A2 Milk Company Limited Short Interest Rises 24.9% in February 2023.

March 21, 2023

Trending News ☀️

A2 ($ASX:A2M): The a2 Milk Company Limited, one of the world’s leading dairy companies, saw a sharp increase in its Short Interest during the month of February 2023. In particular, the Short Interest rose by 24.9%, which is a significant increase from the previous month. This rise in Short Interest may indicate that investors are expecting that the company’s share price will grow in the near future. The a2 Milk Company Limited has recently been expanding its operations, adding more products to its product range and increasing its presence in international markets. It is likely that this expansion has caused investors to become more bullish on the company’s prospects, leading to the sharp increase in Short Interest.

The company’s share price has already seen a considerable increase in value over the past year, with investors becoming more confident in its ability to deliver above-average returns to shareholders. The recent growth in Short Interest could be further evidence of this confidence, suggesting that investors are likely to remain bullish on the company’s prospects for some time. The company’s expansion plans, combined with a strong share price performance over the past year, suggest that investors are expecting further growth in the near future.

Price History

This is despite the fact that media sentiment towards the company has predominantly been positive. A2 MILK opened at AU$6.6 and closed at AU$6.6, down 0.5% from its previous closing price of 6.6. This indicates that the increase in short interest has not had a significant impact on the company’s stock price. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for A2 Milk. More…

| Total Revenues | Net Income | Net Margin |

| 1.57k | 136.77 | 8.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for A2 Milk. More…

| Operations | Investing | Financing |

| 102.2 | -361.29 | -68.08 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for A2 Milk. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.7k | 494.39 | 1.64 |

Key Ratios Snapshot

Some of the financial key ratios for A2 Milk are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.5% | -28.9% | 13.0% |

| FCF Margin | ROE | ROA |

| 5.9% | 10.7% | 7.5% |

Analysis

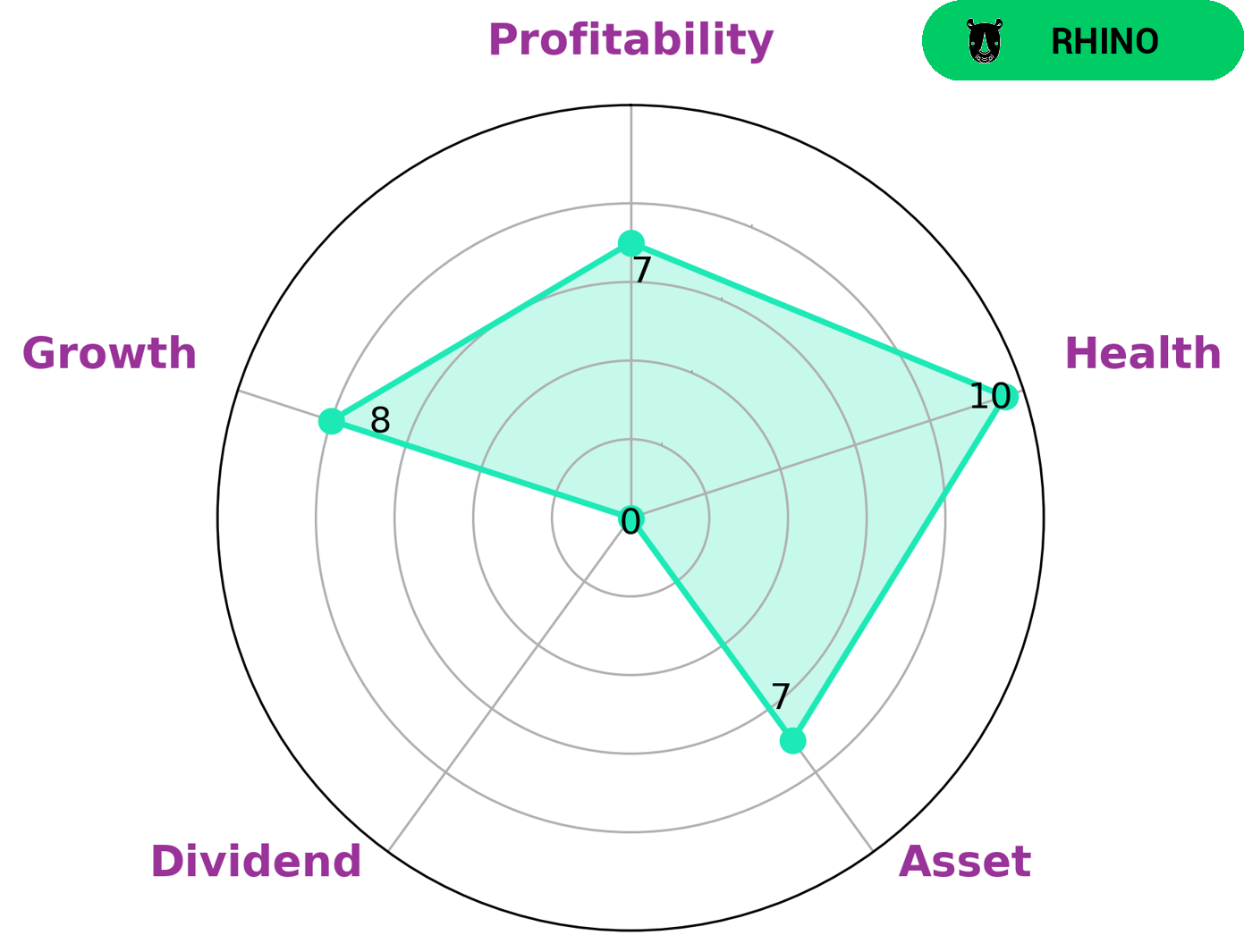

GoodWhale conducted an analysis of A2 MILK‘s financials, and found that its star chart showed it to be strong in asset, growth, and profitability, but weak in dividend. The company’s health score was 10/10 with regard to its cashflows and debt, meaning it is capable to pay off debt and fund future operations. It was classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. For investors looking to invest in A2 MILK, they should consider the company’s current financial health and its moderate revenue growth. Even though dividend is not a main focus, the company’s strong performance in other areas indicates that it is still a stable investment. Investors should also consider the potential for growth in the future – given the company’s ability to pay off debt and fund its operations, it is likely there will be more opportunities for investment in the future. More…

Peers

The a2 Milk Co Ltd is one of the leading companies in the dairy industry and competes with other large companies such as Pengdu Agriculture & Animal Husbandry Co Ltd, BRC Inc, and Inner Mongolia Yili Industrial Group Co Ltd. a2 Milk Co Ltd focuses on providing high-quality milk products that are safe and nutritious for consumers. The company has a strong presence in Australia, New Zealand, China, and the United States.

– Pengdu Agriculture & Animal Husbandry Co Ltd ($SZSE:002505)

Pengdu Agriculture & Animal Husbandry Co Ltd has a market cap of 17.98B as of 2022, a Return on Equity of 6.27%. The company is engaged in the business of animal husbandry and agriculture. It is one of the leading companies in the industry with a strong market share. The company has a strong financial position and is well-positioned to continue its growth trajectory in the future.

– BRC Inc ($NYSE:BRCC)

BRC Inc is a publicly traded company with a market capitalization of 331.47 million as of 2022. The company has a Return on Equity of 3455.87%, meaning that it has generated a profit for shareholders on every dollar that they have invested in the company. BRC Inc is a leading provider of software and services to the retail industry, with a focus on helping retailers improve their operations and grow their businesses. The company’s products and services are used by retailers of all sizes, from small businesses to large multinational chains.

– Inner Mongolia Yili Industrial Group Co Ltd ($SHSE:600887)

Inner Mongolia Yili Industrial Group Co Ltd has a market cap of 191.6B as of 2022, a Return on Equity of 15.16%. The company is a leading dairy producer in China, with a strong presence in the domestic market. It has a wide range of products, including milk powder, yogurt, cheese, and infant formula. The company has a strong research and development capabilities, and has been investing heavily in new product development and marketing.

Summary

Investors have become increasingly bullish on A2 Milk Company Limited in the last month, with short interest rising by 24.9% in February 2023. This sentiment is reflected in the media, which has been mostly positive about the stock. Investor analysis indicates that A2 MILK is a strong growth story for the long-term, with a strong balance sheet, low debt and strong exposure to high-growth dairy markets. The company has also been focusing on increasing profitability, with improved cost management and productivity enhancements.

However, to sustain its current share price, the company needs to continue to grow its revenues and deliver consistent earnings growth.

Recent Posts