VNOM Stock Fair Value – VIPER ENERGY PARTNERS LP Reports Strong Quarter: Non-GAAP EPS and Revenue Surpass Expectations

May 2, 2023

Trending News ☀️

Viper Energy Partners ($NASDAQ:VNOM) LP (VNOM) had a strong quarter, with non-GAAP Earnings Per Share (EPS) of $0.53 exceeding analysts’ expectations by $0.18 and its revenue of $168.9M surpassing estimates by $7.38M. Viper Energy Partners is a publicly traded master limited partnership (MLP) focused on the acquisition, exploitation and development of oil and natural gas properties in North America. Viper Energy’s revenue growth was driven by higher commodity prices and increased production from its acreage. The increase in production was also supported by higher prices for oil, natural gas and natural gas liquids, which helped the company achieve higher revenue.

Additionally, the company’s cost of goods sold decreased, allowing the company to realize higher profits. Viper Energy Partners is well positioned to benefit from growing oil and gas demand in North America. The company is focused on capitalizing on the opportunities in the Permian Basin with its portfolio of high-quality oil and gas assets. The company also has a strong balance sheet, which provides flexibility to pursue strategic initiatives and further expand its operations. With strong fundamentals, Viper Energy Partners is well positioned to continue delivering strong results going forward.

Stock Price

On Monday, VIPER ENERGY PARTNERS LP stock opened at $29.2 and closed at $29.1, down by 1.2% from the prior closing price of $29.4. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VNOM. More…

| Total Revenues | Net Income | Net Margin |

| 865.77 | 151.31 | 18.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VNOM. More…

| Operations | Investing | Financing |

| 699.8 | 47.57 | -768.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VNOM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.92k | 598.85 | 9.43 |

Key Ratios Snapshot

Some of the financial key ratios for VNOM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 42.7% | 52.1% | 76.6% |

| FCF Margin | ROE | ROA |

| 73.6% | 58.6% | 14.2% |

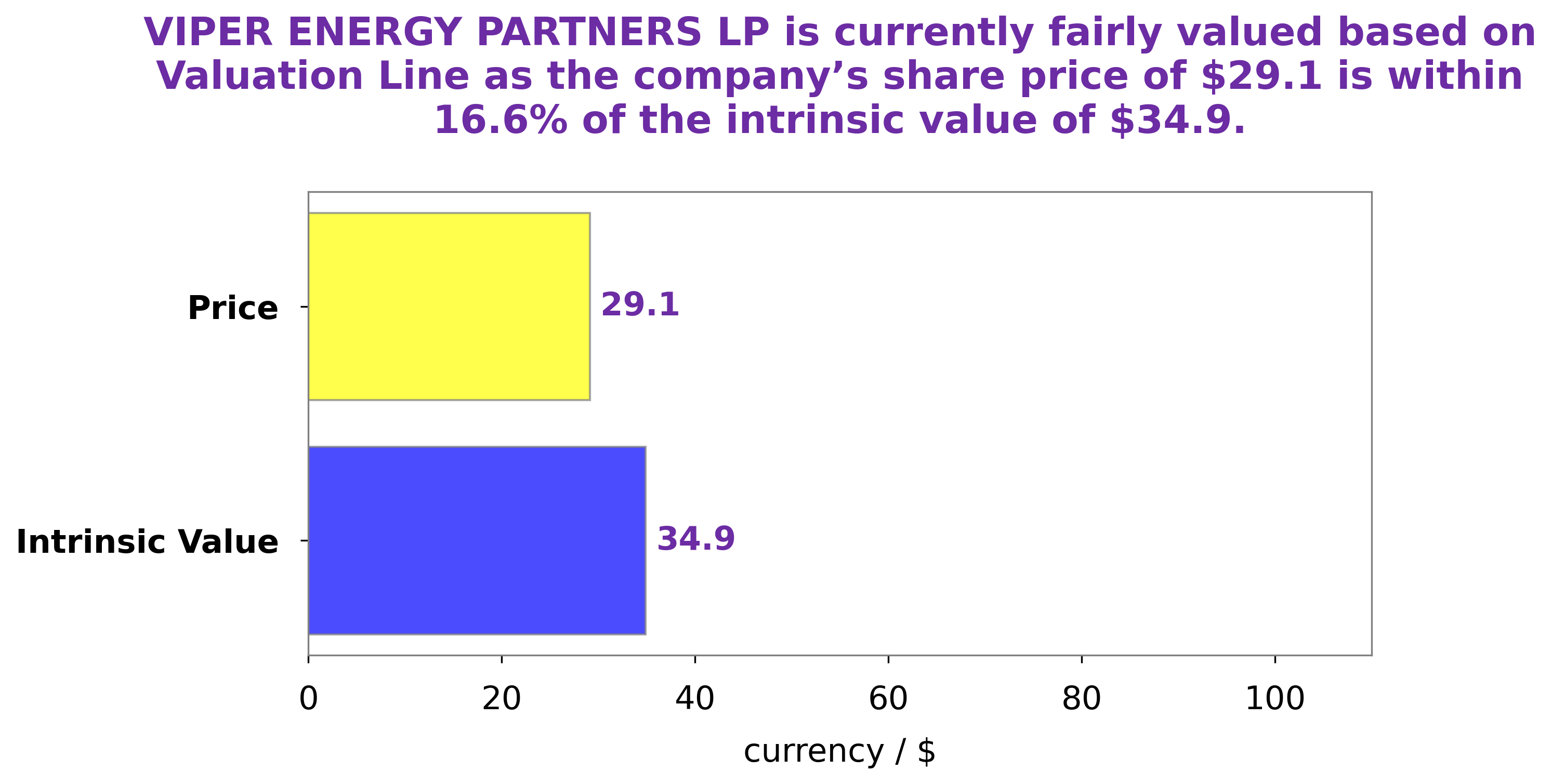

Analysis – VNOM Stock Fair Value

GoodWhale has conducted an analysis of VIPER ENERGY PARTNERS LP’s welfare and found that the intrinsic value of its share is around $34.9. This figure was calculated using our proprietary Valuation Line. Currently, VIPER ENERGY PARTNERS LP stock is traded at $29.1 – a fair price that is undervalued by 16.5%. This presents investors with an opportunity to purchase stock at a discount to its true worth. However, it is important to consider the risks involved when investing in any security and conduct due diligence before making any decisions. More…

Peers

The oil and gas industry is a highly competitive market. There are many oil and gas companies that compete for market share. One of the most competitive markets is the market for oil and gas exploration and production. In this market, there are many companies that compete for market share. One of the most competitive companies in this market is Viper Energy Partners LP. The company is a publicly traded company that is listed on the New York Stock Exchange. The company has a market capitalization of $2.6 billion. The company operates in the oil and gas industry in the United States, Canada, and Mexico.

– Rubellite Energy Inc ($TSX:RBY)

Rubellite Energy Inc is a Canadian oil and gas company with a market cap of 153.23M as of 2022. The company is engaged in the exploration, development, and production of oil and gas properties in the Western Canada Sedimentary Basin.

– Basic Energy Corp ($PSE:BSC)

Basic Energy Corp. is a holding company, which engages in the provision of oilfield services. It operates through the following segments: Drilling Services, Well Services, and Manufacturing and Repair. The Drilling Services segment offers onshore drilling rigs and related services. The Well Services segment provides pressure pumping and other well services. The Manufacturing and Repair segment manufactures and repairs equipment used in oil and gas drilling, completion, and production operations. The company was founded on April 28, 1987 and is headquartered in Houston, TX.

– BPI Energy Holdings Inc ($OTCPK:BPIGF)

BPI Energy Holdings Inc is a publicly traded holding company that owns and operates businesses in the energy sector. The company has a market cap of 146.97k as of 2022 and a Return on Equity of -513.73%. BPI Energy Holdings Inc owns and operates businesses in the oil and gas, power generation, and renewable energy industries. The company’s businesses include exploration and production, power generation, and energy trading.

Summary

Viper Energy Partners LP (VIPR) is an oil and gas company that focuses on the acquisition, ownership, and exploitation of mineral interests in oil and natural gas properties located in the United States. This is a positive sign that suggests that VIPR is continuing to grow and generate positive returns for investors. The company has also continued to strengthen its balance sheet through cost-cutting measures and capital discipline. Going forward, VIPR looks well-positioned to capitalize on the current market environment and deliver further value to its shareholders.

Recent Posts