Hormel Foods Reports GAAP EPS Beat of $0.01, Revenue Miss of $60M

June 2, 2023

🌧️Trending News

The company beat expectations on its GAAP earnings per share (EPS), with a reported result of $0.40, exceeding estimates by $0.01. However, revenue fell short of expectations at $3B, with a miss of $60M. Hormel Foods ($NYSE:HRL) Corporation is a leading producer of shelf-stable, refrigerated, fresh meat, and frozen food products for retail and institutional customers.

Earnings

HORMEL FOODS reported its Q1 earnings results of FY2023 on January 31 2023, showing a miss on revenue of $60M. These figures marked a 2.4% decrease in total revenue and a 9.1% decrease in net income when compared to the same quarter of the previous year.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hormel Foods. More…

| Total Revenues | Net Income | Net Margin |

| 12.39k | 978.13 | 7.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hormel Foods. More…

| Operations | Investing | Financing |

| 954.85 | -659.83 | -504.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hormel Foods. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 13.28k | 5.66k | 13.93 |

Key Ratios Snapshot

Some of the financial key ratios for Hormel Foods are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 3.2% | 10.6% |

| FCF Margin | ROE | ROA |

| 5.6% | 10.9% | 6.2% |

Stock Price

Despite this, the stock opened at $40.2 and closed at the same price, registering a 5.1% rise from the previous closing price of $38.2. This move up in stock price indicates that investors are satisfied with the performance despite the revenue miss. Live Quote…

Analysis

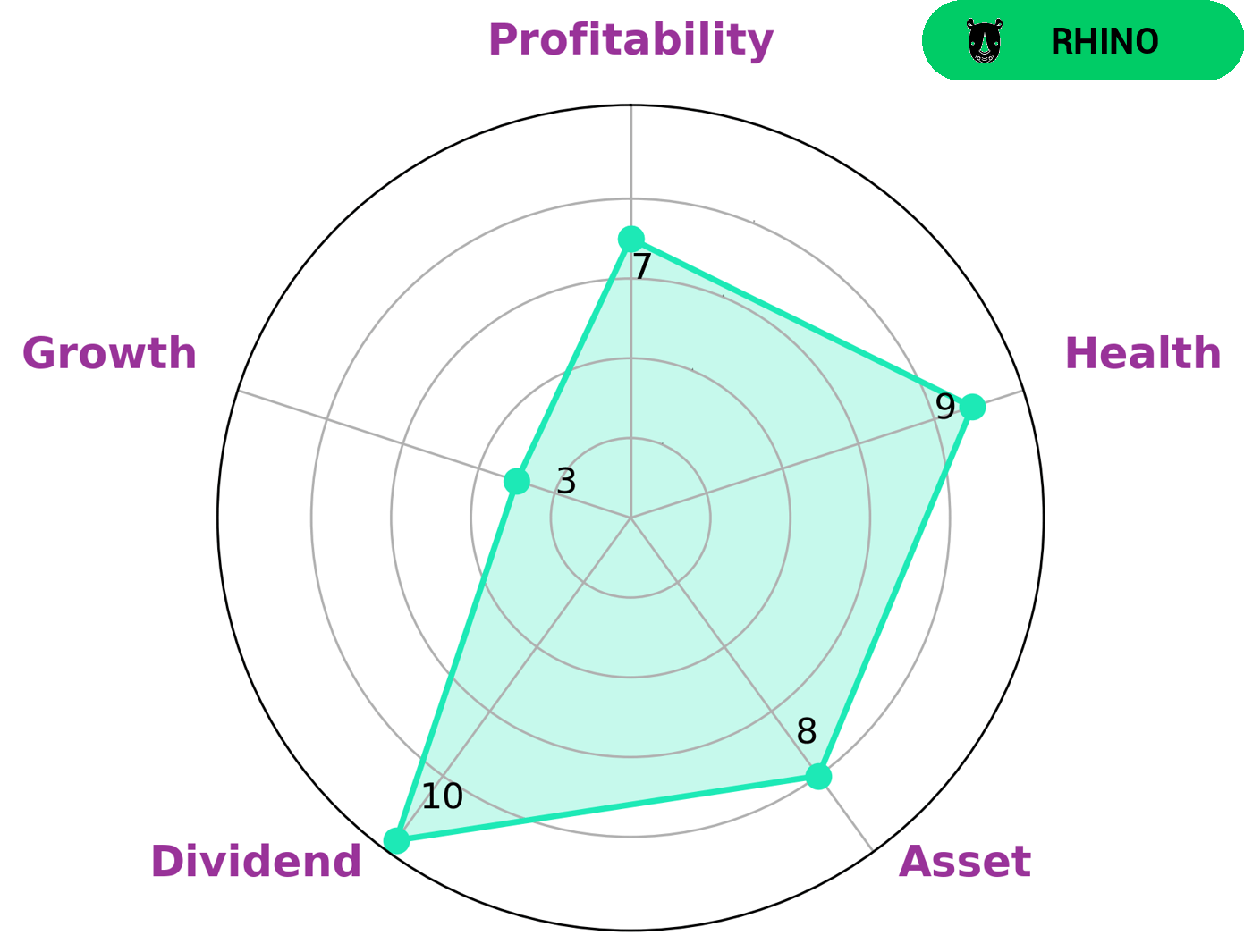

GoodWhale conducted an analysis of HORMEL FOODS‘s wellbeing and based on our Star Chart, the company is strong in areas such as assets, dividends, and profitability. However, it was determined to be weak in terms of growth. Additionally, we have given HORMEL FOODS a health score of 9/10 which considers its cashflows and debt, and determines that the company is capable of sustaining future operations in times of crisis. Based on this analysis, we have classified HORMEL FOODS as a ‘rhino’ which is a type of company that has achieved moderate revenue or earnings growth. Therefore, investors who are looking for steady but not extremely fast-paced returns may be interested in such a company. More…

Peers

In the food industry, Hormel Foods Corp competes with JM Smucker Co, Fleury Michon, and Bell Food Group Ltd. These companies all produce similar products, so the competition is fierce. Hormel Foods Corp has an advantage because it is a well-established company with a strong brand.

– JM Smucker Co ($NYSE:SJM)

The J. M. Smucker Company has a market capitalization of $15.24 billion as of March 2022 and a return on equity of 7.19%. The company manufactures and markets branded food and beverage products in North America and internationally. Its products include coffee, peanut butter, shortening and oils, ice cream toppings, fruit spreads, syrups, and frozen desserts. The company was founded in 1879 and is headquartered in Orrville, Ohio.

– Fleury Michon ($LTS:0J75)

Fleury Michon is a French company that specializes in the production of prepared foods. The company has a market cap of 79.9 million as of 2022 and a return on equity of 1.6%. Fleury Michon is a publicly traded company listed on the Euronext Paris stock exchange. The company was founded in 1887 and is headquartered in Vire, France.

– Bell Food Group Ltd ($LTS:0RFX)

BFG Ltd’s market cap is 1.43B as of 2022 and has a ROE of 7.15%. The company is a food group that manufactures and supplies food products. It offers a range of products including meat, poultry, fish, vegetables, and desserts. The company has a strong presence in the UK and Ireland, with a network of over 30 manufacturing sites and a workforce of around 23,000 people.

Summary

Hormel Foods Corporation, a leading producer of a variety of food products, recently reported its financial results for the quarter. The company’s GAAP earnings per share (EPS) of $0.40 beat analysts’ estimates by $0.01, while revenue of $3 billion missed analysts’ expectations by $60 million. Despite the miss in revenue, investors responded positively to the earnings beat, pushing the stock price higher on the day of the announcement.

Looking forward, analysts expect Hormel Foods to continue to benefit from its diverse product portfolio and strong brand recognition in the marketplace, which should enable the company to deliver steady growth. With its valuation relatively attractive and positive momentum in the stock, Hormel Foods may be an attractive investment opportunity for investors looking for exposure to the consumer staples sector.

Recent Posts