Kellogg Company stock dividend – Kellogg’s Upcoming Spin-Off and Increased Dividend Make It More Appealing Than General Mills

May 25, 2023

Trending News ☀️

The company’s stock has become increasingly appealing to investors in recent months due to its higher dividend and upcoming spin-off. With the spin-off and increased dividend, Kellogg ($NYSE:K) shares have become more attractive than those of its competitor, General Mills. Kellogg recently announced that it would be spinning off its Morning Foods business as a standalone company by the end of 2021. This spin-off is expected to unlock significant value for investors and create significant potential for both companies to grow and succeed.

Additionally, Kellogg’s dividend has been increased for the past four consecutive quarters and is now a much more attractive option compared to General Mills’ current dividend policy. As the company continues to develop, its stock will continue to become increasingly appealing to investors. With a strong track record of success and strong financial performance, Kellogg is an ideal choice for investors looking for a dependable and rewarding stock.

Dividends – Kellogg Company stock dividend

For the years 2021 to 2023, they have projected a dividend yield of 3.29%, 3.28%, and 3.79% respectively, with an average dividend yiled of 3.45%. If you are interested in dividend stocks, then Kellogg Company should be added to your list of consideration.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kellogg Company. More…

| Total Revenues | Net Income | Net Margin |

| 15.7k | 836 | 5.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kellogg Company. More…

| Operations | Investing | Financing |

| 1.6k | -541 | -943 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kellogg Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.63k | 14.15k | 11.82 |

Key Ratios Snapshot

Some of the financial key ratios for Kellogg Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.2% | 1.7% | 8.2% |

| FCF Margin | ROE | ROA |

| 6.7% | 20.2% | 4.3% |

Market Price

Kellogg Company has recently announced that it will be spinning off its North American business and increasing its dividend, making it a more appealing investment option compared to General Mills. On Wednesday, Kellogg Company’s stock opened at $68.7 and closed at $68.5, indicating investor confidence in the company’s new strategy. This move will allow the company to focus on faster-growing markets in Asia, Latin America, and other emerging markets. The increased dividend rate is intended to reward shareholders for their loyalty and confidence in the company.

Kellogg Company’s strategic moves make it an attractive investment option compared to General Mills, which has been struggling to keep up with changing consumer trends and has not been able to successfully adapt to emerging markets. With its renewed focus on faster-growing markets and an increased dividend, Kellogg Company makes a more appealing investment opportunity than General Mills. Live Quote…

Analysis – Kellogg Company Stock Fair Value Calculation

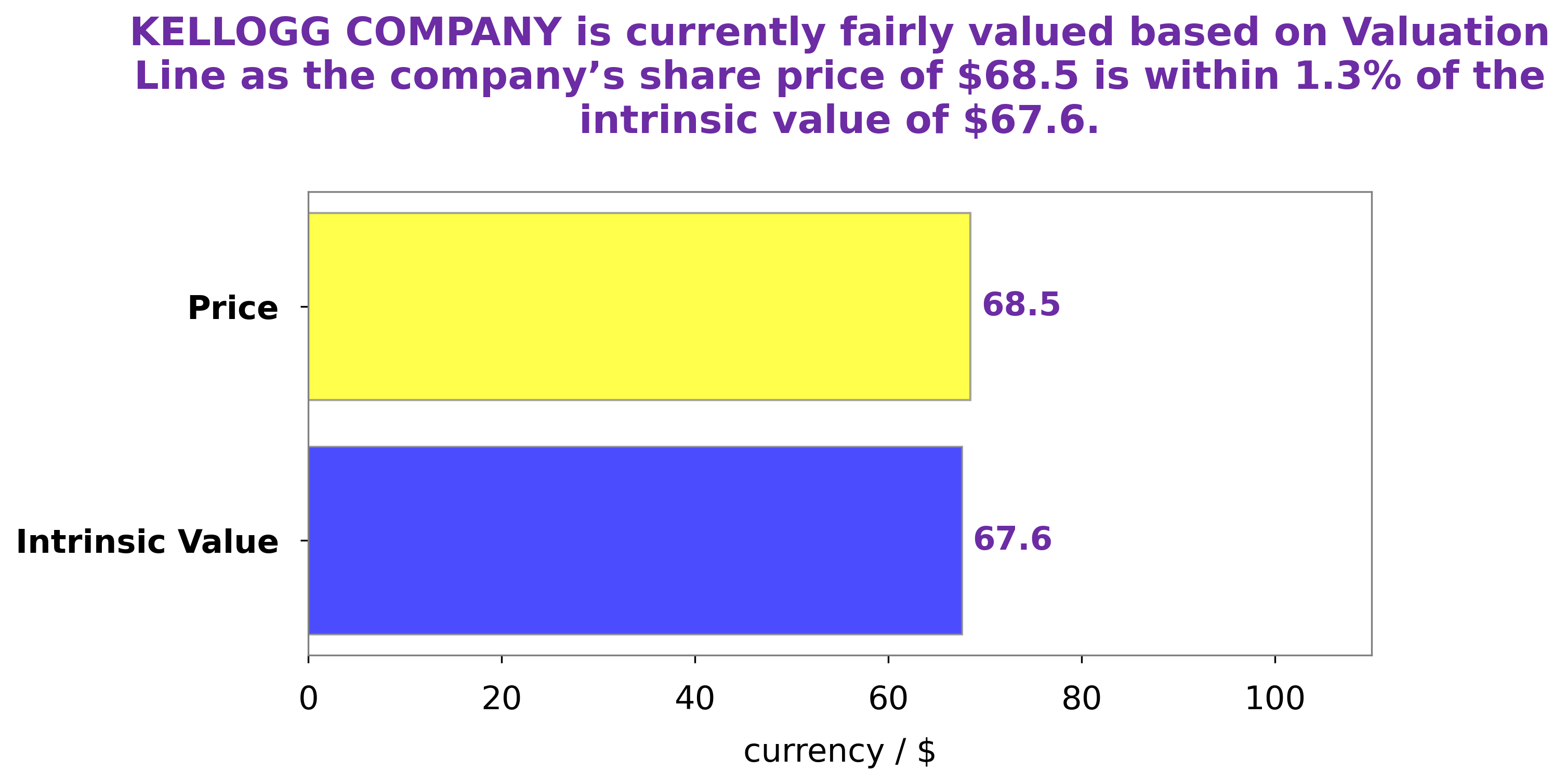

At GoodWhale, we conducted research on the fundamentals of KELLOGG COMPANY, and our proprietary Valuation Line has determined the fair value of a KELLOGG COMPANY share to be around $67.6. Currently, the market is trading KELLOGG COMPANY stock at $68.5, which is a fair price that is overvalued by 1.4%. This means that the opportunity to buy KELLOGG COMPANY shares at a discount is limited, though short-term investments may still be worthwhile if the stock trends upward. More…

Peers

Kellogg Co is in competition with Nestle SA, McCormick & Co Inc, and Procter & Gamble Co. All four companies are large, international corporations that manufacture and sell food products. Kellogg Co’s primary product is cereal, but it also manufactures snacks and frozen foods. Nestle SA is a Swiss company that is the largest food company in the world. It manufactures a wide variety of food products, including baby food, bottled water, cereals, coffee, and confectioneries. McCormick & Co Inc is an American company that manufactures spices, herbs, and seasonings. Procter & Gamble Co is an American company that manufactures a wide variety of consumer goods, including food, beverages, cleaning products, and personal care products.

– Nestle SA ($OTCPK:NSRGY)

Nestle SA is a food and beverage company with a market capitalization of 288.43 billion as of 2022. The company has a return on equity of 14.82%. Nestle SA is a food and beverage company that manufactures and markets a variety of food and beverage products, including baby food, bottled water, cereals, coffee, dairy products, and pet food. The company has operations in over 190 countries and employs over 339,000 people.

– McCormick & Co Inc ($NYSE:MKC)

McCormick & Co Inc is a US-based company that manufactures, markets, and distributes spices, seasoning mixes, condiments, and other flavoring products. It has a market cap of 19.85B as of 2022 and a return on equity of 13.21%. The company operates through three segments: Consumer, Industrial, and Other.

– Procter & Gamble Co ($NYSE:PG)

Procter & Gamble Co is a consumer goods company with a market cap of $304.7B as of 2022. The company has a return on equity of 25.38%. Procter & Gamble Co manufactures and markets a variety of consumer goods, including beauty, grooming, health care, fabric care and home care products. The company operates in over 180 countries and has over 125,000 employees. Procter & Gamble Co is one of the largest consumer goods companies in the world.

Summary

Kellogg Company has become increasingly attractive to investors due to its higher dividend yield and upcoming spin-off. The spin-off of the company’s frozen foods business, which is expected to take place in spring 2021, is expected to generate value for shareholders by creating two focused, independent businesses. Investors are advised to take advantage of Kellogg’s current attractive valuation and consider investing in its stock or bonds before the spin-off takes place. This could help them realize a high return on investment in the future.

Recent Posts