Infrastructure Capital Advisors LLC Invests in Delek Logistics Partners, LP in Fourth Quarter

June 12, 2023

🌥️Trending News

Delek Logistics Partners ($NYSE:DKL), LP is an independent master limited partnership formed by Delek US Holdings, Inc. to own, operate, acquire and construct crude oil and refined products logistics and marketing assets. The company is focused on the ownership, operation, and expansion of pipelines, terminals, storage facilities, and other transportation and logistics assets. In the fourth quarter, Infrastructure Capital Advisors LLC acquired a stake in Delek Logistics Partners, LP, as reported in the firm’s most recent 13F filing. This is the firm’s first investment in the company, signaling a potential increase in market interest for the stock.

It is not yet known how large Infrastructure Capital Advisors LLC’s stake in Delek Logistics Partners, LP is, but the firm’s investment could potentially impact the stock’s performance in the future. As Infrastructure Capital Advisors LLC continues to build its stake in the publically traded company, investors will be watching closely to see if this could lead to a surge in the stock’s value.

Price History

On Wednesday, the stock opened at $53.5 and closed at $53.8, a 2.8% increase from its previous closing price of $52.4. The investment by ICA shows confidence in the future success of DKL and demonstrates the growing potential for the company’s long-term success. This is in line with DKL’s increasing presence in the industry and its ability to deliver on its commitments to shareholders. ICA’s confidence in DKL’s future shows that it is a strong investment and is likely to continue to offer solid returns in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for DKL. More…

| Total Revenues | Net Income | Net Margin |

| 1.07k | 156.91 | 14.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for DKL. More…

| Operations | Investing | Financing |

| 173.44 | -784.94 | 619.74 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for DKL. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.69k | 1.81k | -2.54 |

Key Ratios Snapshot

Some of the financial key ratios for DKL are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 21.7% | 19.9% | 24.0% |

| FCF Margin | ROE | ROA |

| 1.1% | -141.4% | 9.5% |

Analysis

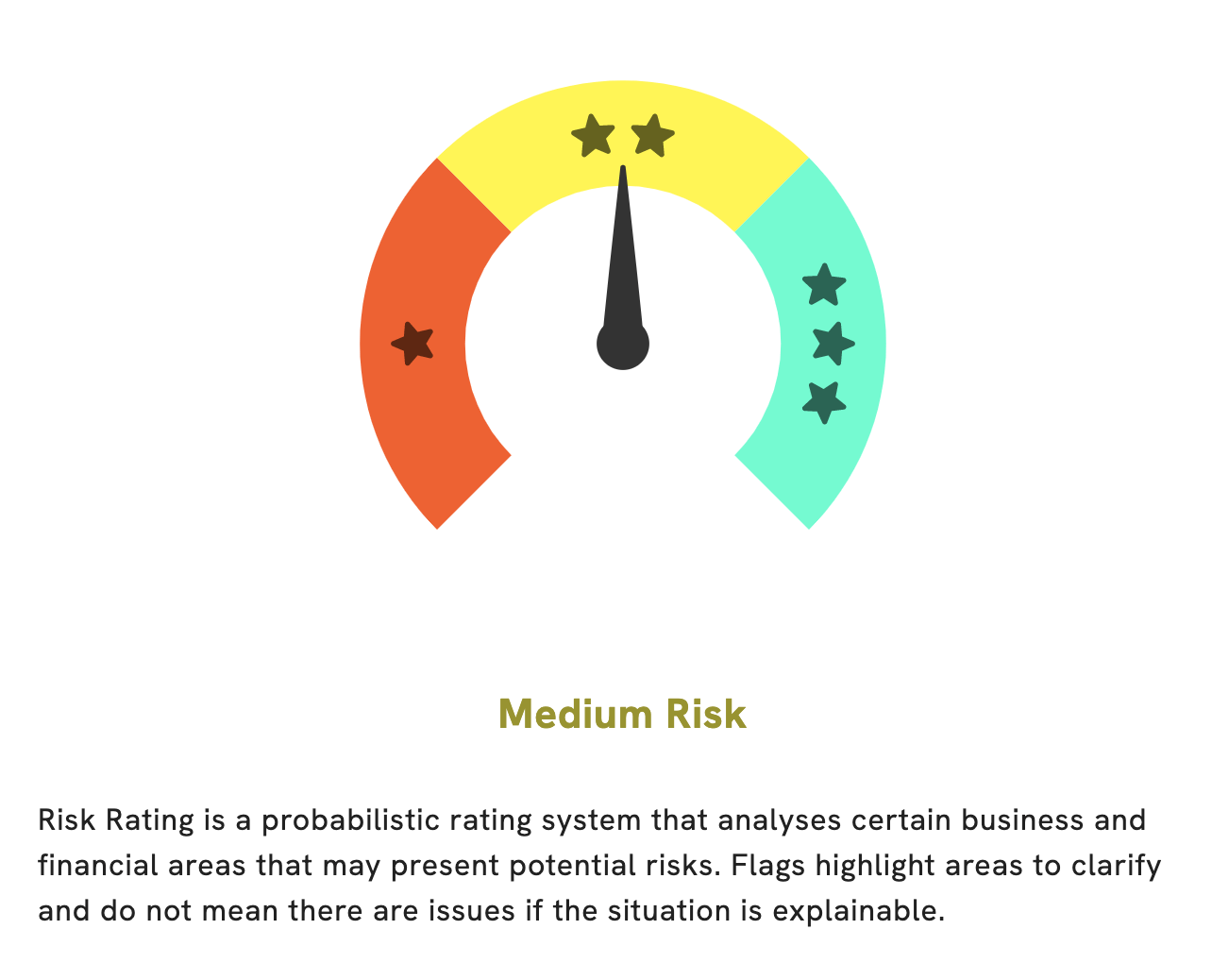

At GoodWhale, we conducted an analysis of DELEK LOGISTICS PARTNERS’ financials and determined that it is a medium risk investment in terms of financial and business aspects. After taking a deep dive into the financial data, we identified two risk warnings in their income sheet and financial journal which should be taken into consideration when making a decision to invest. If you are interested in knowing more about these risk warnings, become a registered user at GoodWhale and check it out. More…

Peers

Delek Logistics Partners LP and its competitors, PBF Logistics LP, Shell Midstream Partners LP, TORM PLC, are all engaged in a highly competitive market. Each company is striving to gain market share and increase profits. In order to do this, they are constantly innovating and improving their operations. As a result, the competition between these companies is fierce and the margin for error is very slim.

– PBF Logistics LP ($NYSE:PBFX)

PBF Logistics LP is a publicly traded master limited partnership that owns, operates, and develops crude oil, refined products, and natural gas liquids (NGL) storage and transportation assets. PBF Logistics LP is headquartered in Parsippany, New Jersey. The company was founded in 2013 and has a market cap of $1.36 billion as of 2022. The company’s return on equity is 40.3%. PBF Logistics LP owns and operates crude oil storage tanks and terminals, refined product storage tanks and terminals, and NGL storage tanks and pipelines. The company’s assets are located in the United States.

– Shell Midstream Partners LP ($NYSE:SHLX)

Dormant for much of the past decade, British energy company BP plc (NYSE:BP) has awakened in recent years, growing its production and making a major acquisition.

The company’s market cap is $17.22B as of 2022 and its ROE is 17.86%.

BP is one of the world’s largest oil and gas companies, providing fuel for transportation, energy for heat and light, retail services and petrochemicals products for customers around the world. The company has operations in more than 70 countries and employs more than 74,000 people.

Summary

Delek Logistics Partners, LP (DELLP) is an attractive investment opportunity for investors looking to capitalize on the transportation of crude oil and refined petroleum products. Analysts are optimistic about the stock’s potential, given its strong presence in the distribution and logistics market. DELLP has a well-established network of pipelines and storage facilities, making it a reliable option for large-scale product delivery.

Additionally, the company has a track record of delivering consistent dividends, making it a compelling income opportunity. Investors should consider DELLP for long-term growth potential, as well as its ability to generate a steady stream of income.

Recent Posts