Valvoline Completes Sale of Global Products Business.

March 4, 2023

Trending News 🌥️

Valvoline Inc ($NYSE:VVV)., a leading worldwide supplier of premium branded lubricants and automotive services, has announced the completion of the sale of its Global Products business. This strategic move was undertaken as part of Valvoline’s broader transformation plan to provide better focus on its core automotive services business. Valvoline Inc.’s Global Products business, which includes their traditional lubricant and retail products, was sold to entities affiliated with American Securities LLC. American Securities is an investment firm specializing in private equity investments in middle-market companies.

This move is expected to enable Valvoline to focus more on their automotive services business, which offers a variety of services from oil changes and fuel system cleaning to brake repair and tire rotation. The sale of the Global Products business is expected to provide Valvoline Inc. with the financial flexibility to focus on their core automotive services business and their expansion plans.

Stock Price

Valvoline Inc. has concluded the sale of its Global Products Business to Afton Chemical Corporation. The terms of the transaction were not disclosed. On Friday, VALVOLINE INC stock opened at $36.0 and closed at $37.0, up by 3.6% from prior closing price of 35.7.

This rise in stock price indicates an optimistic outlook from investors as they view the completion of the sale of Global Products Business as a positive move for Valvoline Inc. It is expected that this move will help Valvoline Inc. focus on their core business activities and utilize their resources to its fullest potential. Furthermore, it is believed that the divestiture of the Global Products Business will create immense value for Valvoline Inc.’s shareholders over the long term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Valvoline Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.28k | 419.2 | 11.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Valvoline Inc. More…

| Operations | Investing | Financing |

| 243.7 | -218.6 | -82.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Valvoline Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.55k | 3.26k | 1.74 |

Key Ratios Snapshot

Some of the financial key ratios for Valvoline Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -19.3% | -13.9% | 13.9% |

| FCF Margin | ROE | ROA |

| 8.1% | 37.3% | 3.1% |

Analysis

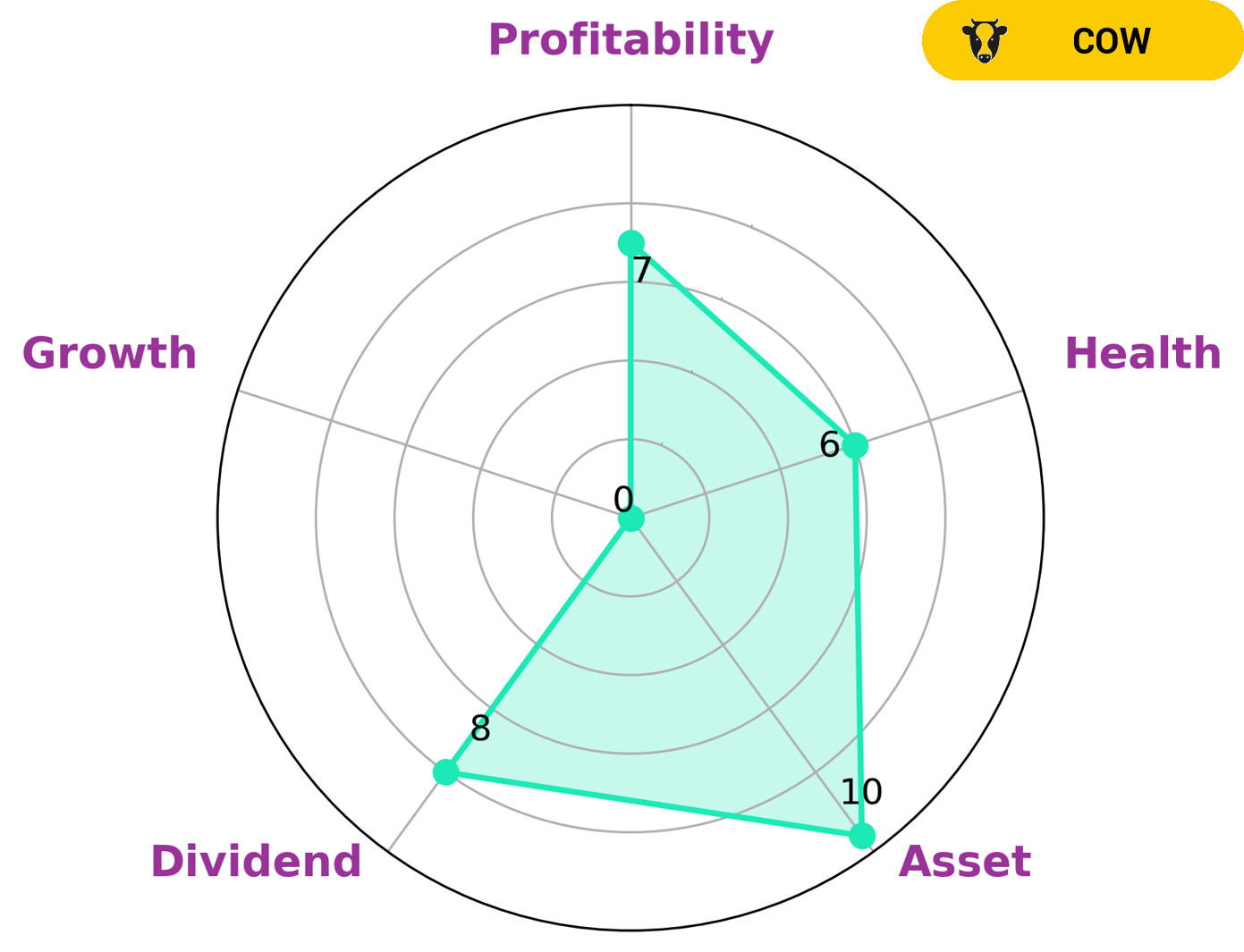

At GoodWhale, we recently conducted an analysis of VALVOLINE INC‘s wellbeing. Our results from the Star Chart classification classify VALVOLINE INC as a ‘cow’, which indicates it has the track record of consistently paying out sustainable dividends. This type of company is likely to be popular amongst dividend investors, as well as those looking for consistent and reliable returns over time. VALVOLINE INC scored highly for assets, dividends and profitability, but weakly for growth potential. This suggests it is a company who is relatively stable and successful in its current operations, but lacks the ambition to make large capital investments or expand operations. Finally, VALVOLINE INC has an intermediate health score of 6/10 when considering its cashflows and debt. This, combined with its consistent performance, suggests that the company is likely to sustain future operations, even in the face of crisis. More…

Peers

The company has a long history of competition with its competitors, Petrol AD, CrossAmerica Partners LP, and Petronas Dagangan Bhd. Valvoline’s products are available in more than 100 countries and the company has a strong presence in North America, Europe, Asia, and Australia. Valvoline is committed to providing the highest quality products and services to its customers.

– Petrol AD ($LTS:0IMR)

Petrol AD is a Bulgarian oil and gas company with a market capitalization of 4.26M as of 2022. The company has a Return on Equity of -634.11%. Petrol AD is engaged in the exploration, production, refining and marketing of oil and gas. The company has operations in Bulgaria, Romania and Serbia.

– CrossAmerica Partners LP ($NYSE:CAPL)

CrossAmerica Partners LP is a wholesale distributor of motor fuels and convenience store operator in the United States. The company operates through two segments, Wholesale and Retail. The Wholesale segment engages in the wholesale distribution of motor fuels to lessees, independent dealers, and other customers. The Retail segment operates company-operated convenience stores. As of December 31, 2020, the company operated 1,873 convenience stores in 35 states.

– Petronas Dagangan Bhd ($KLSE:5681)

Petronas Dagangan Bhd is a market leader in the retail and commercial segments of the Malaysian petroleum market. The company has a long-established reputation for providing high-quality products and services, and is committed to meeting the needs of its customers. Petronas Dagangan Bhd has a strong financial position, with a market capitalisation of 21.16 billion as of 2022 and a return on equity of 9.86%. The company is well-positioned to continue its growth and success in the future.

Summary

Valvoline Inc. is an American manufacturer of automotive and industrial lubricants, equipment, and services. This sale provides Valvoline with greater financial flexibility and may allow it to focus more on its core business. Going forward, investors should continue to monitor the company’s liquidity and debt load, as these factors will significantly affect their growth prospects. If Valvoline is able to grow its core businesses and increase cash flow generation, this could be beneficial for shareholders in the long-term.

Recent Posts