Texas Teacher Retirement System Invests $1.50 Million in Simply Good Foods Company

June 12, 2023

☀️Trending News

The Teacher Retirement System of Texas (TRS) recently made a smart investment decision, by investing $1.50 million in the Simply Good Foods ($NASDAQ:SMPL) Company, a defense contractor. Simply Good Foods Company is an innovative company focused on developing and manufacturing nutritious and delicious food products that are both convenient and affordable. Their mission is to make it easier for everyone to access delicious, nutritious food that fits into their individual lifestyles. Simply Good Foods Company has developed a wide range of products, including breakfast foods, snacks, and meal replacements. These products are designed to be both nutritious and delicious, with low-fat and low-sugar ingredients for the health-conscious consumer.

They also offer a wide selection of vegan and vegetarian options, as well as options to suit many different dietary needs. The company is committed to creating products that are good for the environment as well, with no artificial flavors or colors. This investment will help them continue to develop products that make it easier for everyone to access nutritious foods that fit into their individual lifestyles.

Market Price

The TRS believes that the company’s portfolio of nutrition-focused snack foods has a strong potential for growth. In response to the news, SIMPLY GOOD FOODS stock opened at $35.8 and closed at $35.9, down by 0.1% from the previous closing price of 35.9. Despite the minor dip, the company’s stock has been on a steady rise since January and many experts anticipate that the TRS investment will continue to bode well for the Simply Good Foods Company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SMPL. More…

| Total Revenues | Net Income | Net Margin |

| 1.19k | 130.46 | 11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SMPL. More…

| Operations | Investing | Financing |

| 133.66 | -4.06 | -117.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SMPL. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.09k | 596.76 | 14.71 |

Key Ratios Snapshot

Some of the financial key ratios for SMPL are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.8% | 30.3% | 16.3% |

| FCF Margin | ROE | ROA |

| 11.0% | 8.2% | 5.8% |

Analysis

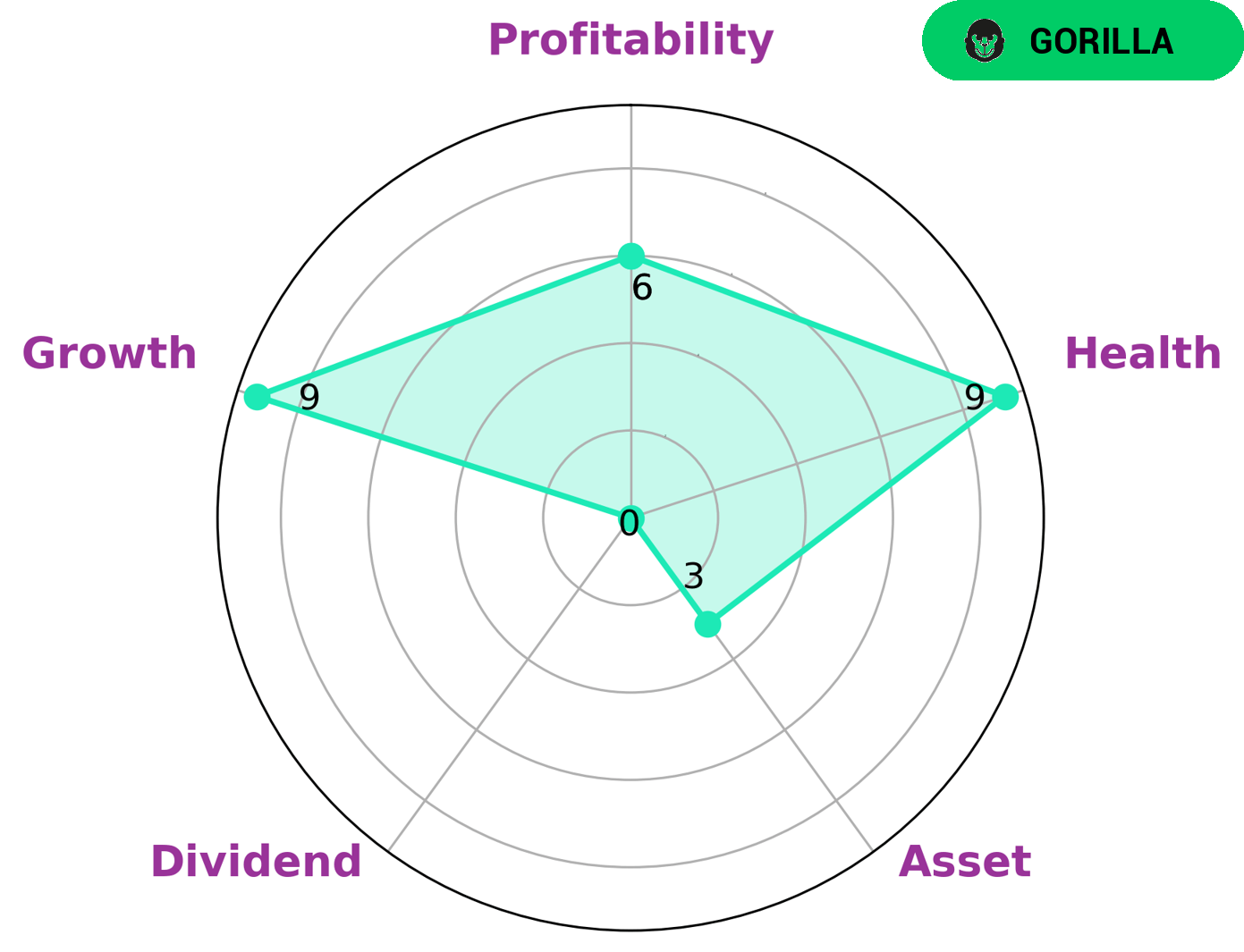

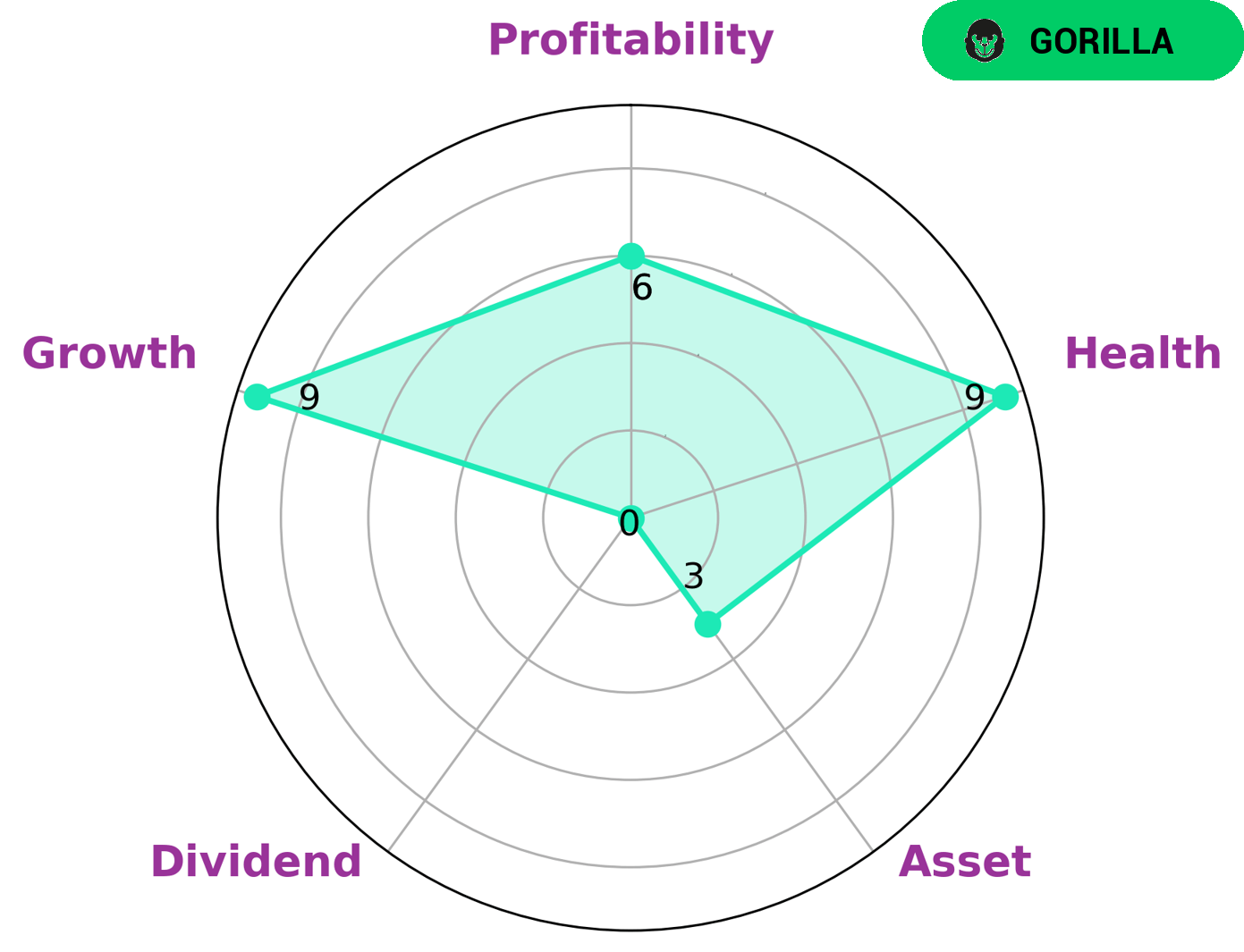

GoodWhale conducted an analysis of SIMPLY GOOD FOODS’s wellbeing. Our Star Chart revealed that SIMPLY GOOD FOODS has a high health score of 9/10, indicating that it is capable of paying off debt and funding future operations. We classified SIMPLY GOOD FOODS as a ‘gorilla’, meaning that it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Investors interested in such a company may include growth investors, who seek to invest in companies that are growing rapidly and have a competitive advantage. They may also include value investors, who seek to invest in companies with undervalued stocks or those that provide dividend payments. Additionally, SIMPLY GOOD FOODS is strong in growth, medium in profitability, and weak in asset and dividend. Investors interested in these factors may also find it attractive. More…

Peers

The Simply Good Foods Co is in a fierce competition with several other companies in the food industry. These competitors include High Liner Foods Inc, Ganyuan Foods Co Ltd, and Mowi ASA. All of these companies are striving to provide the best quality foods and services to their customers while remaining competitive in the market. As each company seeks to outdo the other, they are continually pushing the boundaries of innovation in order to offer the best products and services.

– High Liner Foods Inc ($TSX:HLF)

High Liner Foods Inc is a leading frozen seafood processing and marketing company in North America. It is one of the largest players in the frozen seafood industry, with operations in the United States, Canada, and Europe. As of 2022, High Liner Foods Inc has a market cap of 456.85M, making it one of the largest companies in the industry. Moreover, the company has an impressive Return on Equity (ROE) of 14.66% which shows the company is well managed and efficiently utilizing its resources to generate shareholder returns.

– Ganyuan Foods Co Ltd ($SZSE:002991)

Ganyuan Foods Co Ltd is a Chinese agricultural and food processing company. It has an impressive market capitalization of 7.22B as of 2022, which makes it one of the largest companies in the sector. The company has also achieved a Return on Equity (ROE) of 9.48%, demonstrating the effectiveness of its financial strategies. Ganyuan Foods Co Ltd is active in the production of grain, oilseed, tea, and other agricultural products, as well as in the processing and sale of these products to both domestic and international markets. The company also produces and sells a variety of processed foods, including noodles, grains, and snacks. By leveraging its extensive experience in agricultural production and food processing, Ganyuan Foods Co Ltd continues to be a leader in the industry.

– Mowi ASA ($BER:PND)

Mowi ASA is a multinational seafood company that specializes in the production and sale of farmed salmon and other seafood products. As of 2022, Mowi has a market capitalization of 7.96 billion USD, making it one of the largest seafood companies in the world. The company also has an impressive Return on Equity (ROE) of 17.38%, which is indicative of its strong financial performance and overall success. Mowi has achieved this impressive ROE figure through its commitment to efficiency, innovation, and sustainable practices. This has allowed the company to remain competitive despite the many challenges posed by the global seafood industry.

Summary

Simply Good Foods Company, a leading maker of low-carb, high-protein snacks, has recently caught the attention of investors. Analysts have noted that the company has seen increased demand and profitability due to consumer trends towards healthier snacks, and is well positioned to capitalize on the low-carb food market. With a strong portfolio of products and a healthy balance sheet, Simply Good Foods is a sound investment opportunity for those looking to diversify their portfolio.

Recent Posts

Texas Teacher Retirement System Invests $1.50 Million in Simply Good Foods Company

June 12, 2023

☀️Trending News

The Teacher Retirement System of Texas (TRS) recently made a smart investment decision, by investing $1.50 million in the Simply Good Foods ($NASDAQ:SMPL) Company, a defense contractor. Simply Good Foods Company is an innovative company focused on developing and manufacturing nutritious and delicious food products that are both convenient and affordable. Their mission is to make it easier for everyone to access delicious, nutritious food that fits into their individual lifestyles. Simply Good Foods Company has developed a wide range of products, including breakfast foods, snacks, and meal replacements. These products are designed to be both nutritious and delicious, with low-fat and low-sugar ingredients for the health-conscious consumer.

They also offer a wide selection of vegan and vegetarian options, as well as options to suit many different dietary needs. The company is committed to creating products that are good for the environment as well, with no artificial flavors or colors. This investment will help them continue to develop products that make it easier for everyone to access nutritious foods that fit into their individual lifestyles.

Market Price

The TRS believes that the company’s portfolio of nutrition-focused snack foods has a strong potential for growth. In response to the news, SIMPLY GOOD FOODS stock opened at $35.8 and closed at $35.9, down by 0.1% from the previous closing price of 35.9. Despite the minor dip, the company’s stock has been on a steady rise since January and many experts anticipate that the TRS investment will continue to bode well for the Simply Good Foods Company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for SMPL. More…

| Total Revenues | Net Income | Net Margin |

| 1.19k | 130.46 | 11.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for SMPL. More…

| Operations | Investing | Financing |

| 133.66 | -4.06 | -117.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for SMPL. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.09k | 596.76 | 14.71 |

Key Ratios Snapshot

Some of the financial key ratios for SMPL are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.8% | 30.3% | 16.3% |

| FCF Margin | ROE | ROA |

| 11.0% | 8.2% | 5.8% |

Analysis

GoodWhale conducted an analysis of SIMPLY GOOD FOODS’s wellbeing. Our Star Chart revealed that SIMPLY GOOD FOODS has a high health score of 9/10, indicating that it is capable of paying off debt and funding future operations. We classified SIMPLY GOOD FOODS as a ‘gorilla’, meaning that it has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Investors interested in such a company may include growth investors, who seek to invest in companies that are growing rapidly and have a competitive advantage. They may also include value investors, who seek to invest in companies with undervalued stocks or those that provide dividend payments. Additionally, SIMPLY GOOD FOODS is strong in growth, medium in profitability, and weak in asset and dividend. Investors interested in these factors may also find it attractive. More…

Peers

The Simply Good Foods Co is in a fierce competition with several other companies in the food industry. These competitors include High Liner Foods Inc, Ganyuan Foods Co Ltd, and Mowi ASA. All of these companies are striving to provide the best quality foods and services to their customers while remaining competitive in the market. As each company seeks to outdo the other, they are continually pushing the boundaries of innovation in order to offer the best products and services.

– High Liner Foods Inc ($TSX:HLF)

High Liner Foods Inc is a leading frozen seafood processing and marketing company in North America. It is one of the largest players in the frozen seafood industry, with operations in the United States, Canada, and Europe. As of 2022, High Liner Foods Inc has a market cap of 456.85M, making it one of the largest companies in the industry. Moreover, the company has an impressive Return on Equity (ROE) of 14.66% which shows the company is well managed and efficiently utilizing its resources to generate shareholder returns.

– Ganyuan Foods Co Ltd ($SZSE:002991)

Ganyuan Foods Co Ltd is a Chinese agricultural and food processing company. It has an impressive market capitalization of 7.22B as of 2022, which makes it one of the largest companies in the sector. The company has also achieved a Return on Equity (ROE) of 9.48%, demonstrating the effectiveness of its financial strategies. Ganyuan Foods Co Ltd is active in the production of grain, oilseed, tea, and other agricultural products, as well as in the processing and sale of these products to both domestic and international markets. The company also produces and sells a variety of processed foods, including noodles, grains, and snacks. By leveraging its extensive experience in agricultural production and food processing, Ganyuan Foods Co Ltd continues to be a leader in the industry.

– Mowi ASA ($BER:PND)

Mowi ASA is a multinational seafood company that specializes in the production and sale of farmed salmon and other seafood products. As of 2022, Mowi has a market capitalization of 7.96 billion USD, making it one of the largest seafood companies in the world. The company also has an impressive Return on Equity (ROE) of 17.38%, which is indicative of its strong financial performance and overall success. Mowi has achieved this impressive ROE figure through its commitment to efficiency, innovation, and sustainable practices. This has allowed the company to remain competitive despite the many challenges posed by the global seafood industry.

Summary

Simply Good Foods Company, a leading maker of low-carb, high-protein snacks, has recently caught the attention of investors. Analysts have noted that the company has seen increased demand and profitability due to consumer trends towards healthier snacks, and is well positioned to capitalize on the low-carb food market. With a strong portfolio of products and a healthy balance sheet, Simply Good Foods is a sound investment opportunity for those looking to diversify their portfolio.

Recent Posts