Beats Estimates

April 9, 2023

Trending News ☀️

Electra Battery Materials ($NASDAQ:ELBM), a company specializing in the development and production of high-performance battery materials, recently reported their third quarter earnings, showing a GAAP earnings per share of C$0.31, exceeding analysts’ predictions. This impressive performance is a testament to the success of their innovative approach to battery materials development. The company is a leader in the sector, boasting a wide range of battery materials for electric vehicle and energy storage applications. They use advanced nanomedicine and bioengineering techniques to create new materials that are more efficient and cost-effective than traditional materials. This approach has enabled them to develop new products that meet the growing demand for advanced energy storage solutions. In addition to their impressive third quarter earnings, Electra Battery Materials has made significant progress in other areas as well.

They have continued to expand their product portfolio, introducing several new products that utilize their advanced technology. They have also made investments in research and development to further improve their product offerings. Overall, Electra Battery Materials has outperformed its expectations and continues to show strong potential for future growth. It is clear that their commitment to innovation and technological advancement will continue to drive the company’s success. As they continue to develop new products and expand their market presence, they are sure to remain a leader in the sector for years to come.

Price History

On Wednesday, ELECTRA BATTERY MATERIALS reported impressive earnings that surpassed analysts’ expectations. The stock opened at $2.0 and closed at $1.8, a 6.6% drop from the previous closing price of $2.0. Despite the drop in the stock price, ELECTRA BATTERY MATERIALS’ strong earnings report was good news for investors and the company itself. It is clear that ELECTRA BATTERY MATERIALS was able to exceed expectations and deliver impressive results despite the challenging economic conditions. This is positive news for shareholders who are looking for steady returns on their investments. ELECTRA BATTERY MATERIALS’ strong earnings report is evidence of the company’s commitment to innovation and growth in a competitive market. The company has a well-diversified product portfolio which allows them to capitalize on new opportunities in the market.

In addition, they have established a strong presence in key markets and are continuously exploring ways to expand their customer base. Overall, ELECTRA BATTERY MATERIALS’ report of beating analysts’ expectations is positive news for the company and its shareholders. The company’s commitment to innovation and growth has enabled them to remain competitive and deliver strong financial results. With a diversified product portfolio and presence in key markets, ELECTRA BATTERY MATERIALS is well positioned to capitalize on new opportunities and continue to deliver impressive returns in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ELBM. More…

| Total Revenues | Net Income | Net Margin |

| 0 | 12.55 | – |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ELBM. More…

| Operations | Investing | Financing |

| -15.85 | -43.55 | 8.48 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ELBM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 187.52 | 61.02 | 3.43 |

Key Ratios Snapshot

Some of the financial key ratios for ELBM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.0% | – | – |

| FCF Margin | ROE | ROA |

| – | -8.8% | -5.6% |

Analysis

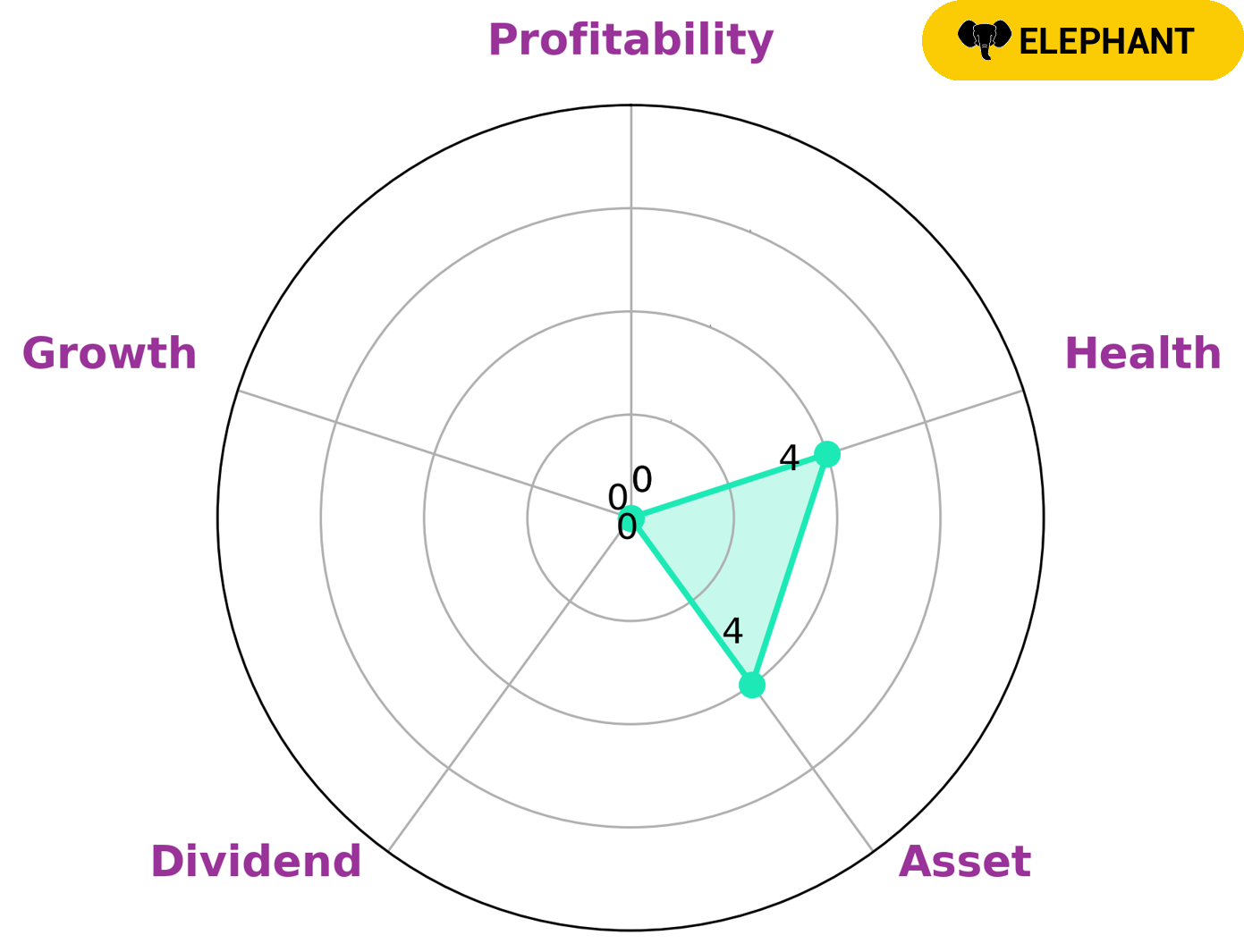

GoodWhale recently conducted an analysis of ELECTRA BATTERY MATERIALS’s wellbeing. Our Star Chart revealed that ELECTRA BATTERY MATERIALS is strongest in asset, medium in dividend, and weak in growth and profitability metrics. Our intermediate health score of 4/10 reflects the company’s debt and cash flows, which indicates that it is likely to sustain future operations in times of crisis. We classify ELECTRA BATTERY MATERIALS as an ‘elephant’ type of company, which we conclude are rich in assets after deducting off liabilities. This analysis may be of interest to investors who are looking to invest in companies with strong asset bases and the ability to sustain operations through difficult economic periods. More…

Summary

ELECTRA Battery Materials is a Canadian company that manufactures and distributes energy storage solutions for various applications. Following the results announcement, the stock price of ELECTRA Battery Materials declined significantly due to investor reaction to the earnings. For investors considering ELECTRA Battery Materials, it is important to assess the company’s financials and growth prospects. The company’s balance sheet should be carefully reviewed to ensure that it can meet its obligations and maintain sufficient liquidity. Additionally, investors should look at the company’s revenue, operating income, and cash flows to see if it is likely to generate returns for shareholders. Furthermore, investors should monitor the company’s competitive position in the industry, and whether there are any risks associated with its operations. Overall, ELECTRA Battery Materials has potential for growth due to its strong presence in the energy storage market and its financial performance.

However, investors should be aware of the inherent risks associated with investing in any stock, and conduct thorough research before investing in the company.

Recent Posts