Scorpio Tankers Reactivates Securities Repurchase Program

June 2, 2023

☀️Trending News

Scorpio Tankers ($NYSE:STNG) Inc. recently announced that it has reactivated its securities repurchase program in order to purchase its common stock in the open market. This decision follows the approval of the Board of Directors of Scorpio Tankers in accordance with its Securities Repurchase Program. Scorpio Tankers is a shipping company involved in the transportation of petroleum products. It has a fleet of owned, part-owned and long-term time-charter vessels that transport various petroleum products, such as naphtha, jet fuel, gasoline and diesel.

The company is focused on maintaining a fleet of modern, fuel-efficient vessels and meeting customer needs. Scorpio Tankers is also committed to providing shareholders with an attractive return on their investments. By repurchasing its common stock in the open market, the company is taking steps to create value for its owners while also demonstrating confidence in its future prospects.

Price History

On Thursday, Scorpio Tankers Inc. (SCORPIO TANKERS) announced that it has reactivated its securities repurchase program. The company’s stock opened the trading day at $46.8 and closed at $47.0, representing an increase of 2.8% from the previous closing price of 45.8. The resumption of the program suggests that Scorpio Tankers is now confident enough in the current market conditions and outlook to begin buying back their own stock. It is likely that investors viewed this news positively, as evidenced by the stock’s increase in value.

This gives Scorpio Tankers the flexibility to take advantage of opportunities that may arise in the market as the year progresses. Overall, the news of Scorpio Tankers reactivating its securities repurchase program was welcomed by investors as indicated by the stock’s increase in value. The program will give the company flexibility to take advantage of potential opportunities that may arise in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Scorpio Tankers. More…

| Total Revenues | Net Income | Net Margin |

| 1.77k | 914.94 | 51.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Scorpio Tankers. More…

| Operations | Investing | Financing |

| 1.04k | 352.54 | -1.02k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Scorpio Tankers. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.69k | 2.14k | 42.63 |

Key Ratios Snapshot

Some of the financial key ratios for Scorpio Tankers are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 32.5% | 87.5% | 60.5% |

| FCF Margin | ROE | ROA |

| 57.0% | 26.5% | 14.3% |

Analysis

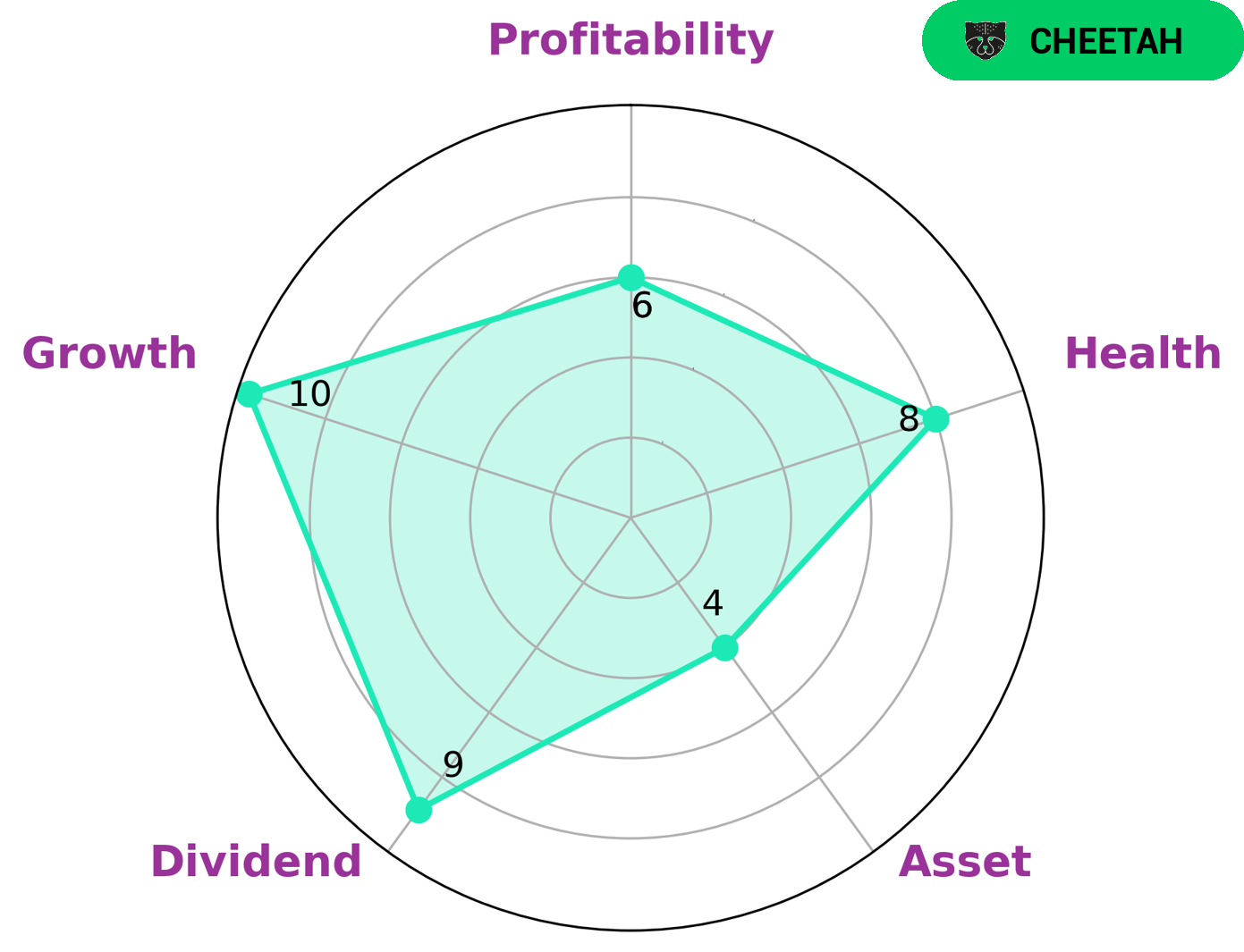

GoodWhale has conducted a financial analysis of SCORPIO TANKERS to assess their health score. According to our Star Chart, SCORPIO TANKERS has received a high score of 8/10, indicating they are capable to safely ride out any crisis without the risk of bankruptcy. Their cashflows and debt are both strong, and they have a moderate dividend yield, growth rate, and asset quality. We classify SCORPIO TANKERS as a ‘cheetah’, which is a company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. We believe that SCORPIO TANKERS may be of interest to investors who like to take higher risks for potentially high rewards. Those who are more conservative may want to look elsewhere as SCORPIO TANKERS cannot guarantee the same level of stability. It is also important to consider that the market is constantly changing and the company’s financials may not remain the same over time. More…

Peers

Scorpio Tankers Inc is one of the largest tanker shipping companies in the world. Founded in 2009, the company is headquartered in Monaco. Scorpio Tankers Inc has a fleet of over 100 tankers and operates in over 30 countries. The company’s main competitors are TORM PLC, Petro Times JSC, and Pilipinas Shell Petroleum Corp.

– TORM PLC ($LTS:0RG4)

In 2022, Dorman Products, Inc. had a market capitalization of $16.22 billion and a return on equity of 17.86%. Dorman Products, Inc. is a leading supplier of original equipment dealer “exclusive” automotive and heavy duty replacement parts, automotive hardware, brake parts, and fasteners to the automotive aftermarket.

– Petro Times JSC ($HNX:PPT)

Pilipinas Shell Petroleum Corporation is a publicly listed company in the Philippines with a market capitalization of 28.95 billion as of 2022. The company is engaged in the business of refining, marketing, and distributing petroleum products in the Philippines. The company has a return on equity of 17.04%.

Summary

Scorpio Tankers (STNG) has recently announced a reinvigorated share repurchase program. This is an opportunity for investors to take advantage of the company’s strong financial position, as well as its ability to take advantage of current market conditions. With this program, investors can expect to see an increase in the price of the stock as well as improved short and long-term earnings potential. The company’s cash flow, liquidity, and dividends make it an attractive choice for investors seeking a potential growth opportunity.

Furthermore, with its current fleet of vessels and strategic initiatives, Scorpio Tankers is well-positioned to capitalize on the current market dynamics. Investing in Scorpio Tankers is a high-risk endeavor, but with the right analysis and risk management, investors have the potential to generate long-term returns.

Recent Posts