NuStar Chairman Donates $1M to Support San Antonio Zoo Expansion

July 29, 2023

☀️Trending News

NUSTAR ($NYSE:NS): NuStar Energy L.P. is an American company that specializes in the transportation, storage, and marketing of petroleum products. The company is based in San Antonio, Texas and is a publicly-traded partnership on the New York Stock Exchange. Recently, the former NuStar Chairman W. Kitt Wakeley has generously donated $1 million towards the expansion of the San Antonio Zoo, according to the San Antonio Business Journal. This donation will contribute to the zoo’s goal of expanding its facilities and allowing visitors to have a more immersive experience with the wildlife.

The San Antonio Zoo is one of the top attractions in the city and this generous donation from W. Kitt Wakeley will help support its mission of providing a unique and enjoyable experience for all visitors. This donation is a testament to the continued dedication of NuStar Energy L.P. to give back to the community.

Market Price

On Monday, NuStar Energy L.P opened at $17.5 and closed at $17.3, down by 0.3% from the prior closing price of 17.4. The same day, NuStar Chairman Bill Greehey made a huge donation to support the San Antonio Zoo’s expansion plans. Greehey pledged $1 million to the nonprofit organization, which is dedicated to the conservation of global wildlife.

His contribution is expected to help the zoo in its efforts to expand animal habitats and build new educational exhibits. This generous donation is a testament to Greehey’s commitment to making the world a better place and to his belief in the importance of protecting wildlife. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for NS. More…

| Total Revenues | Net Income | Net Margin |

| 1.67k | 131.82 | 16.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for NS. More…

| Operations | Investing | Financing |

| 546.3 | 45.41 | -597.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for NS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.92k | 3.54k | 12.47 |

Key Ratios Snapshot

Some of the financial key ratios for NS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.6% | 1.5% | 32.2% |

| FCF Margin | ROE | ROA |

| 24.8% | 24.6% | 6.8% |

Analysis

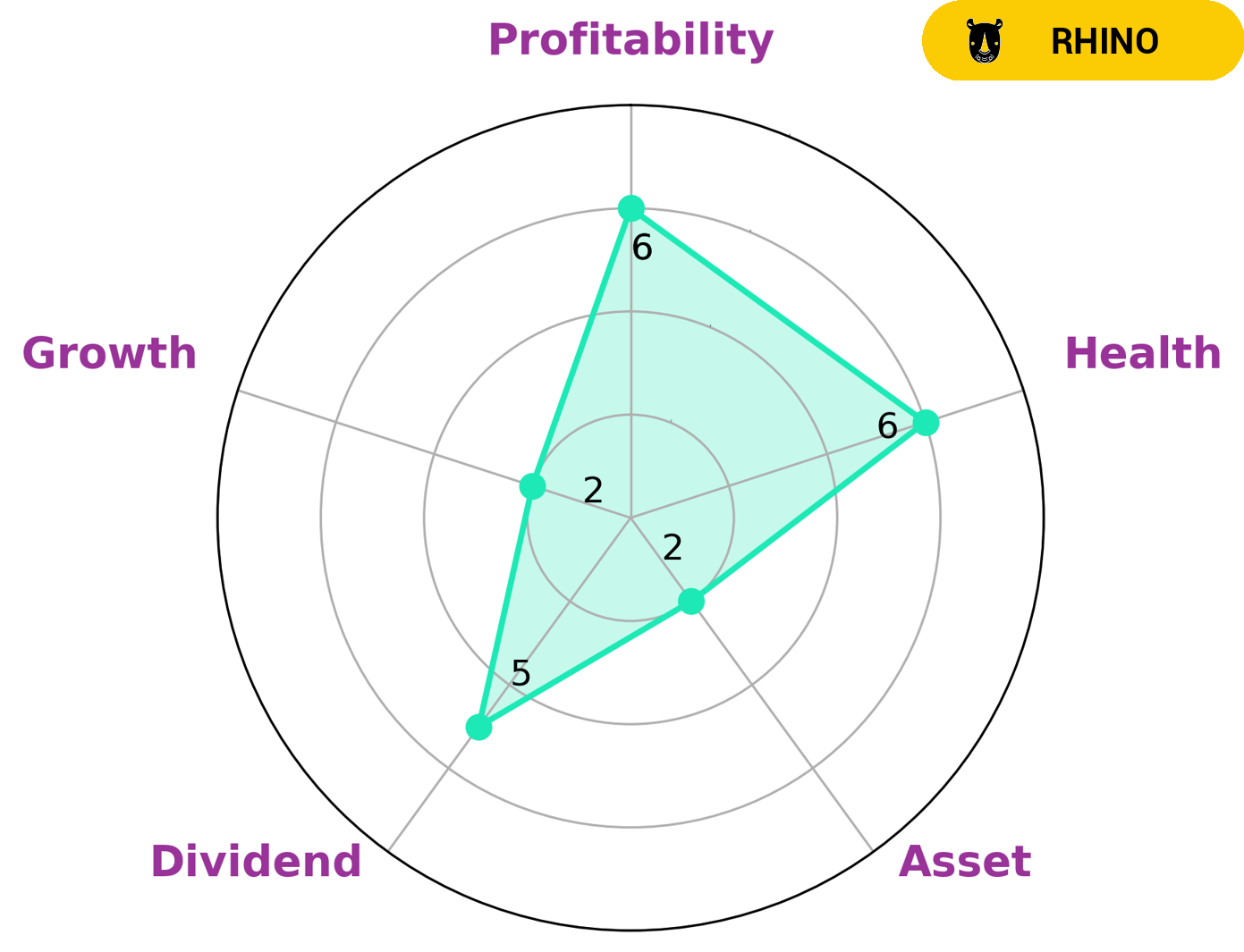

GoodWhale has conducted an analysis of NUSTAR ENERGY L.P’s wellbeing. According to the Star Chart, NUSTAR ENERGY L.P scores strong in dividend, medium in profitability, and weak in asset and growth. GoodWhale has assigned an intermediate health score of 6/10 to NUSTAR ENERGY L.P as its cashflows and debt suggest that it could ride out any crisis without the risk of bankruptcy. We classify NUSTAR ENERGY L.P as ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors who are looking for gradual and steady growth may be interested in such a company. In addition, investors who are willing to accept less than stellar performance in exchange for stability may also find NUSTAR ENERGY L.P appealing. More…

Peers

The company also owns a 50% interest in a joint venture that owns a pipeline system transporting crude oil from Cushing, Oklahoma to the U.S. Gulf Coast. Competitors to NuStar Energy LP include: Adams Resources & Energy Inc, Martin Midstream Partners LP, Gibson Energy Inc.

– Adams Resources & Energy Inc ($NYSEAM:AE)

Adams Resources & Energy, Inc. is a publicly traded crude oil marketing and transportation company headquartered in Houston, Texas. The Company markets, transports, and stores crude oil and refined products in the United States. Adams also owns and operates a fleet of barges and tankers.

Adams Resources & Energy Inc has a market cap of 94.42M as of 2022. The company’s Return on Equity is 6.55%. Adams Resources & Energy, Inc. is a publicly traded crude oil marketing and transportation company headquartered in Houston, Texas. The Company markets, transports, and stores crude oil and refined products in the United States. Adams also owns and operates a fleet of barges and tankers.

– Martin Midstream Partners LP ($NASDAQ:MMLP)

The company’s market cap as of 2022 is 121.21M, and its ROE is -140.7%. The company is involved in the transportation, storage, and distribution of crude oil and refined products.

– Gibson Energy Inc ($TSX:GEI)

Gibson Energy is a Canadian midstream energy company that owns and operates a network of fuel storage and transportation assets across North America. The company has a market cap of $3.44 billion and a return on equity of 32.72%. Gibson Energy’s assets include a network of crude oil pipelines, storage tanks, and rail cars. The company also owns and operates a fleet of tanker trucks and barges. Gibson Energy’s customers include major oil companies, refiners, and marketers.

Summary

NuStar Energy L.P. is an energy logistics company that owns and operates terminals, storage tanks, pipelines, and other assets for crude oil, refined products, and specialty liquids. It is engaged in the transportation, storage, and marketing of crude oil, refined products, and liquid asphalt.

In addition, the company operates a fuels refinery, a asphalt refinery, and a lubricants manufacturing facility. NuStar also offers transportation services to independent refiners and producers by delivering crude oils and other feedstocks to its terminals. The company’s investments primarily involve capital expenditures to expand its pipelines, terminals, storage capacity, and crude oil processing capability. NuStar’s financial performance is closely tied to the price of crude oil and refined products, as well as the market demand for fuels, asphalt, and lubricants. The current chairman of NuStar has recently announced a contribution of $1 million to help fund the expansion of San Antonio Zoo.

Recent Posts