VNOM stock dividend – VIPER ENERGY PARTNERS LP: Solid Growth, Attractive Valuation, and Generous Dividend Yields

April 29, 2023

Trending News ☀️

VIPER ENERGY PARTNERS LP ($NASDAQ:VNOM) (VNOM) is an attractive option for dividend investors. The company has exhibited strong growth over the past several years, both organically and through acquisitions. It has a competitive position in the oil and gas industry and is well-positioned to capitalize on future opportunities.

In addition, VNOM has an attractive valuation. This indicates that VNOM is undervalued relative to its peers, making it an attractive investment. Overall, VNOM is an attractive opportunity for dividend investors. Its strong growth prospects and attractive valuation make it a compelling choice. And with its generous dividend yield, investors can enjoy steady income while also benefiting from potential capital gains in the future.

Dividends – VNOM stock dividend

VIPER ENERGY PARTNERS LP has shown solid growth and attractive valuations over the past three years, making it an ideal investment for those looking for a generous dividend yield. In the last three years, VIPER ENERGY PARTNERS LP has issued a dividend of 2.44 USD per share annually, offering a dividend yield of 8.29% from 2022 to 2022. The company has consistently paid out generous dividends and offers a reliable and sustainable form of income. For those looking for a high-yield investment, VIPER ENERGY PARTNERS LP may be worth considering.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for VNOM. More…

| Total Revenues | Net Income | Net Margin |

| 865.77 | 151.31 | 18.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for VNOM. More…

| Operations | Investing | Financing |

| 699.8 | 47.57 | -768.64 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for VNOM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.92k | 598.85 | 9.43 |

Key Ratios Snapshot

Some of the financial key ratios for VNOM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 42.7% | 52.1% | 76.6% |

| FCF Margin | ROE | ROA |

| 73.6% | 58.6% | 14.2% |

Price History

On Friday, VNOM opened at $28.4 and closed at $29.4, up 3.6% from the prior day’s closing price. This is indicative of the company’s steadily increasing share price over recent months. The company has consistently generated strong cash flows from its operations and have been able to pay out generous dividends to its shareholders. Furthermore, analysts are expecting VIPER ENERGY PARTNERS LP to report strong earnings growth in the upcoming quarters, driven by an increase in crude oil production in the Permian Basin.

This is expected to lead to higher cash flows and consequently, higher dividend payouts in the future. Overall, VIPER ENERGY PARTNERS LP is well-positioned for long-term growth and attractive returns for investors, making it an attractive investment option for those looking for a compelling combination of dividend yields and growth prospects. Live Quote…

Analysis

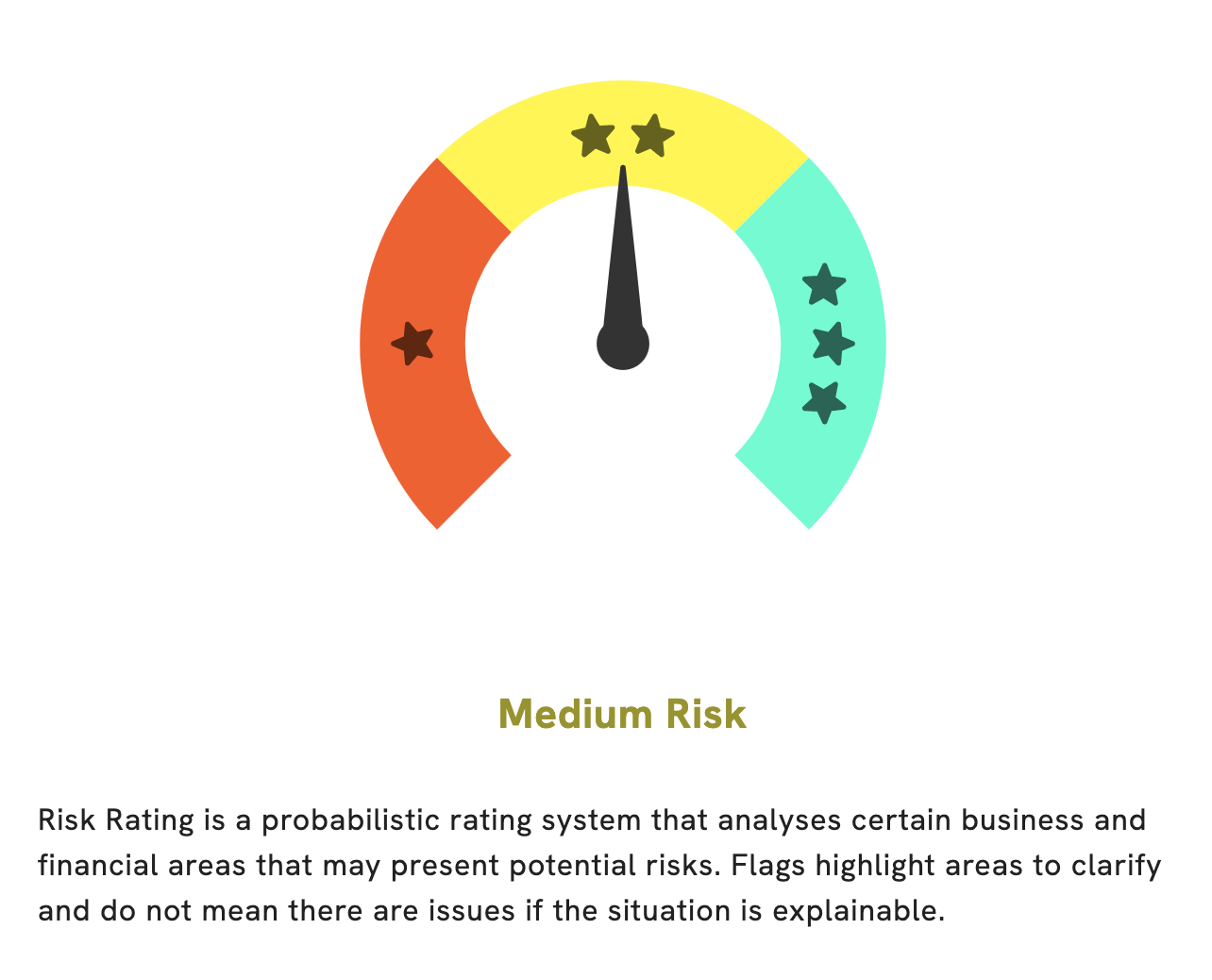

At GoodWhale, we recently conducted an analysis of VIPER ENERGY PARTNERS LP’s financials. After carefully examining the financials, we have determined that VIPER ENERGY PARTNERS LP is a medium risk investment in terms of financial and business aspects. After our rigorous research, we were able to identify three risk warnings in the income sheet, balance sheet, and financial journal. These risk warnings may have a significant impact on your decision to invest in VIPER ENERGY PARTNERS LP. If you would like to review the results of our analysis, please register on goodwhale.com and get access to our detailed report. We guarantee you will find all the information needed to make the most informed investment decisions. More…

Peers

The oil and gas industry is a highly competitive market. There are many oil and gas companies that compete for market share. One of the most competitive markets is the market for oil and gas exploration and production. In this market, there are many companies that compete for market share. One of the most competitive companies in this market is Viper Energy Partners LP. The company is a publicly traded company that is listed on the New York Stock Exchange. The company has a market capitalization of $2.6 billion. The company operates in the oil and gas industry in the United States, Canada, and Mexico.

– Rubellite Energy Inc ($TSX:RBY)

Rubellite Energy Inc is a Canadian oil and gas company with a market cap of 153.23M as of 2022. The company is engaged in the exploration, development, and production of oil and gas properties in the Western Canada Sedimentary Basin.

– Basic Energy Corp ($PSE:BSC)

Basic Energy Corp. is a holding company, which engages in the provision of oilfield services. It operates through the following segments: Drilling Services, Well Services, and Manufacturing and Repair. The Drilling Services segment offers onshore drilling rigs and related services. The Well Services segment provides pressure pumping and other well services. The Manufacturing and Repair segment manufactures and repairs equipment used in oil and gas drilling, completion, and production operations. The company was founded on April 28, 1987 and is headquartered in Houston, TX.

– BPI Energy Holdings Inc ($OTCPK:BPIGF)

BPI Energy Holdings Inc is a publicly traded holding company that owns and operates businesses in the energy sector. The company has a market cap of 146.97k as of 2022 and a Return on Equity of -513.73%. BPI Energy Holdings Inc owns and operates businesses in the oil and gas, power generation, and renewable energy industries. The company’s businesses include exploration and production, power generation, and energy trading.

Summary

Viper Energy Partners LP (VNOM) has been a compelling investment for dividend investors in recent months, driven by strong growth prospects and a reasonable valuation. This represents a total return of nearly 28% since the IPO. Viper Energy Partners is a midstream oil and natural gas master limited partnership that is majority owned by Diamondback Energy. It is focused on owning, acquiring and developing oil and natural gas properties in the Permian Basin.

With high-quality assets and an experienced management team, Viper Energy Partners has been able to capitalize on high production growth levels and generate steady cash flows. Its diverse mix of assets also provides downside protection against declines in oil prices. As such, Viper Energy Partners is an attractive option for dividend investors seeking long-term growth in the energy space.

Recent Posts