Lamb Weston Holdings Stock Soars in Bullish Market.

March 6, 2023

Trending News 🌥️

Lamb Weston ($NYSE:LW) Holdings Inc. recently experienced a surge in their stock value on a bullish trading day. The company saw its stock increase in value above the market, leading to a profitable day for investors. The favorable performance of Lamb Weston’s stocks is a testament to the company’s commitment to providing high-quality products to the marketplace. The rise in their stock price demonstrates the confidence that investors have in Lamb Weston to continue their success in the future. This also speaks to the trust they have in the company’s leadership, which has seen them achieve huge milestones through innovative strategies and sound investments.

The surge in Lamb Weston’s stock price is indicative of more positive performance to come. The company’s future success is certain to lead to even greater returns for both existing and potential investors. With their commitment to excellence, Lamb Weston Holdings Inc. is sure to remain an industry leader and an attractive investment opportunity.

Market Price

On Thursday, LAMB WESTON stock opened at $101.2 and closed at $102.3, up by 1.4% from previous closing price of 100.9. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lamb Weston. More…

| Total Revenues | Net Income | Net Margin |

| 4.51k | 473.6 | 10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lamb Weston. More…

| Operations | Investing | Financing |

| 498.6 | -473.9 | -240.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lamb Weston. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.57k | 4k | 3.98 |

Key Ratios Snapshot

Some of the financial key ratios for Lamb Weston are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.6% | -0.3% | 15.5% |

| FCF Margin | ROE | ROA |

| 2.7% | 80.6% | 9.6% |

Analysis

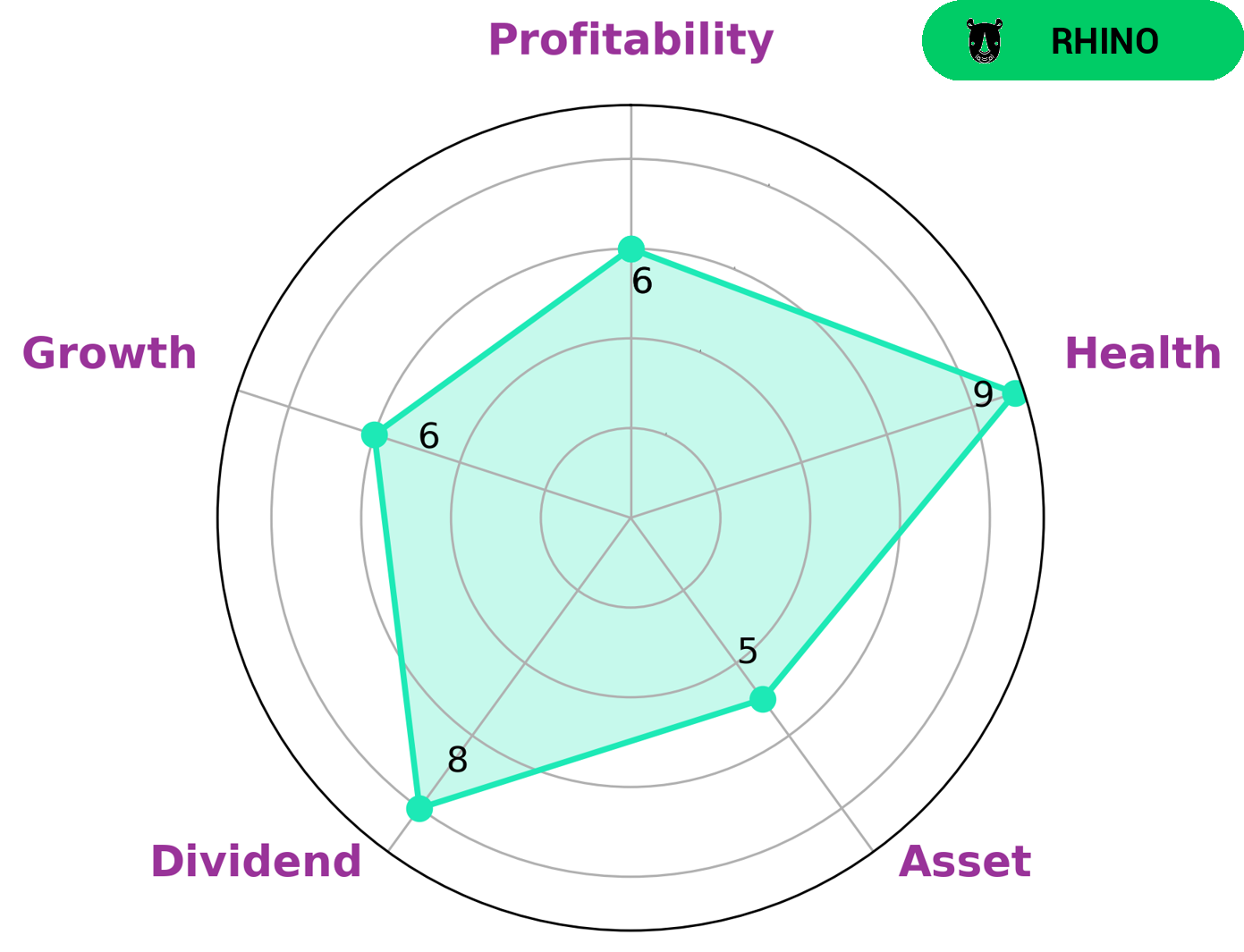

GoodWhale has conducted a detailed analysis of the fundamentals of LAMB WESTON. The Star Chart reveals that LAMB WESTON is strong in dividend and medium in asset, growth and profitability. Our health score of 9/10 has shown that the company is financially strong enough to sustain future operations even in times of crisis. Additionally, LAMB WESTON is classified as a “rhino”, a type of company that has achieved moderate revenue and earnings growth. Given the fundamental strength of LAMB WESTON combined with its moderate growth potential, investors who are looking for a safe and secure yet potentially profitable investment could be interested in this company. Moreover, investors who prefer slow and steady returns would find LAMB WESTON an attractive choice – as the company pays out strong dividends and its stock price is not too volatile. More…

Peers

Its main competitors are Tyson Foods Inc, Pilgrims Pride Corp, and Beyond Meat Inc. All three companies are large, publicly traded companies with a significant presence in the US food industry.

– Tyson Foods Inc ($NYSE:TSN)

Tyson Foods is an American multinational corporation based in Springdale, Arkansas, that operates in the food industry. The company was founded in 1935 by John W. Tyson and is currently one of the world’s largest processors and marketers of chicken, beef, and pork. Tyson Foods also produces a wide variety of prepared foods, and is a major exporter of poultry products.

Tyson Foods has a market capitalization of $24.45 billion as of 2022. The company’s return on equity is 18.58 percent. Tyson Foods is one of the world’s largest processors and marketers of chicken, beef, and pork. The company also produces a wide variety of prepared foods.

– Pilgrims Pride Corp ($NASDAQ:PPC)

Pilgrims Pride Corporation is an American poultry company based in Greeley, Colorado. Founded in 1947, it is the second-largest poultry company in the United States and the largest in Mexico. The company has more than 40,000 employees and operates over 50 facilities in the United States and Mexico.

– Beyond Meat Inc ($NASDAQ:BYND)

As of 2022, Beyond Meat Inc has a market cap of 975.39M and a ROE of 5821.1%. The company produces and sells plant-based meat products. The products are made from pea protein, rice protein, and mung bean protein. Beyond Meat’s products are sold in grocery stores, restaurants, and online. The company has a strong presence in the United States and Canada. Beyond Meat is a publicly traded company on the Nasdaq Stock Exchange.

Summary

Lamb Weston Holdings Inc. has recently enjoyed a surge in share prices, with its stock performing strongly in a bullish market. Analysts are optimistic about the company’s future prospects, with positive news coverage and investor sentiment about the company’s current position. Particularly noteworthy is Lamb Weston’s well-defined strategy to focus on long-term growth, solid financial performance and strong brand recognition. A key factor in this is the deployment of efficient capital allocation, cost management and other financial management practices.

Additionally, the company has made significant investments in innovation and forward-looking product initiatives to better target customers in its key markets. All in all, many analysts believe that Lamb Weston is well-positioned to take advantage of emerging trends and capitalize on opportunities over the coming years.

Recent Posts