MCEWEN MINING Surpasses 50-Day Moving Average in Wednesday Trading

April 29, 2023

Trending News 🌥️

MCEWEN ($NYSE:MUX): This marks the first time since January that the stock has been above this mark, and investors have responded positively. McEwen Mining is a gold and silver producer, operating mines in the United States and Mexico. It is one of the leading mid-tier miners in North America, with a focus on creating shareholder value through responsible mining. Wednesday’s surge in the stock’s value is seen as a sign of investor confidence in the company’s prospects.

Share Price

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mcewen Mining. More…

| Total Revenues | Net Income | Net Margin |

| 110.42 | -81.08 | -86.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mcewen Mining. More…

| Operations | Investing | Financing |

| -58.61 | -23.9 | 65.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mcewen Mining. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 528.72 | 172.44 | 6.81 |

Key Ratios Snapshot

Some of the financial key ratios for Mcewen Mining are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.9% | – | -65.7% |

| FCF Margin | ROE | ROA |

| -75.0% | -13.3% | -8.6% |

Analysis

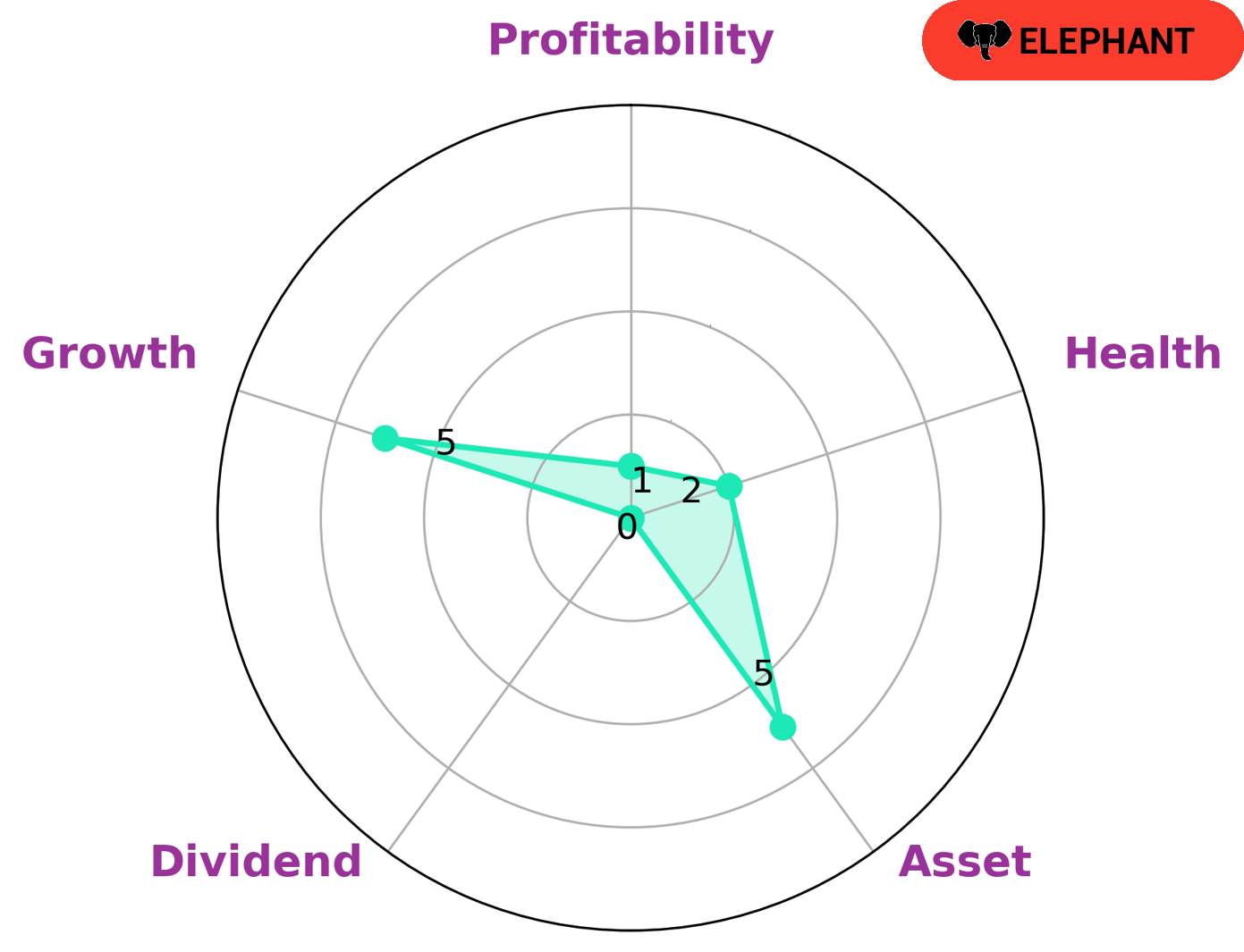

GoodWhale has conducted an analysis of MCEWEN MINING‘s fundamentals. According to Star Chart, MCEWEN MINING is strong in assets, medium in growth and weak in dividend and profitability. Its health score is only 2/10, indicating it may not be able to sustain operations in times of crisis. We have classified MCEWEN MINING as an ‘elephant’, meaning that it is rich in assets after liabilities. Investors interested in such companies may look to benefit from their asset-rich nature. They may be looking for investments that are more resilient during periods of market volatility or economic downturns. Additionally, such investors may be interested in taking a long-term approach to investing in order to benefit from the potential appreciation of their assets over time. More…

Peers

The competition between McEwen Mining Inc and its competitors is fierce. All four companies are vying for supremacy in the gold mining industry. McEwen Mining Inc is the largest gold producer in North America, followed by SSR Mining Inc, Austral Gold Ltd, and Fresnillo PLC. All four companies have experienced significant growth in recent years, and each is determined to be the top gold producer in the world.

– SSR Mining Inc ($TSX:SSRM)

As of 2022, SSR Mining Inc has a market cap of 3.89B and a Return on Equity of 6.57%. The company is a leading precious metals producer with operations in North and South America. The company’s core assets include the Marigold mine in Nevada, the Puna Operations in Argentina, and the Seabee Gold Operation in Saskatchewan.

– Austral Gold Ltd ($ASX:AGD)

Austral Gold Ltd is a gold mining and exploration company. The company has a market cap of 26.33M as of 2022 and a Return on Equity of -12.84%. The company operates in Australia, Chile, and Argentina. Austral Gold Ltd is focused on increasing shareholder value through the exploration, development, and production of gold and copper projects.

– Fresnillo PLC ($LSE:FRES)

Fresnillo PLC is a Mexican-based precious metals mining company with a market capitalization of 5.22 billion as of 2022. The company is the world’s largest primary silver producer and Mexico’s largest gold producer. Fresnillo’s main assets are the Fresnillo and Saucito mines in the state of Zacatecas, and the Herradura mine in the state of Sonora. The company also has several development projects in Mexico, Peru, and Chile. Fresnillo’s primary products are silver and gold, and it also produces lead and zinc. The company has a strong focus on sustainable development and aims to reduce its environmental impact.

Summary

MCEWEN MINING INC is a mining company that has been trading on the stock market. On Wednesday, the stock price of the company passed above its fifty day moving average. This is a positive sign for investors and indicates that the price of the stock is trending upwards. This is often a sign of strong investor confidence and could be seen as a potential buying opportunity.

Analysts suggest that investors take a long term strategy with MCEWEN MINING, as the stock has shown consistency over time and could be a worthwhile investment. Short term investors should still be cautious as stock prices can be highly volatile. Investors should consider doing their own extensive research before investing in MCEWEN MINING.

Recent Posts