Investors in USANA Health Sciences Suffer 47% Loss Over Five Years

June 3, 2023

🌧️Trending News

USANA ($NYSE:USNA) Health Sciences, Inc. is a global nutritional and personal care company which provides products that are designed to support a healthy lifestyle. Unfortunately, over the past five years investors of USANA Health Sciences have suffered a significant financial loss. This decrease in stock price has had a negative impact on investors and caused them to lose a significant amount of money. This sharp decline is largely attributed to lower than expected earnings, weak sales of its products and negative sentiment from the market. Moreover, the company has been facing increasing competition from other nutritional supplement manufacturers.

Additionally, USANA Health Sciences has had to face several lawsuits in recent years which have also caused the stock price to drop. This heartbreaking financial loss is due to a number of factors such as decreased earnings, weak sales, increased competition and lawsuits.

Analysis

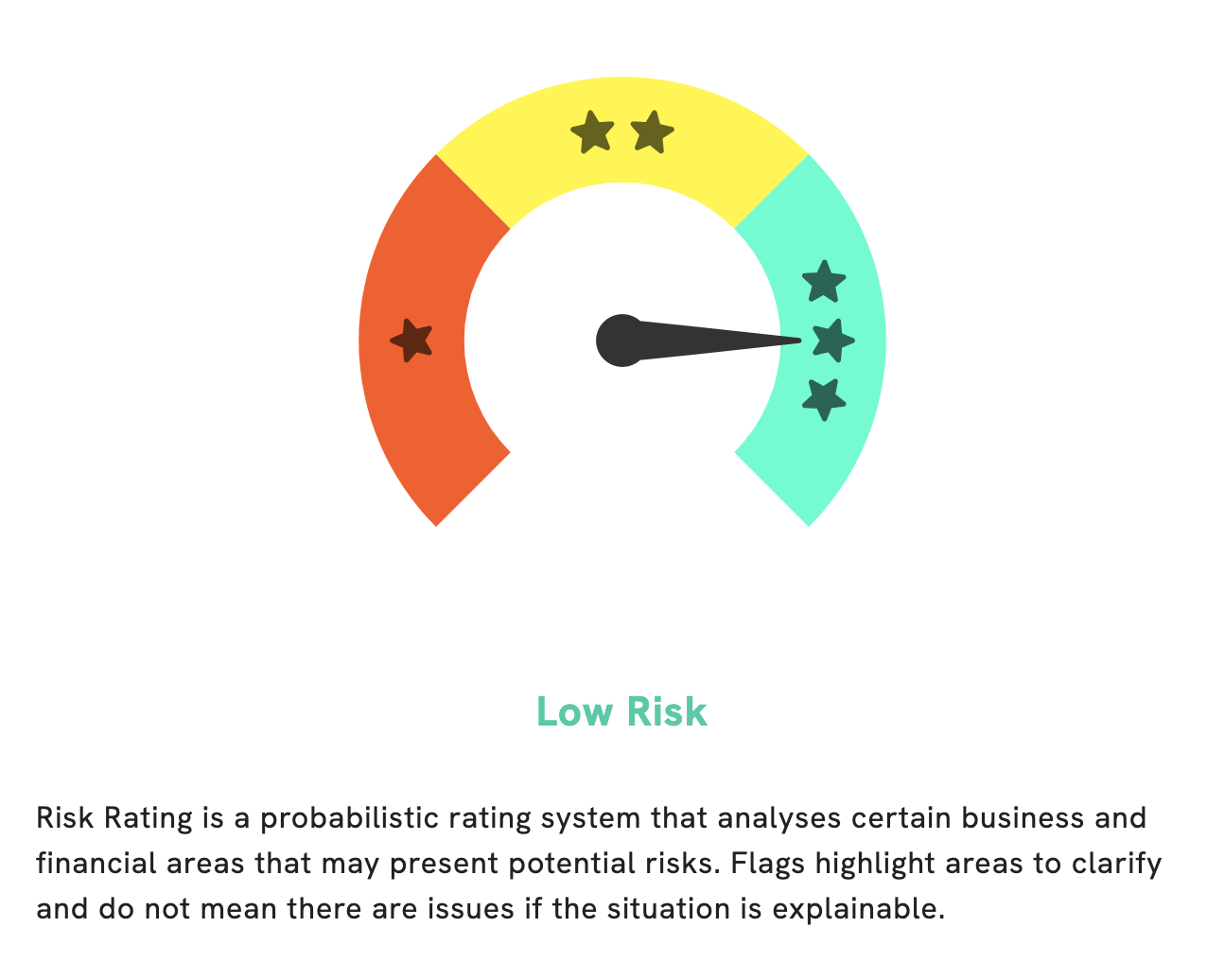

At GoodWhale, we recently analyzed USANA HEALTH SCIENCES’s financials and found that the company is a low risk investment in terms of financial and business aspects. GoodWhale’s Risk Rating indicates that USANA HEALTH SCIENCES is economically stable and has a good history of profitability. However, our analysis also revealed one risk warning in the company’s balance sheet. Interested investors can register on goodwhale.com to get more insight into what this warning entails and whether it is something to be concerned about. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for USNA. More…

| Total Revenues | Net Income | Net Margin |

| 974.09 | 65.26 | 6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for USNA. More…

| Operations | Investing | Financing |

| 97.03 | -13.96 | -13.69 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for USNA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 605.53 | 150.18 | 23.6 |

Key Ratios Snapshot

Some of the financial key ratios for USNA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.6% | -12.3% | 10.7% |

| FCF Margin | ROE | ROA |

| 8.9% | 14.6% | 10.7% |

Peers

Founded in 1992, Usana has a long history of providing high quality supplements to its customers.

However, it faces stiff competition from other well-established companies such as Natures Sunshine Products Inc, Naturhouse Health SA, and Empowered Products Inc. These companies all offer similar products and services, but each has its own unique selling points. Ultimately, it is up to the consumer to decide which company offers the best value for their needs.

– Natures Sunshine Products Inc ($NASDAQ:NATR)

Nature’s Sunshine Products Inc is a leading manufacturer and direct seller of nutritional and personal care products. The company has a market cap of 163.6M as of 2022 and a return on equity of 12.0%. Nature’s Sunshine Products Inc manufactures and sells a wide range of products including vitamins, minerals, herbs, and other supplements. The company also offers a variety of personal care products such as skin care, hair care, and cosmetics. Nature’s Sunshine Products Inc is committed to providing quality products and services to its customers.

– Naturhouse Health SA ($LTS:0R9G)

Naturhouse Health SA is a company that provides health and nutrition services. It has a market cap of 95.32M as of 2022 and a return on equity of 29.55%. The company has a network of over 1,700 stores in Europe, Latin America, and China. It offers a range of products and services including weight loss, weight management, and nutrition counseling.

– Empowered Products Inc ($OTCPK:EMPO)

Empowered Products Inc is a publicly traded company that manufactures and sells sexual wellness products. The company has a market capitalization of $941.83 million and a return on equity of -23.8%. Empowered Products Inc’s products are sold online and through retail stores in the United States and internationally. The company’s products include vibrators, lubricants, and other sexual wellness products. Empowered Products Inc is headquartered in Austin, Texas.

Summary

Investing in USANA Health Sciences has been a challenging proposition in recent years. The stock has suffered a significant 47% decline over the past five years, as the company has struggled to keep up with changing consumer preferences and health trends. As a result, USANA Health Sciences has seen its market share shrink and its profits dwindle. While the company remains committed to providing quality health products, investors may want to conduct a thorough analysis before committing to an investment in USANA Health Sciences.

Recent Posts