a2 Milk Company Short Interest Decreases 11.3% in May

May 31, 2023

☀️Trending News

A2 ($ASX:A2M): The a2 Milk Company Limited has seen a decline in short interest during the month of May, with short interest decreasing by 11.3% according to Defense World. The a2 Milk Company is an Australian dairy company that is known for its high quality milk products. It is a global beverage and nutritional products business that is based on proprietary milk science. They specialize in fresh milk, cheese, yogurt, and other dairy products which have been scientifically tested to be higher in nutrition and easier to digest. The company’s stock is listed on the ASX and they also have a strong presence in the U.S. and U.K. markets.

The decrease in short interest may be attributed to investors recognizing the potential of the company’s dairy products and the demand for them in multiple markets. The company’s stock has seen an increase in value over the past few months as well, likely helped by the increased demand for their products. It appears that investors are starting to recognize the strength of the company’s business model and the quality of their products, resulting in the decrease of short interest in them.

Analysis

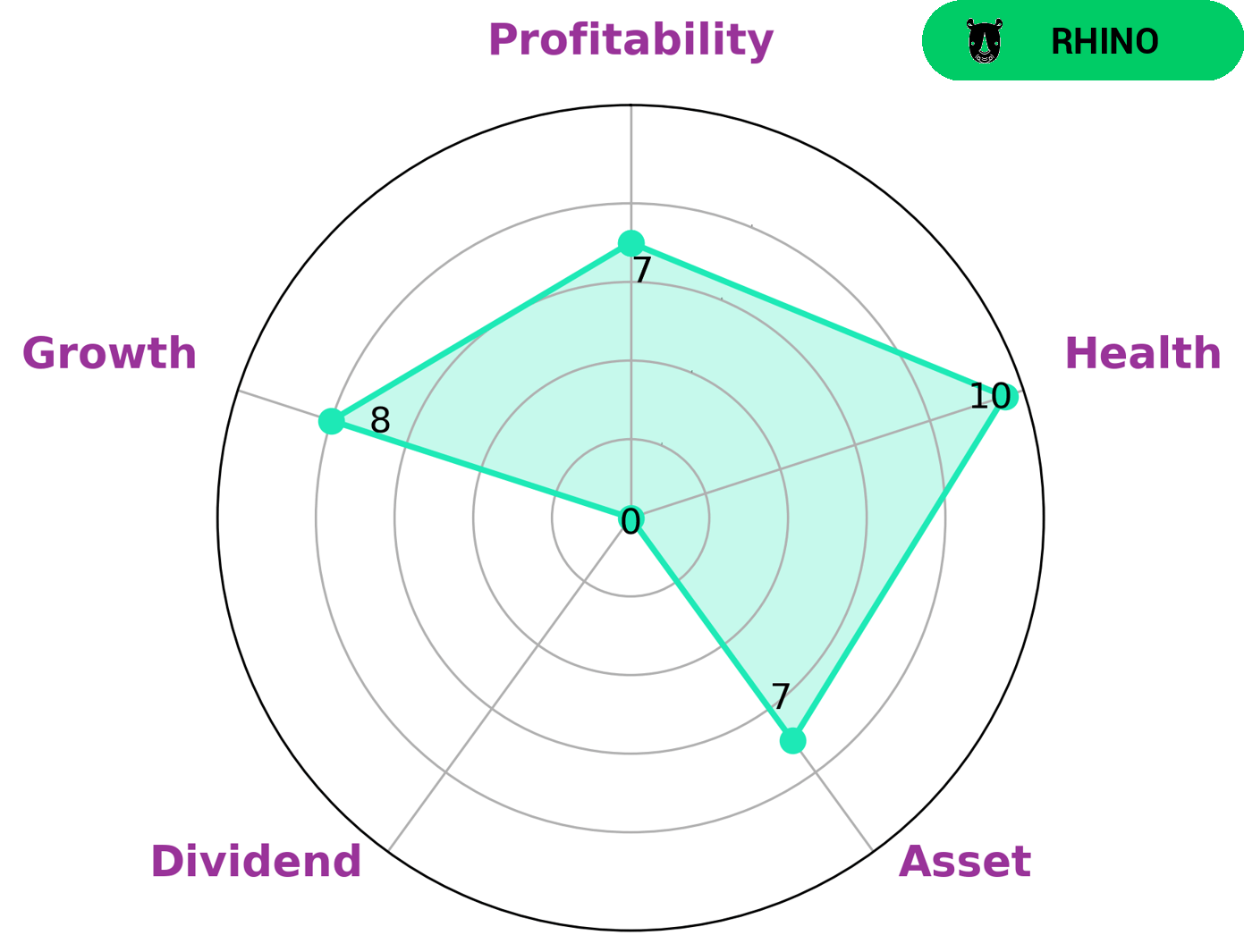

At GoodWhale, we analyze A2 MILK’s financials using our powerful analytics platform. According to our Star Chart, A2 MILK is classified as a ‘rhino’, which indicates that the company has achieved moderate revenue growth or earnings growth. Investors looking to capitalize on this moderate growth may be interested in investing in A2 MILK. GoodWhale also found that A2 MILK has a high health score of 10/10 with regard to its cashflows and debt, meaning that it is capable of sustaining its future operations even in times of crisis. A2 MILK is also strong in asset, growth, and profitability, but unfortunately weak in dividend. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for A2 Milk. More…

| Total Revenues | Net Income | Net Margin |

| 1.57k | 136.77 | 8.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for A2 Milk. More…

| Operations | Investing | Financing |

| 102.2 | -361.29 | -68.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for A2 Milk. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.7k | 494.39 | 1.64 |

Key Ratios Snapshot

Some of the financial key ratios for A2 Milk are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.5% | -28.9% | 13.0% |

| FCF Margin | ROE | ROA |

| 5.9% | 10.7% | 7.5% |

Peers

The a2 Milk Co Ltd is one of the leading companies in the dairy industry and competes with other large companies such as Pengdu Agriculture & Animal Husbandry Co Ltd, BRC Inc, and Inner Mongolia Yili Industrial Group Co Ltd. a2 Milk Co Ltd focuses on providing high-quality milk products that are safe and nutritious for consumers. The company has a strong presence in Australia, New Zealand, China, and the United States.

– Pengdu Agriculture & Animal Husbandry Co Ltd ($SZSE:002505)

Pengdu Agriculture & Animal Husbandry Co Ltd has a market cap of 17.98B as of 2022, a Return on Equity of 6.27%. The company is engaged in the business of animal husbandry and agriculture. It is one of the leading companies in the industry with a strong market share. The company has a strong financial position and is well-positioned to continue its growth trajectory in the future.

– BRC Inc ($NYSE:BRCC)

BRC Inc is a publicly traded company with a market capitalization of 331.47 million as of 2022. The company has a Return on Equity of 3455.87%, meaning that it has generated a profit for shareholders on every dollar that they have invested in the company. BRC Inc is a leading provider of software and services to the retail industry, with a focus on helping retailers improve their operations and grow their businesses. The company’s products and services are used by retailers of all sizes, from small businesses to large multinational chains.

– Inner Mongolia Yili Industrial Group Co Ltd ($SHSE:600887)

Inner Mongolia Yili Industrial Group Co Ltd has a market cap of 191.6B as of 2022, a Return on Equity of 15.16%. The company is a leading dairy producer in China, with a strong presence in the domestic market. It has a wide range of products, including milk powder, yogurt, cheese, and infant formula. The company has a strong research and development capabilities, and has been investing heavily in new product development and marketing.

Summary

A2 Milk Company Limited (A2M) experienced a decrease in short interest of 11.3% in May, according to data from Nasdaq. This decline indicates that investors believe the stock is undervalued and would be a good long-term investment. Investors should consider the company as a long-term play given its solid fundamentals and growth prospects.

Recent Posts