Kraft Heinz Intrinsic Stock Value – Kraft Heinz Reports Strong Q4 Earnings with EPS of $0.68, Beating Expectations by $0.08 and Revenue of $6.49B, Surpassing Estimate by $100M

May 4, 2023

Trending News ☀️

Kraft Heinz ($NASDAQ:KHC), a global food and beverage company, recently reported strong fourth quarter earnings that beat Wall Street expectations. The company’s Non-GAAP earnings per share (EPS) came in at $0.68, which exceeded the estimated $0.60 by a margin of $0.08. Furthermore, its revenue amounted to $6.49B, surpassing the estimated $6.39B by approximately $100M. Kraft Heinz is a powerhouse in the food and beverages industry, with a portfolio of some of the world’s most recognized brands. From Oscar Mayer to Heinz Ketchup, Kraft Heinz has been providing consumers with iconic and delicious products for years.

Recently, the company has been focusing their efforts on increasing their presence in the digital space, investing in innovative technology to expand their reach and better serve customers around the world. The strong Q4 earnings reported by Kraft Heinz are a testament to the success of their digital transformation initiatives, as well as their ability to adapt to changing consumer preferences and demands. Looking ahead, Kraft Heinz is well positioned to continue to capitalize on trends in the industry and deliver value for its shareholders.

Earnings

In its FY2022 Q4 ending December 31st, KRAFT HEINZ earned $7.38B in total revenue and $0.89B in net income. This is a 10.0% increase in total revenue compared to the same period last year, and a 442.3% decrease in net income. It is also worth noting that KRAFT HEINZ’s total revenue has grown from $6.94B to $7.38B over the last three years.

These impressive results demonstrate the progress KRAFT HEINZ has made in recent quarters, further reinforcing its position as one of the leading companies in packaged foods and beverages. Moving forward, KRAFT HEINZ will continue to focus on innovation and efficiency in order to deliver solid returns to its shareholders.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kraft Heinz. More…

| Total Revenues | Net Income | Net Margin |

| 26.48k | 2.36k | 11.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kraft Heinz. More…

| Operations | Investing | Financing |

| 2.47k | -1.09k | -3.71k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kraft Heinz. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 90.51k | 41.64k | 39.74 |

Key Ratios Snapshot

Some of the financial key ratios for Kraft Heinz are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | -2.9% | 14.7% |

| FCF Margin | ROE | ROA |

| 5.9% | 5.0% | 2.7% |

Price History

Revenue also came in higher than expected at $6.49B, surpassing the estimated figure by $100M. Upon the announcement of the results, the company’s stock opened at $40.8 and closed the day at $40.2, up 2.0% from its previous closing price of $39.4. These strong numbers demonstrate KRAFT HEINZ‘s ability to navigate the challenging market conditions and continue to deliver strong performance for its shareholders. Live Quote…

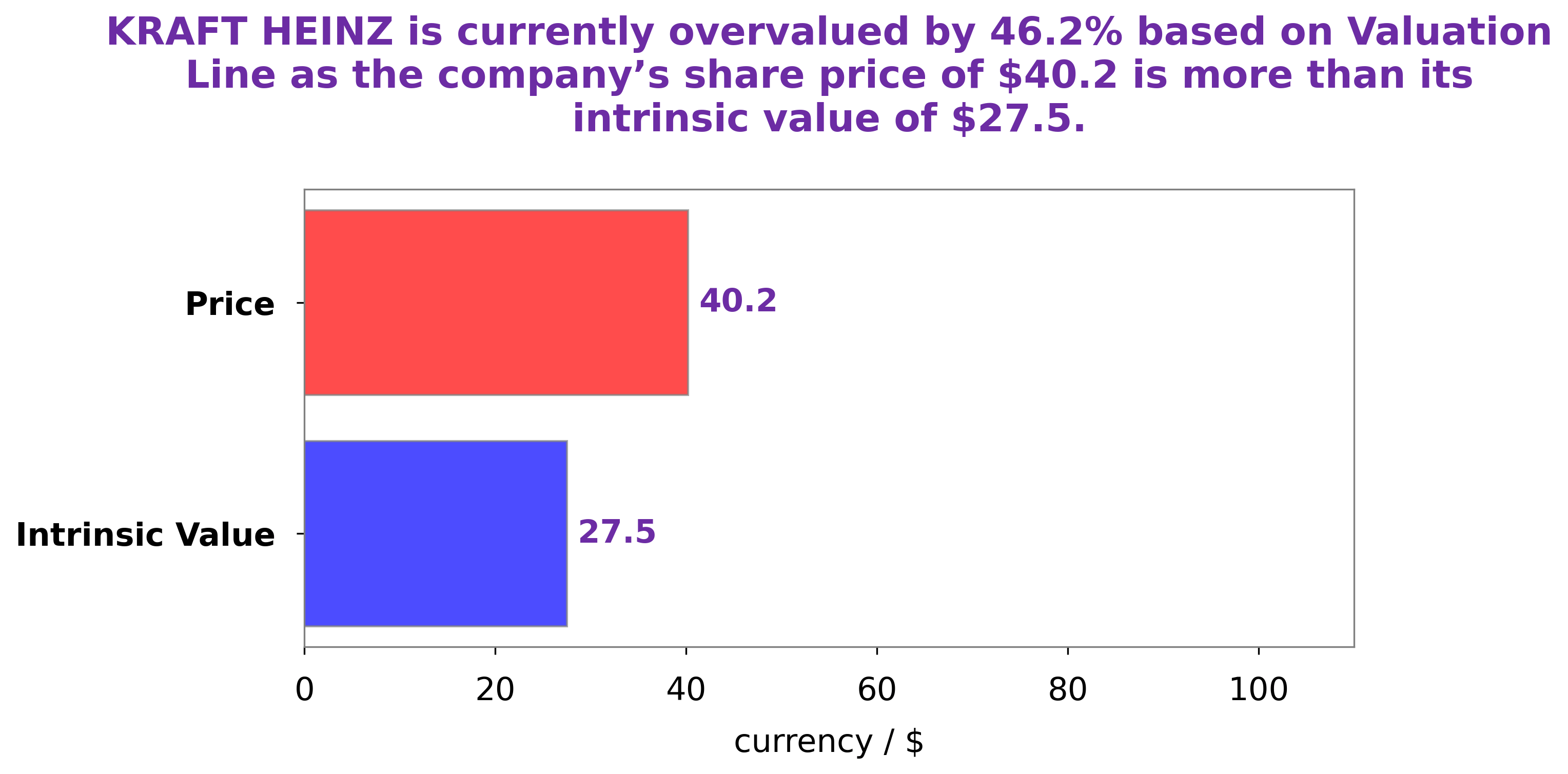

Analysis – Kraft Heinz Intrinsic Stock Value

At GoodWhale, we analyze the financials of KRAFT HEINZ to make sure investors have the right information to assess their stock. According to our proprietary Valuation Line, KRAFT HEINZ share is worth $27.5. This intrinsic value indicates that the stock is currently overvalued by 46.4%, as it is currently trading at $40.2 per share. With this in mind, investors should be cautious when it comes to investing in KRAFT HEINZ at its current price. More…

Peers

The Kraft Heinz Co. is a food and beverage company that offers a variety of products. Its competitors include Kellogg Co, General Mills Inc, and Treehouse Foods Inc.

– Kellogg Co ($NYSE:K)

Kellogg Co is a food manufacturing company that produces cereal, snacks, and other food products. The company has a market cap of $25.03 billion and a return on equity of 33.71%. Kellogg’s products are sold in more than 180 countries and include brands such as Kellogg’s, Keebler, Pop-Tarts, and Eggo. The company has more than 30,000 employees worldwide.

– General Mills Inc ($NYSE:GIS)

General Mills Inc is a food company that produces and markets branded consumer foods in the United States and internationally. The company’s products include cereals, yogurt, snacks, and baking mixes. General Mills Inc has a market cap of 46.37B as of 2022 and a return on equity of 20.18%. The company’s products are marketed under the brands including Cheerios, Lucky Charms, Nature Valley, and Betty Crocker.

– Treehouse Foods Inc ($NYSE:THS)

Treehouse Foods Inc is a food manufacturing company with a market cap of $2.7 billion as of 2022. The company has a return on equity of 0.58%. Treehouse Foods Inc manufactures and sells packaged foods and beverages in the United States. The company offers canned soups, salad dressings, peanut butter, syrups, and other food products. It also provides infant formula and baby food products; and pet food and pet snacks.

Summary

The company posted Non-GAAP earnings per share of $0.68, which beat the analyst consensus by $0.08. Revenue of $6.49 billion also beat the forecast by $100 million. Investors should pay close attention to the financial performance of the company for further indications of its future success.

Recent Posts