59% of Vox Royalty Corp. Owned by Retail Investors, Suggesting Key Decisions are Influenced by Them

May 25, 2023

Trending News 🌥️

Vox Royalty ($TSXV:VOX) Corp. is a gold and precious metal streaming company that provides investors with exposure to gold and precious metals, without the requirement of capital expenditures. The company’s key shareholders include retail investors who constitute 59%, while institutions account for 16%. This suggests that key decisions are largely influenced by the retail investors. The fact that retail investors have a controlling interest in Vox Royalty Corp. means that their interests can shape the way the company is run. This includes influencing key decisions such as corporate strategy, acquisitions, mergers, and dividend policies.

Retail investors can also have a strong influence on how the company is marketed and its position in the market. At the same time, it is also important to note that retail investors do not always act in the company’s best interests. They may be more focused on short-term gains, which can lead to decisions that do not maximize long-term shareholder value. Therefore, it is important that Vox Royalty Corp. is mindful of its retail investor base and takes their interests into consideration when making strategic decisions.

Analysis

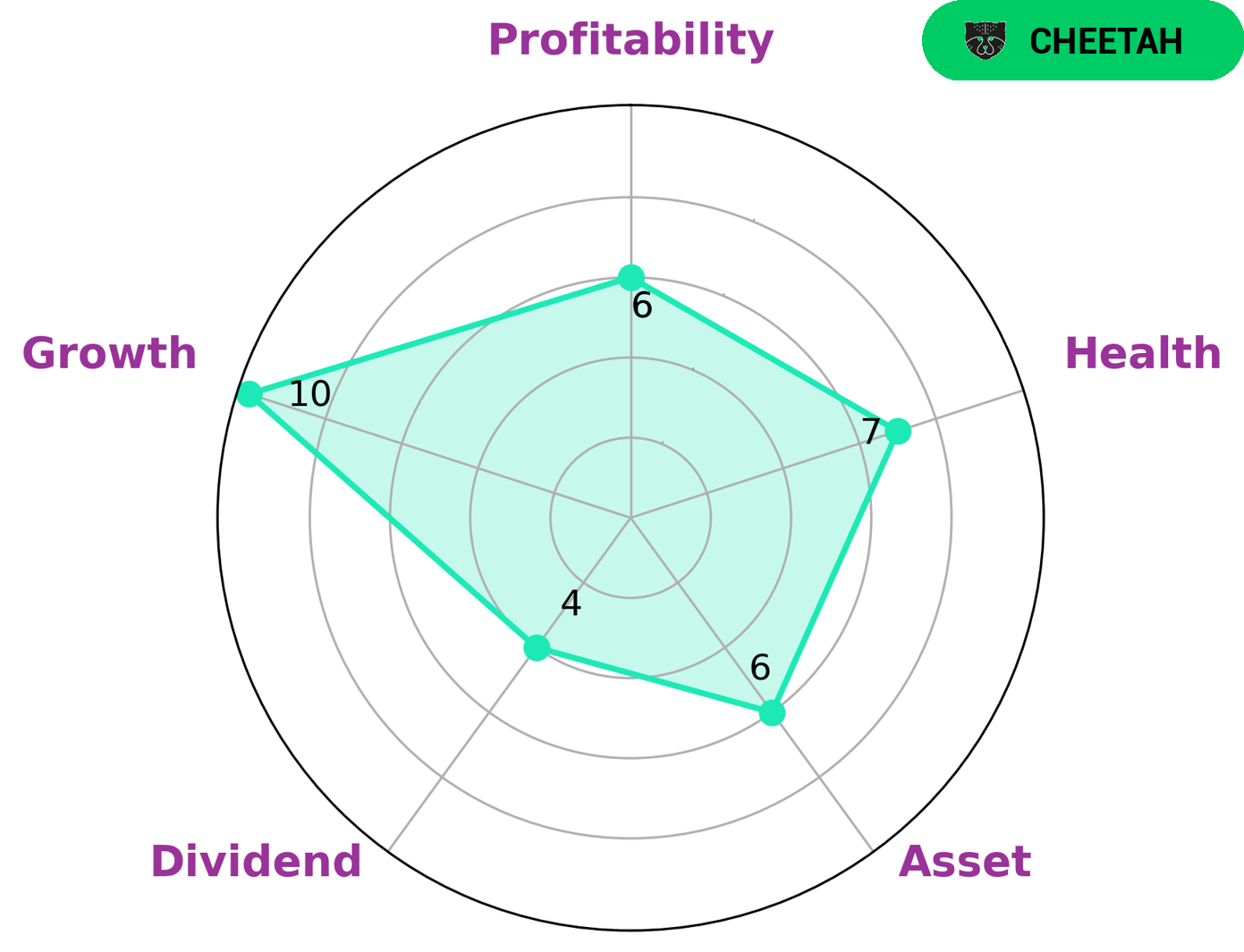

GoodWhale has conducted an analysis of VOX ROYALTY‘s fundamentals and found that it is strong in growth and medium in asset, dividend, and profitability according to Star Chart. Based on this, we have classified them as a “cheetah” company – one that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Given the company’s classification, we believe that investors looking for high-growth opportunities may be interested in VOX ROYALTY. In addition, VOX ROYALTY has a high health score of 7/10 with regard to its cashflows and debt, which indicates that the company is capable of sustaining future operations in times of crisis. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Vox Royalty. More…

| Total Revenues | Net Income | Net Margin |

| 10.62 | -0.11 | -2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Vox Royalty. More…

| Operations | Investing | Financing |

| 2.95 | -3.52 | -1.02 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Vox Royalty. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 43.24 | 8.28 | 0.77 |

Key Ratios Snapshot

Some of the financial key ratios for Vox Royalty are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | 15.8% |

| FCF Margin | ROE | ROA |

| -16.4% | 3.0% | 2.4% |

Peers

In recent years, the precious metals royalty and streaming sector has seen a lot of consolidation with a few large companies, such as Wheaton Precious Metals Corp, Gold Royalty Corp, and Silver Scott Mines Inc, emerging as the dominant players.

However, there is still a lot of competition between these companies for new projects and acquisitions.

– Wheaton Precious Metals Corp ($TSX:WPM)

Wheaton Precious Metals Corp is a gold and silver mining company with operations in Canada, the United States, Mexico, and Chile. The company has a market cap of 22.77B as of 2022 and a return on equity of 7.79%. Wheaton Precious Metals Corp is one of the world’s largest precious metals streaming companies and has a diversified portfolio of high-quality assets. The company’s core focus is on gold and silver and it has a proven track record of delivering strong returns.

– Gold Royalty Corp ($NYSEAM:GROY)

Gold Royalty Corp. (CVE:GRY) is a Canadian-based company that owns and operates gold mines in North America. The company has a market cap of 378.49M as of 2022 and a return on equity of -2.34%. Gold Royalty Corp. is focused on creating shareholder value through the acquisition and development of quality gold assets in politically stable jurisdictions.

Summary

Vox Royalty Corp. is a significant player in the mining industry, offering investors an array of investing opportunities. Through its shareholding structure, Vox Royalty has a large amount of retail investors with 59% ownership, while institutions own 16%. This large retail investor base suggests that decisions made at the company will be influenced by the interests of the investing public. When considering investing in Vox Royalty, investors must do their due diligence and assess the risks associated with the company, as well as evaluate the expected return on investment.

Investors should also look at the financial results of the company to ensure they are investing in a sound business. By taking these precautions and analyzing the fundamentals of Vox Royalty Corp., investors can make a more informed decision about whether or not to invest.

Recent Posts