NuStar Energy L.P. to Showcase at Upcoming Investor Conferences

December 13, 2023

☀️Trending News

NUSTAR ($NYSE:NS): NuStar Energy L.P. is a premier pipeline limited partnership with a diverse portfolio of assets and operations across the United States, Mexico, Canada, the Netherlands, including St. Eustatius in the Caribbean Sea, and the United Kingdom. With their strong network of pipelines and terminals, they are able to transport and store crude oil and refined products for energy customers around the world. NuStar is committed to providing safe, reliable and efficient services to their customers with their highly experienced team of experts. NuStar Energy L.P. has recently announced that they will be taking part in upcoming investor conferences. This will allow them to showcase their accomplishments and share their vision for the future.

The conferences will provide an invaluable opportunity for NuStar to share their long-term strategy with investors as well as provide an update on the company’s performance. This will also help them attract new investors and build relationships with existing investors. The NuStar team is looking forward to the opportunity to discuss the company’s operations, strategy, and projects at these upcoming investor conferences. With their strong portfolio of assets and commitment to providing excellent services, NuStar Energy L.P. is well-positioned to take advantage of the opportunities that the future holds for them.

Stock Price

On Tuesday, NUSTAR ENERGY L.P stock opened at $19.1 and closed at $19.1, down by 0.3% from its prior closing price of 19.2. Investors can look forward to hearing about the company’s recent developments and events as they discuss their strategies for the future. It also provides storage, terminalling, and related services to customers with crude oil and refined products stored and marketed by NuStar Energy, L.P. The company has operations in the United States, Canada, Mexico, the Netherlands, including St. Eustatius in the Caribbean, and the United Kingdom. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NS. More…

| Total Revenues | Net Income | Net Margin |

| 1.61k | 111.83 | 15.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NS. More…

| Operations | Investing | Financing |

| 520.17 | -8.94 | -514.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.91k | 3.87k | 8.28 |

Key Ratios Snapshot

Some of the financial key ratios for NS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.6% | 0.9% | 33.1% |

| FCF Margin | ROE | ROA |

| 24.3% | 31.2% | 6.8% |

Analysis

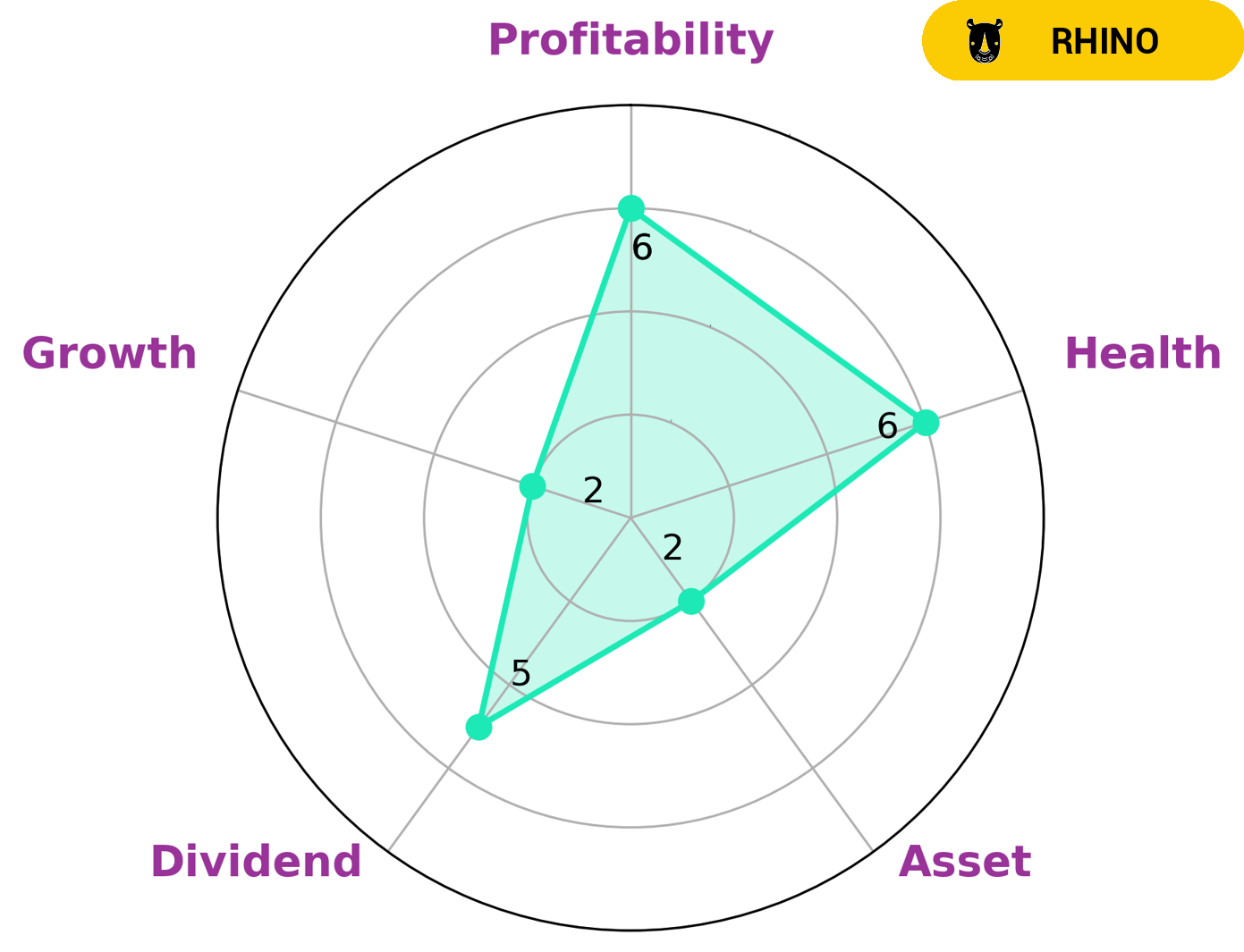

Our analysis of NUSTAR ENERGY L.P’s wellness indicates the company has achieved a moderate overall health score of 6/10. Its Star Chart shows that the company is strong in dividend, medium in profitability, and weak in asset and growth. Thus, we can conclude that NUSTAR ENERGY L.P is a ‘rhino’ type of company, which has achieved moderate revenue or earnings growth. The Star Chart also reveals that NUSTAR ENERGY L.P is strong when it comes to its cash flows and debt management, indicating the company might be able to sustain future operations during times of crisis. This makes NUSTAR ENERGY L.P an attractive prospect for investors seeking a medium-risk, long-term investment with potential growth in revenue and earnings. More…

Peers

The company also owns a 50% interest in a joint venture that owns a pipeline system transporting crude oil from Cushing, Oklahoma to the U.S. Gulf Coast. Competitors to NuStar Energy LP include: Adams Resources & Energy Inc, Martin Midstream Partners LP, Gibson Energy Inc.

– Adams Resources & Energy Inc ($NYSEAM:AE)

Adams Resources & Energy, Inc. is a publicly traded crude oil marketing and transportation company headquartered in Houston, Texas. The Company markets, transports, and stores crude oil and refined products in the United States. Adams also owns and operates a fleet of barges and tankers.

Adams Resources & Energy Inc has a market cap of 94.42M as of 2022. The company’s Return on Equity is 6.55%. Adams Resources & Energy, Inc. is a publicly traded crude oil marketing and transportation company headquartered in Houston, Texas. The Company markets, transports, and stores crude oil and refined products in the United States. Adams also owns and operates a fleet of barges and tankers.

– Martin Midstream Partners LP ($NASDAQ:MMLP)

The company’s market cap as of 2022 is 121.21M, and its ROE is -140.7%. The company is involved in the transportation, storage, and distribution of crude oil and refined products.

– Gibson Energy Inc ($TSX:GEI)

Gibson Energy is a Canadian midstream energy company that owns and operates a network of fuel storage and transportation assets across North America. The company has a market cap of $3.44 billion and a return on equity of 32.72%. Gibson Energy’s assets include a network of crude oil pipelines, storage tanks, and rail cars. The company also owns and operates a fleet of tanker trucks and barges. Gibson Energy’s customers include major oil companies, refiners, and marketers.

Summary

NuStar Energy L.P. is an energy logistics company with a presence in the U.S., Mexico, and the Caribbean. The company is currently focused on achieving growth through both organic and acquisition-based strategies. To that end, NuStar has recently announced its participation in upcoming investor conferences to increase visibility and market awareness of its operations and proposed growth initiatives. A careful analysis of NuStar’s current financial position, track record of performance, and future plans are important considerations for investors looking to assess the value of the company.

Investors should consider the company’s history of steady dividend payments, cash flow generation, and long-term debt to equity ratio. They should also be mindful of NuStar’s historical and projected earnings per share, as well as its ability to execute its growth initiatives. With these factors in mind, investors can make a well-informed decision as to whether NuStar is a sound investment opportunity.

Recent Posts