Rob McEwen to Make Major Investment in MCEWEN MINING Through 37% Stake in Satori Resources.

February 12, 2023

Trending News 🌧️

MCEWEN MINING ($NYSE:MUX) is a growing gold producer that has focused on the acquisition, exploration, development and operation of gold and other mineral properties. The company is headquartered in Toronto, Canada, and operates in Mexico, the United States, Argentina and Chile. The company’s exploration and development activities have been focused on the El Gallo Project in Mexico and the Gold Bar Mine in Nevada. In addition to these projects, MCEWEN MINING also owns other projects including San Jose Mine and the Los Azules copper project in Argentina. The company’s portfolio of gold and silver producing assets, combined with its highly experienced management team, have enabled it to become a leader in the gold mining industry.

In addition, the company’s strategy of focusing on quality production and cost-effective operations has enabled it to remain profitable in a volatile gold market. The acquisition of Satori Resources by Rob McEwen could potentially bring a range of benefits to MCEWEN MINING. These include increased access to capital, increased public exposure, and increased expertise in mineral exploration and development. This move could potentially bring a range of benefits to the company, including increased access to capital, increased public exposure and increased expertise in mineral exploration and development.

Stock Price

This move is being seen as a positive one, as it will increase the company’s exposure and strengthen its financial position.

However, the news has been mostly mixed so far, as many investors remain uncertain about the long-term implications of this major investment. On Tuesday, MCEWEN MINING stock opened at $6.2 and closed at $6.3, up by 1.0% from the prior closing price of 6.2. This indicates that investors have yet to be convinced of the merits of this investment, as the stock remains largely flat over the past few days. While the news of Rob McEwen’s investment has had a marginal impact on the stock price, analysts believe that the long-term implications could be much more significant. The additional capital provided by this investment could allow MCEWEN MINING to expand its operations and explore new potential growth opportunities.

Additionally, the increased exposure could help to attract more long-term investors and drive up the stock price in the long-run. While the stock price has not reacted significantly to this news yet, analysts are optimistic that this move could pay off for the company in the long-term. Only time will tell if this investment will be beneficial for MCEWEN MINING and its shareholders. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mcewen Mining. More…

| Total Revenues | Net Income | Net Margin |

| 117.14 | -64.57 | -67.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mcewen Mining. More…

| Operations | Investing | Financing |

| -51.7 | -20.99 | 62.05 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mcewen Mining. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 545.14 | 146.81 | 7.59 |

Key Ratios Snapshot

Some of the financial key ratios for Mcewen Mining are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.6% | – | -53.7% |

| FCF Margin | ROE | ROA |

| -64.2% | -10.9% | -7.2% |

Analysis

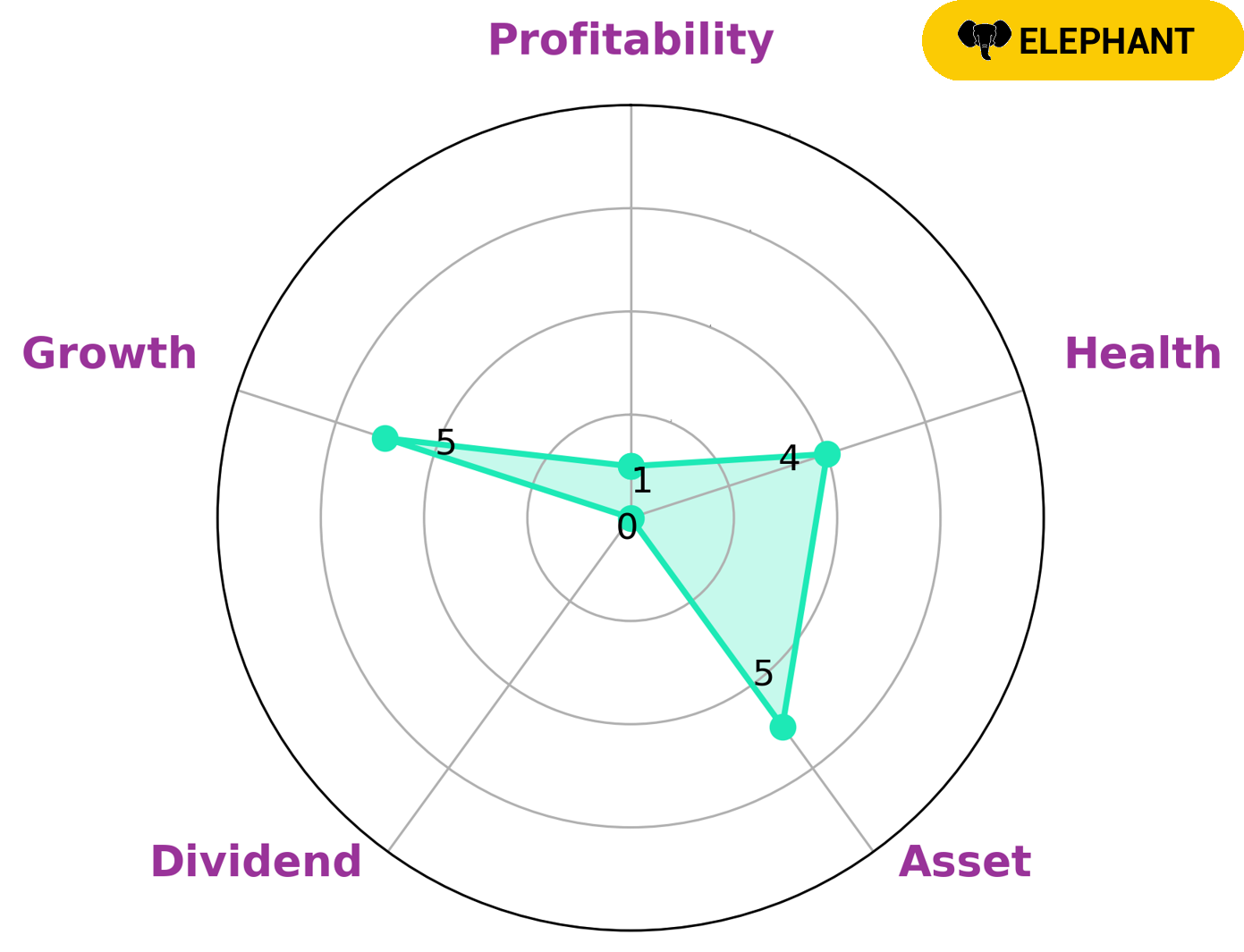

GoodWhale performed an analysis of MCEWEN MINING‘s wellbeing, which resulted in an intermediate health score of 4/10 with regard to its cashflows and debt. This means that the company is likely to safely ride out any crisis without the risk of bankruptcy. The analysis also classified MCEWEN MINING as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. Such companies may be of interest to a wide range of investors, including those looking for long-term investments with a low risk of bankruptcy and those looking to add value to their portfolios. In terms of specific areas, MCEWEN MINING looks strong in terms of its assets and medium in terms of its growth and dividends. Its profitability is weak, which may deter some investors. However, it is worth noting that the company’s asset-rich nature and intermediate health score may negate this weakness in some cases. Overall, MCEWEN MINING looks like a solid choice for investors who are looking for a low risk option with potential for long-term growth. Its asset-rich nature provides a cushion against potential losses, while its intermediate health score suggests that the company is well-positioned to weather any economic storms. More…

Peers

The competition between McEwen Mining Inc and its competitors is fierce. All four companies are vying for supremacy in the gold mining industry. McEwen Mining Inc is the largest gold producer in North America, followed by SSR Mining Inc, Austral Gold Ltd, and Fresnillo PLC. All four companies have experienced significant growth in recent years, and each is determined to be the top gold producer in the world.

– SSR Mining Inc ($TSX:SSRM)

As of 2022, SSR Mining Inc has a market cap of 3.89B and a Return on Equity of 6.57%. The company is a leading precious metals producer with operations in North and South America. The company’s core assets include the Marigold mine in Nevada, the Puna Operations in Argentina, and the Seabee Gold Operation in Saskatchewan.

– Austral Gold Ltd ($ASX:AGD)

Austral Gold Ltd is a gold mining and exploration company. The company has a market cap of 26.33M as of 2022 and a Return on Equity of -12.84%. The company operates in Australia, Chile, and Argentina. Austral Gold Ltd is focused on increasing shareholder value through the exploration, development, and production of gold and copper projects.

– Fresnillo PLC ($LSE:FRES)

Fresnillo PLC is a Mexican-based precious metals mining company with a market capitalization of 5.22 billion as of 2022. The company is the world’s largest primary silver producer and Mexico’s largest gold producer. Fresnillo’s main assets are the Fresnillo and Saucito mines in the state of Zacatecas, and the Herradura mine in the state of Sonora. The company also has several development projects in Mexico, Peru, and Chile. Fresnillo’s primary products are silver and gold, and it also produces lead and zinc. The company has a strong focus on sustainable development and aims to reduce its environmental impact.

Summary

Rob McEwen, the former CEO of gold miner and explorer Goldcorp, is making a major investment in MCEWEN MINING via a 37% stake in Satori Resources. The investment is seen as a positive indicator for MCEWEN MINING, as it illustrates the company’s potential.

However, the overall market reaction to the news has been mixed due to market uncertainty surrounding the gold industry. McEwen’s investment is seen as a sign of confidence in MCEWEN MINING, as he has a long track record of successful investments in gold mining and exploration. Analysts suggest that investors should look beyond the current market sentiment and focus on the long-term potential of MCEWEN MINING.

Recent Posts