Shareholders of China Mengniu Dairy Reap 5-Year Benefits, But Late Buyers Not So Lucky in 2023

March 26, 2023

Trending News 🌧️

China Mengniu Dairy ($SEHK:02319) is a Chinese dairy products producer and marketer, and its stocks have been performing well over the past five years. Shareholders of the company who bought their stocks five years ago are currently reaping the benefits, with their investments now worth significantly more than what they originally paid.

However, those who only recently bought their shares may not be so lucky. Despite an initial rise in the stock price, it has begun to slide again in 2023. Analysts are expecting the downward trend to continue in the future, as the company struggles to stay competitive in a saturated market. It can be seen that investing in China Mengniu Dairy five years ago was a wise decision, as shareholders have experienced a steady growth in their investments. However, those who did not get in on the action early are not experiencing the same level of success. With the stock price now declining, analysts predict that those who bought their shares recently will not be able to recover their losses in the foreseeable future. The story of China Mengniu Dairy’s five-year stock performance serves as a lesson for investors. Getting into a company at the right time is key when it comes to generating returns, and investors should do their due diligence before diving into any stock. While five years ago may have been perfect timing for China Mengniu Dairy, it may not be so lucky in 2023.

Share Price

This was made evident on Monday when the stock opened at HK$33.5 and closed at HK$32.7, representing a 4.2% drop from the previous closing price of 34.2. This downward trend could signify a long-term negative sentiment towards the company and lead to further losses in the future. As such, investors should be wary of potential risks before making any decisions to buy or sell China Mengniu Dairy stocks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for China Mengniu Dairy. More…

| Total Revenues | Net Income | Net Margin |

| 89.96k | 5.83k | 7.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for China Mengniu Dairy. More…

| Operations | Investing | Financing |

| 6.59k | -16.48k | 9.49k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for China Mengniu Dairy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 105.17k | 61.21k | 9.83 |

Key Ratios Snapshot

Some of the financial key ratios for China Mengniu Dairy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.6% | 4.2% | 8.4% |

| FCF Margin | ROE | ROA |

| 1.2% | 12.5% | 4.5% |

Analysis

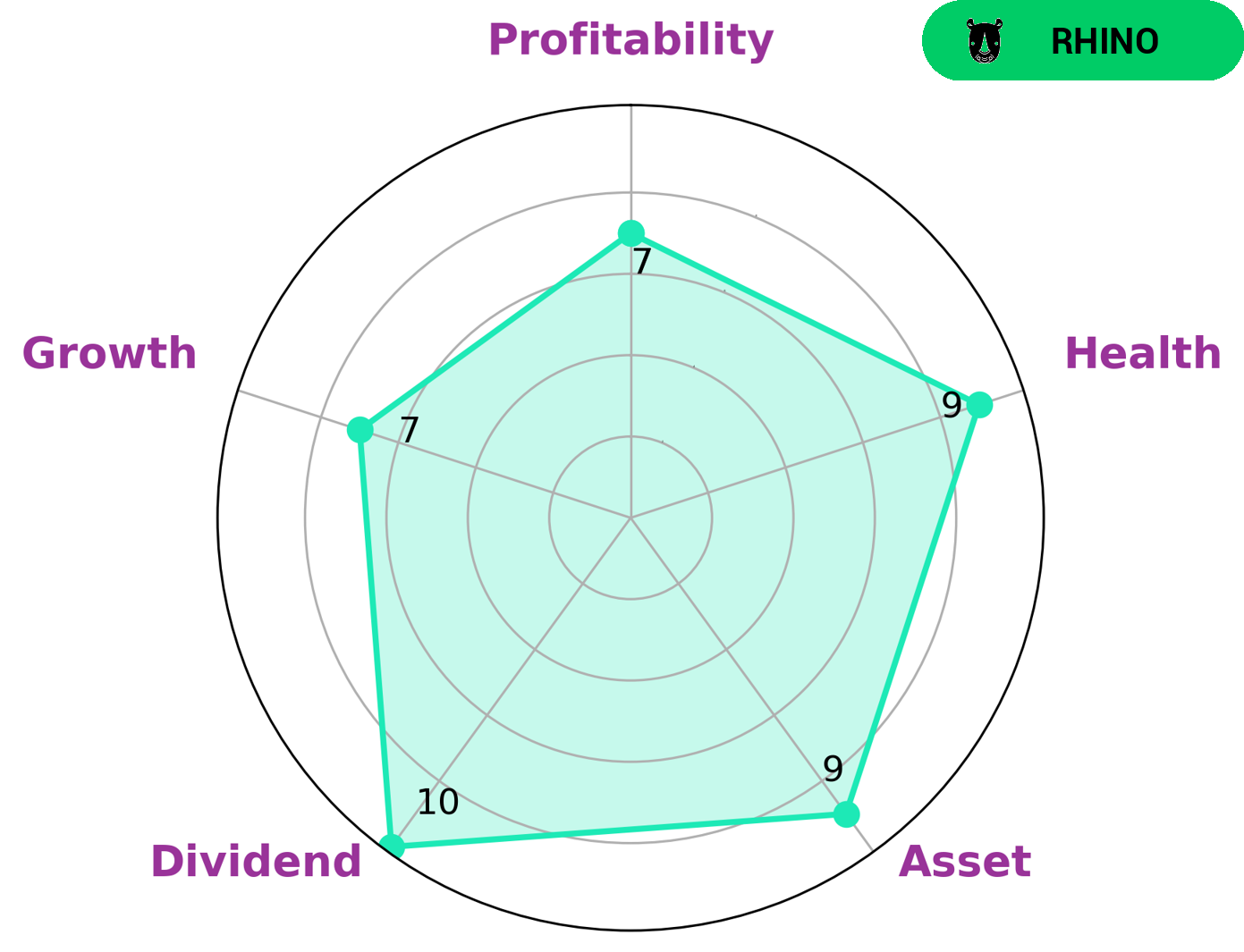

At GoodWhale, we conducted an analysis of CHINA MENGNIU DAIRY’s fundamentals. The results of our Star Chart showed that CHINA MENGNIU DAIRY has a high health score of 9/10 with regard to its cashflows and debt, indicating that the company is capable to pay off debt and fund future operations. Furthermore, CHINA MENGNIU DAIRY scored strongly in the areas of assets, dividend, growth, and profitability. Based on these results, we classified CHINA MENGNIU DAIRY as a ‘rhino’, which we consider to be a company that has achieved moderate revenue or earnings growth. Given its strong fundamentals and performance, we believe that investors looking for steady, consistent returns may be interested in CHINA MENGNIU DAIRY. They may find the company’s dividend yield and growth prospects attractive, as well as its ability to pay off debt and fund operations. Furthermore, those investors looking for a more defensive play may also find CHINA MENGNIU DAIRY appealing. More…

Peers

The Chinese dairy industry is currently in a state of flux, with Mengniu Dairy Co Ltd facing stiff competition from Bright Dairy & Food Co Ltd, Lanzhou Zhuangyuan Pasture Co Ltd, and Wens Foodstuff Group Co Ltd. All four companies are vying for a share of the Chinese market, which is estimated to be worth $61.4 billion. The competition is particularly fierce in the infant formula segment, where Mengniu Dairy Co Ltd holds a 26.9% share, followed by Bright Dairy & Food Co Ltd with 25.6%, Lanzhou Zhuangyuan Pasture Co Ltd with 20.5%, and Wens Foodstuff Group Co Ltd with 14.1%.

– Bright Dairy & Food Co Ltd ($SHSE:600597)

Bright Dairy & Food Co Ltd is a leading Chinese dairy producer with a market cap of 13.04B as of 2022. The company has a strong focus on quality, safety and innovation, which has resulted in a 7.45% return on equity. Bright Dairy & Food Co Ltd produces a wide range of dairy products including milk, cheese, yoghurt and ice cream. The company has a wide distribution network across China and also exports its products to over 50 countries.

– Lanzhou Zhuangyuan Pasture Co Ltd ($SEHK:01533)

Wens Foodstuff Group Co Ltd is a Chinese company that produces and sells packaged food products. The company has a market cap of 117.18B as of 2022 and a Return on Equity of -1.85%. Wens Foodstuff Group Co Ltd is a publicly traded company on the Shenzhen Stock Exchange.

Summary

China Mengniu Dairy has seen a five-year increase in shareholder value, with returns reaching their peak in 2023.

However, this has not been good news for late buyers, as the stock has dropped significantly since then. Media coverage of the company has been largely negative, yet its long-term performance speaks for itself. For those considering investing in Mengniu Dairy, there are several factors to consider, such as current financials, the company’s competitive edge and industry trends. The risk of the stock’s volatility must also be taken into account, as it has shown itself to be both volatile and unpredictable. Ultimately, a comprehensive evaluation of the company’s performance and prospects is recommended before taking the plunge.

Recent Posts