United States. The company’s principal competitors are J&J Snack Foods Corp, MamaMancini’s Holdings Inc, and Bridgford Foods Corp.

– J&J Snack Foods Corp ($NASDAQ:JJSF)

J&J Snack Foods Corp is a publicly traded company with a market capitalization of $2.66 billion as of March 2022. The company manufactures and markets snack foods and beverages. Its products include ice cream, frozen desserts, cookies, crackers, pretzels, and other snacks. J&J Snack Foods Corp has a return on equity of 5.74%.

J&J Snack Foods Corp was founded in 1971 and is headquartered in Pennsauken, New Jersey. The company operates through three segments: Food Service, Retail, and International. The Food Service segment provides products to foodservice customers, including restaurants, schools, and other institutions. The Retail segment sells products to retail grocery and mass merchandiser customers. The International segment consists of sales to customers located outside of the United States.

– MamaMancini’s Holdings Inc ($NASDAQ:MMMB)

MamaMancini’s Holdings Inc is a food company that specializes in the production of Italian-style foods, such as meatballs, sausages, and pasta sauce. The company has a market cap of $39.22 million and a return on equity of -14.63%. MamaMancini’s Holdings Inc is a publicly traded company on the Nasdaq Stock Market under the ticker symbol “MMMB.”

– Bridgford Foods Corp ($NASDAQ:BRID)

Bridgford Foods Corporation is a food company that specializes in the manufacture and sale of frozen and refrigerated food products. The company has a market capitalization of 115.55 million as of 2022 and a return on equity of 46.05%. Bridgford Foods Corporation’s products include breads, rolls, biscuits, snacks, and other frozen and refrigerated foods. The company operates in the United States and Canada.

Summary

Truist Financial Corp increased its ownership of Flowers Foods, Inc. by 3.0% in the second quarter, according to recent reports. This suggests that Truist Financial Corp has confidence in the company’s potential for growth. The increase in stake also indicates that Flowers Foods may be a promising investment opportunity for other investors.

This could be due to strong financial performance or positive market trends in the food industry. Further analysis of the company’s financials and market trends could provide valuable insights for investors looking to make informed decisions on investing in Flowers Foods.

Recent Posts