Allspring Global Investments Holdings LLC Divests 5467 Shares of Ingredion Incorporated.

January 28, 2023

Trending News ☀️

Allspring Global Investments Holdings LLC recently divested 5467 of its shares in Ingredion Incorporated ($NYSE:INGR). Ingredion Incorporated is a global leader in providing ingredients, ingredients systems, and integrated solutions to the food, beverage, paper, and other industries. Ingredion Incorporated operates in four business segments: Corn-Based Products, Rice-Based Products, Starch-Based Products, and Texturizing Solutions. The company is committed to providing customers with innovative products and solutions that meet their needs. Ingredion Incorporated is known for its strong customer relationships and its commitment to quality and safety.

Ingredion Incorporated’s stock is publicly traded on the New York Stock Exchange under the ticker symbol INGR. Ingredion Incorporated has a long history of delivering consistent returns to its shareholders. With its strong track record of delivering value to shareholders and its commitment to providing innovative products and solutions to customers, Ingredion Incorporated is well-positioned for continued success in the future.

Stock Price

The news sentiment is mostly positive so far, with the stock opening at $101.2 and closing at $101.2 on Monday. This is a 0.9% dip from the last closing price of $102.2. The divestment is likely to have an impact on Ingredion Incorporated‘s stock in the near future. The company operates in North America, Latin America, Europe, the Middle East and Africa, making it one of the largest food and beverage ingredient companies in the world.

The company produces a variety of products including starches, nutrition ingredients, and specialty ingredients. This could potentially have an impact on the stock price in the near future. It is important for investors to keep an eye on the news and any other developments related to Ingredion Incorporated to make sure that their investments remain secure. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ingredion Incorporated. More…

| Total Revenues | Net Income | Net Margin |

| 7.71k | 445 | 6.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ingredion Incorporated. More…

| Operations | Investing | Financing |

| 213 | -299 | -15 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ingredion Incorporated. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.4k | 4.22k | 47.43 |

Key Ratios Snapshot

Some of the financial key ratios for Ingredion Incorporated are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.6% | 0.5% | 9.1% |

| FCF Margin | ROE | ROA |

| -1.1% | 14.0% | 5.9% |

VI Analysis

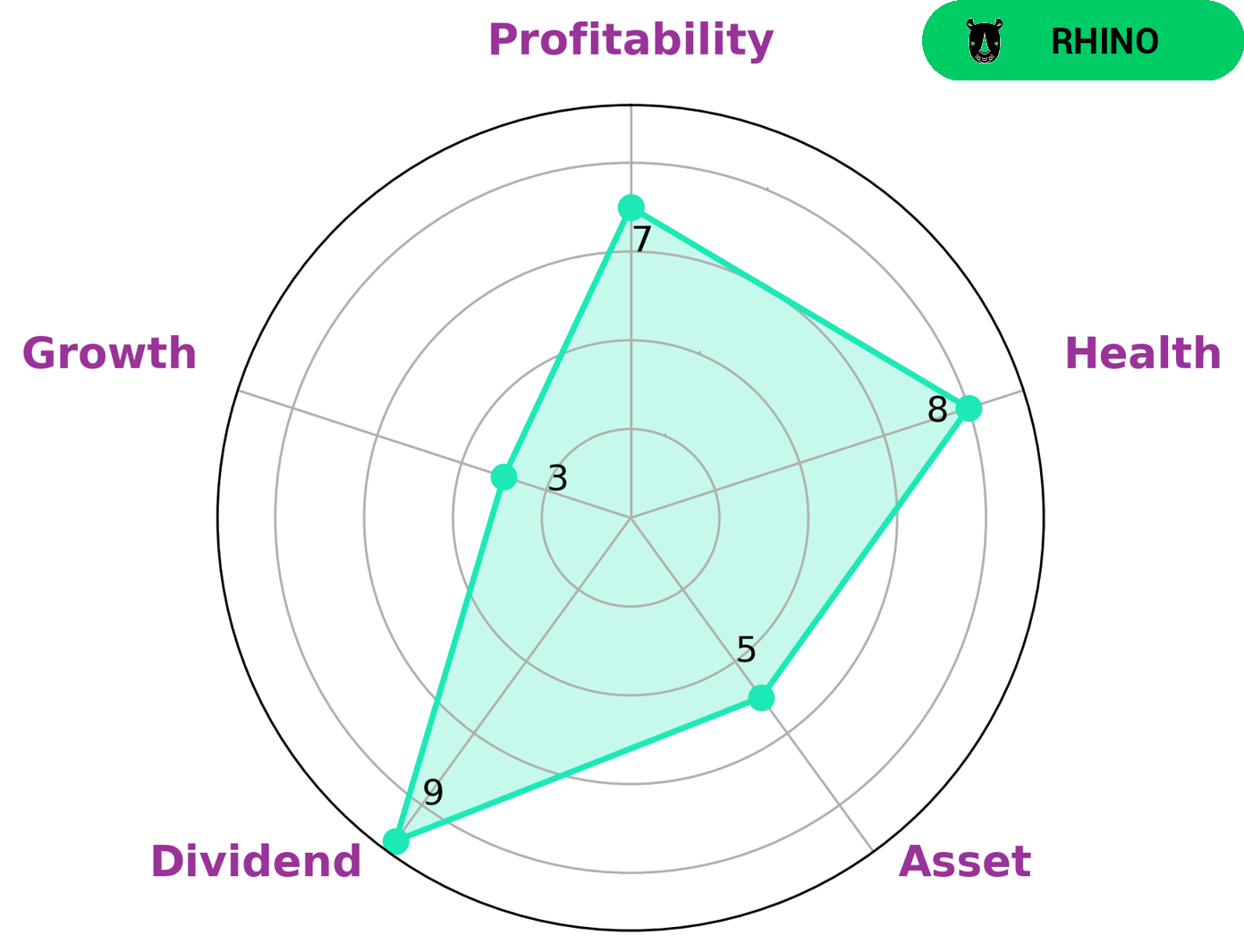

INGREDION INCORPORATED is an attractive investment option for those looking for long-term potential. The VI app makes it easy to analyze INGREDION INCORPORATED’s fundamentals with its Star Chart, which provides a quick and reliable assessment of the company’s health score. With an 8/10 rating, INGREDION INCORPORATED is well-positioned to pay off debt and fund future operations. Further analysis shows that INGREDION INCORPORATED is strong in dividend, profitability and medium in asset, but weak in growth. These factors have led INGREDION INCORPORATED to be classified as a ‘rhino’, indicating it has achieved moderate revenue or earnings growth. The company’s impressive fundamentals make it an ideal choice for investors looking for a reliable long-term return on their investment. Investors looking for steady returns with limited risk would benefit from investing in INGREDION INCORPORATED as it has a proven track record of paying dividends, strong profitability and moderate growth. Additionally, investors seeking capital appreciation over the long-term may find the company’s stock attractive due to its ability to generate steady returns and low volatility. More…

VI Peers

The competition between Ingredion Inc and its competitors, Procter & Gamble Co, Nestle SA, and Edita Food Industries S.A.E., is fierce as each company strives to be the leader in the global food and beverage industry. From product innovation and marketing to pricing and distribution, each company is looking for the edge that will give them the upper hand in the competitive landscape.

– Procter & Gamble Co ($NYSE:PG)

Procter & Gamble Co is a multinational consumer goods giant, headquartered in Cincinnati, Ohio. The company manufactures a wide range of household products, from laundry detergents to toothpaste. As of 2022, the company has a market capitalization of 362.18B and a Return on Equity of 25.38%. The company’s size and profitability are demonstrative of its success in the consumer goods industry. With a large market cap and high return on equity, Procter & Gamble Co has established itself as an industry leader.

– Nestle SA ($LTS:0QR4)

Nestle SA is one of the world’s largest food and beverage companies, serving consumers in over 190 countries. Its market cap of 305.36B as of 2022 is a testament to its success and industry leadership. The company’s return on equity (ROE) of 14.82% is also impressive, indicating that the company is efficiently utilizing the capital it has available to generate profit and create value for its shareholders. This impressive market cap and ROE are indicative of the strength of Nestle SA’s business model and its ability to remain competitive in an ever-changing industry.

– Edita Food Industries S.A.E ($LSE:66XD)

Edita Food Industries S.A.E. is a leading food manufacturing and distribution company based in Egypt. The company has a market capitalization of 371.8 million as of 2022 and has achieved a return on equity of 33.89%. This indicates that the company is financially healthy and is able to generate returns on its investments. Edita produces and markets a wide range of baked goods, snacks and confectionery products, including cakes, pastries, rusks and biscuits, in addition to providing products for specialty markets. It also provides ready-made meals, frozen fruits and vegetables, and frozen ready-meals for catering services. The company is well-positioned to benefit from the growing demand for convenience food products in Egypt and across the region.

Summary

Ingredion Incorporated is a leading global provider of ingredients and solutions to the food, beverage, brewing, and industrial markets. Allspring Global Investments Holdings LLC recently divested 5467 shares of Ingredion Incorporated. Analysts have been upbeat on Ingredion Incorporated’s outlook, noting its strong competitive position and promising growth opportunities. The company has a strong balance sheet with low debt, a strong cash flow, and a solid dividend yield.

Its portfolio of products and services is highly diversified, providing a competitive edge in the industry. Overall, Ingredion Incorporated remains a solid investment option for those looking for reliable returns.

Recent Posts